CHINA BULLETIN: Breaking Up Is Easy to Do, Say Alibaba and JD.com

Welcome to the latest Bamboo Works China Bulletin, where we recap the top China macro, industry and company developments from the past week and give you our spin on what it all means. In this week’s issue breaking up Alibaba-style, stock markets continue their winning streak, and a baked-in-China IPO hits Wall Street. On a scale of 1 to 10, we give the week a 7 for offshore-listed China stocks.

Doug Young, Editor in Chief

MACRO

Breaking Up Is Easy to Do, Say Alibaba and JD.com

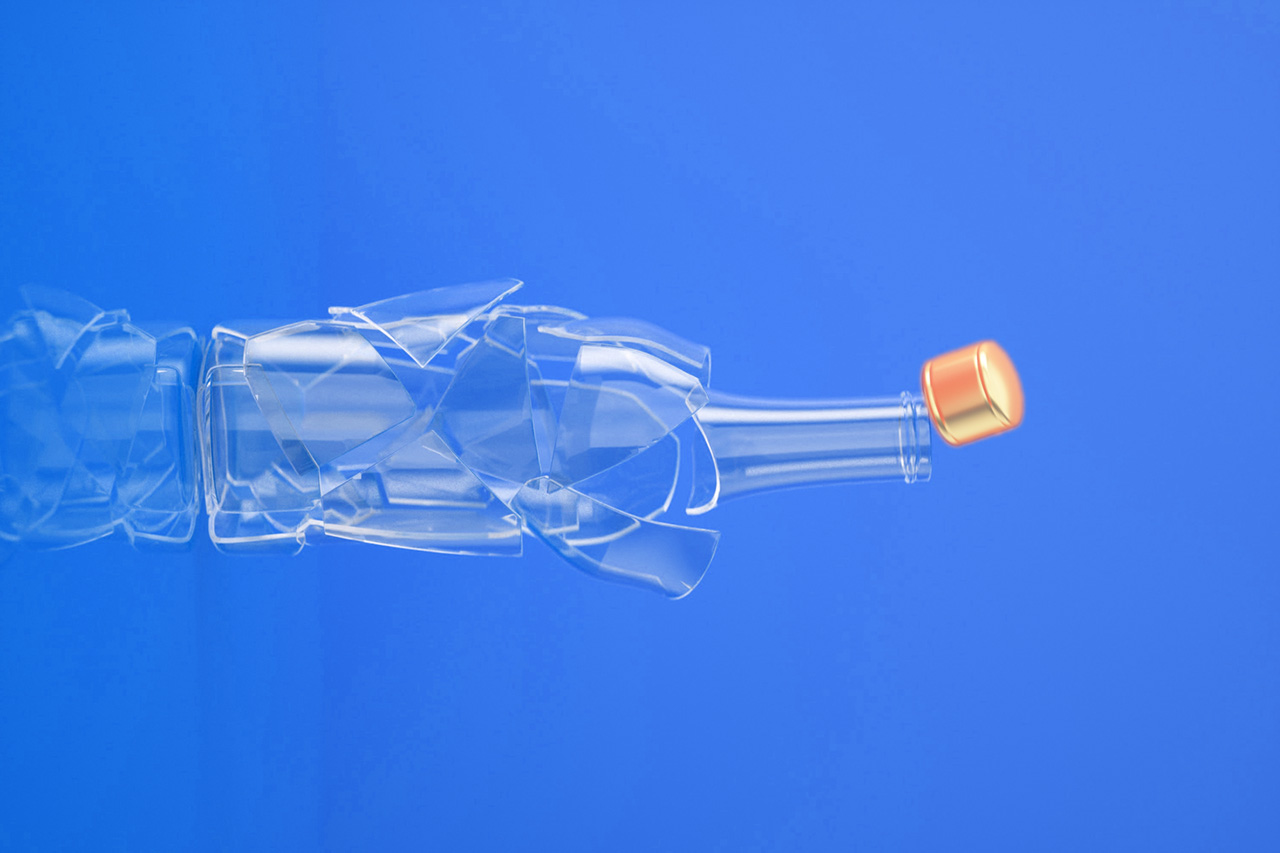

This week’s top China story comes from the regulatory realm, with Alibaba declaring it would break itself up into six units, each to be run and listed separately. Not to be outdone, rival JD.com came out with a similar plan just days later, announcing spinoffs and IPOs for its industrial and property units.

These “break-ups” are the culmination of more than a year of pressure from China’s anti-trust watchdog, which was worried these tech giants have become too big and powerful. While some may liken this to a “Ma Bell”-style breakup, we’ll really need to wait and see whether Alibaba, JD.com, and possibly others, really give up control of their many different units.

Score One for the Yuan

China has been trumpeting a major victory for the globalization of its hometown currency after settling a deal to buy a liquified natural gas (LNG) shipment from France’s TotalEnergies using the yuan. The deal was quite global, involving 600,000 tons of the fuel that were extracted in the United Arab Emirates and then shipped to China.

This particular achievement is part of efforts by China, Russia and others spurned by the West to create alternative currencies to the U.S. dollar for international trade settlement. While this deal marks a milestone of sorts, it’s notable that the buyer was Chinese, and thus probably pushed very hard for the settlement in yuan. It’s questionable whether others will follow suit.

China Stocks Make It Three in a Row

China stocks continued their winning streak, posting a third consecutive net gain last week. Upbeat outlook for the year ahead in the deluge of earnings announcements during the week was probably a major catalyst, and many also may have seen the Alibaba and JD.com breakup announcements as the latest signal of an end to recent regulatory crackdowns.

The Hang Seng China Enterprises Index rose 2.5% during the week, bringing its net gains for the last three weeks to 11%. The iShares MSCI China ETF rose 2.3%, while the broader Hang Seng Index rose 2.4%. With 2022 earnings season now over, all eyes will quickly move to the first quarter of 2023, which has just ended, to see if the rosy predictions for an economic recovery are really happening.

INDUSTRY

The Growing China-Saudi Love Affair

China’s deepening love affair with Saudi Arabia kicked up a notch last week with the latter’s announcement that its Saudi Aramco oil-producing arm would invest 24.6 billion yuan, or about $3.6 billion, for 10% of a major oil refining project in China. That came days after the two sides agreed to a jointly fund a massive $10 billion refinery in Northeast China’s Liaoning province.

It doesn’t take a rocket scientist to see that these deals are between two countries that very much need each other. China is Saudi Arabia’s biggest customer, and is only likely to get bigger. Meantime, China wants to make sure it gets the oil it needs, and would almost certainly prefer to get more from less controversial sources than Russia, which is one of its top suppliers.

Japan Joins Chip-Making Restrictions

In a major victory for the U.S., Japan has agreed to jump on the bandwagon of countries banning the sale of advanced chip-making equipment to China. Specifically, Japan announced late last week that it would require special licenses for the export of 23 types of chip-making equipment. While China’s name wasn’t mentioned, it was certainly heavily implied.

The U.S. has already required similar special licenses for the export of American-made chip-manufacturing equipment to China, and was pressuring the Netherlands – home to one of the world’s most advanced makers, ASML, to do the same. The addition of Japan, home to other major equipment makers, effectively cuts off China from most of the world’s top suppliers.

Banks Say ‘We’re Healthy’ But Still Warn of Risk

The latest annual reports from China’s top five state-run banks offered a classic case of needing to read between the lines to get the real story of what’s happening in their industry. All five reported rosy results, including modest profit growth and steady or even falling ratios for their non-performing loans.

But everyone knows things aren’t quite so hunky-dory for Chinese financiers right now, as they face huge risk of defaults by businesses struggling in a wide range of industries. Many banks alluded to those risks in the comments sections of their reports. Bank of Communications was a case in point, warning: “The liquidity stress of the property industry will still take time to recover.”

COMPANY

Apple Polishes China Connections with Cook Visit

We’re slightly behind the curve on this one, but it’s still worth reporting that Apple CEO Tim Cook’s name was all over the place during a trip he took to China not long after the curtain closed on the National People’s Congress in the first half of March. Cook attended a major forum that comes after the NPC each year, and went on to meet with China’s commerce minister early last week.

Nothing he said was all that earth shattering, though he touched on supply chain issues and Apple’s role in China. Instead, the bigger subtext was recent moves by Apple to diversify its supply chains from China following some major headaches during last year’s strict Covid controls. Cook’s visit seemed aimed at signaling that Apple isn’t planning on abandoning China just yet.

Syngenta’s Stalling IPO

China was king of the fertilizer hill back in 2017, when the relatively obscure state-owned ChemChina purchased Swiss agricultural giant Syngenta for $43 billion. But fast forward six years, when the company’s plans for an IPO to pay back some of the debt from that deal appear to be taking a slow boat to Shanghai’s Nasdaq-style STAR Market.

The latest reports say the Shanghai Stock Exchange delayed a hearing set for last week on the plan to raise 65 billion yuan, or nearly $10 billion, due to concerns about the huge fundraising total. China has a history of this kind of meddling in its stock markets, though it has been trying to take a more laissez faire western-style approach in recent years.

Move Over, Baidu. SenseTime Talks Up Its Own New Chatbot

After a decidedly underwhelming debut for Baidu’s Ernie chatbot a few weeks ago, AI specialist SenseTime wants to see if it can do better. The company said last week it plans to launch its own chatbot around the middle of this year, becoming the latest to try to jump on a craze begun with the launch earlier this year of OpenAI’s ChatGPT.

Personally speaking, we have a little more faith in SenseTime, which is one of China’s leading AI companies. Baidu, on the other hand, has come to the party later, and is focused on autonomous driving. But the bottom line is still that any chatbot could have difficulty in China due to Beijing’s strict limits on the internet content that is key to chatbot learning.

AND FROM THE PAGES OF BAMBOO WORKS

| VNET Mired in Red Ink, Founder’s Manipulative Maneuvers Last week we brought you another of our made-in-China corporate stories, this one involving data center operator VNET, which is also Microsoft’s partner for China-based cloud services. The tale involved a margin call for a loan taken out by VNET’s founder and chairman backed by his roughly 20% of the company’s voting shares. After losing his shares in the call, what did he do? It seems he simply got the board to create a new class of shares with super-duper voting rights, and then sell him enough of those shares to get back his 20% voting stake at a fraction of what his previous shares were worth. Not surprisingly, minority investors weren’t too thrilled about this particular power play at their expense. |

| Chinese Baker Goes to New York We also brought you a lighter baked-in-China story of a bakery operator with a fixation on the Big Apple. The story involved the French-sounding Chanson International, which is really based in western China’s Xinjiang region, where it operates a chain of bakeries. The company made a New York IPO last week, and also plans to open a baker’s dozen of cafes in the city over the next year. We spotlighted the many obstacles the company had to travel to get to Wall Street since it first filed for the listing two years ago. Regulatory obstacles in both the U.S. and China made life difficult, though most seem to be resolved by now. Then there was China’s Covid lockdowns of 2022, which ravaged many companies’ finances, including Chanson’s. |