China’s Takeout Delivery Market Gets a Shakeup

By Doug Young & Rene Vanguestaine

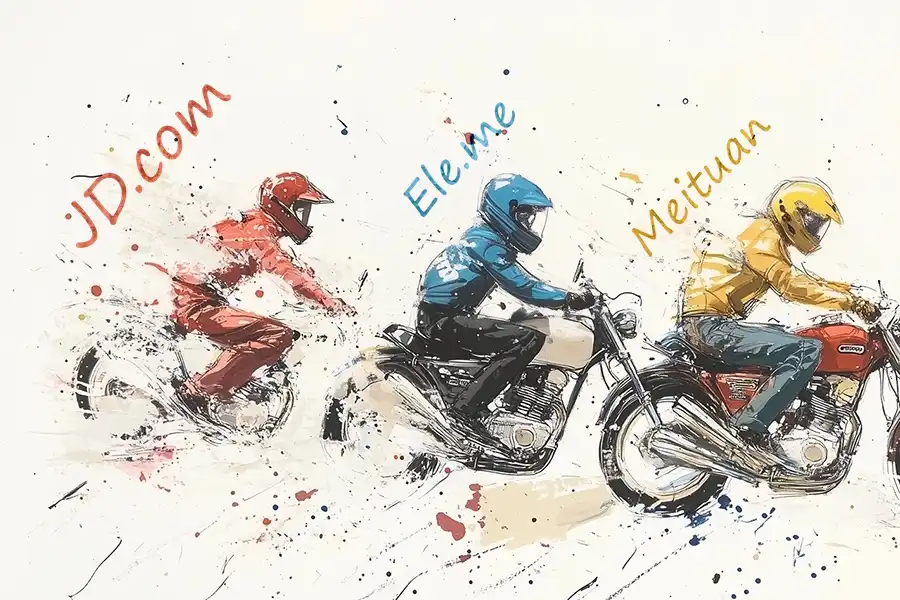

China’s massive takeout delivery market, long dominated by the duopoly of Alibaba’s Ele.me and Meituan, is undergoing a pivotal transformation. Two recent developments — a likely government-led push to expand worker benefits and JD.com’s bold entry into the sector — signal a new era of challenges and opportunities. The shifts reflect broader economic priorities and strategic maneuvering in a hyper-competitive industry.

The social contract: From gig work to benefits

For years, the backbone of China’s food delivery ecosystem — its more than one million of riders — operated as gig workers, earning fees per delivery with minimal extra benefits. This changed abruptly when Ele.me and Meituan announced plans to provide riders with retirement and medical insurance, a move that will significantly inflate their operational costs. The impetus here appears twofold: Beijing’s “common prosperity” agenda and a pragmatic need to bolster consumer confidence.

Sluggish post-pandemic consumption stems partly from household fears of unmanageable healthcare and pension costs. Gig workers, often financially vulnerable, epitomize this anxiety. Extending social safety nets to this group could stimulate spending by lessening the need for precautionary savings — a subtle but critical lever for economic revival. What’s striking is how little protection riders previously had, despite their visibility in urban life. Many had wrongly assumed these workers enjoyed basic benefits — a misconception underscoring the fragmented nature of China’s labor protections.

The financial burden now falls on Ele.me and Meituan, though questions linger about cost-sharing. Delivery platforms typically contract riders through third-party agencies, muddying accountability. While some costs may trickle down to consumers via higher delivery fees, there’s skepticism that the government would permit full pass-through pricing, given the political sensitivity of household budgets. This creates a delicate balancing act: platforms must absorb margin compression while maintaining service affordability.

JD.com’s calculated gamble: Differentiation over duplication

Enter JD.com, which recently declared its intent to disrupt the market using its logistics subsidiary Dada Nexus. Unlike incumbents, JD plans to target high-end restaurants and chains, avoiding the “kitchen sink” approach of Meituan and Ele.me. This differentiation strategy — emphasizing premium service over scale — could carve a niche in an otherwise saturated market.

JD’s disciplined track record in e-commerce logistics suggests it won’t wage a price war. Instead, its focus on quality aligns with its brand reputation for reliability. The timing is strategic: as incumbents grapple with rising labor costs, JD’s narrower focus on higher-margin segments could shield it from margin erosion. Yet challenges abound. The duopoly’s entrenched networks and price-sensitive customer bases won’t be easily unseated. Moreover, government pressure to serve lower-end restaurants and low-income consumers may limit incumbents’ ability to retreat upmarket, trapping them in a low-margin scenario.

A market in flux

These developments underscore a maturing industry where government oversight and competitive innovation collide. The mandate to expand worker benefits reflects Beijing’s broader socioeconomic priorities, while JD’s entry highlights opportunities for differentiation in a homogenous market.

For Ele.me and Meituan, the path forward involves navigating higher costs without alienating cost-conscious users. For JD.com, success hinges on executing its premium playbook while avoiding the margin pitfalls that plague its rivals. The market’s sheer size — serving everything from tier-one city professionals to small-town households — suggests room for multiple players, but profitability will depend on strategic discipline.

In many ways, this mirrors China’s tech sector evolution: pioneers blaze trails, but latecomers with sharper execution often thrive. JD’s bet is that in a market reshaped by regulation and shifting consumer demands, a premium niche could prove more sustainable than competing at scale. Whether this logic holds will depend as much on economic pragmatism as on the invisible hand of policy.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: