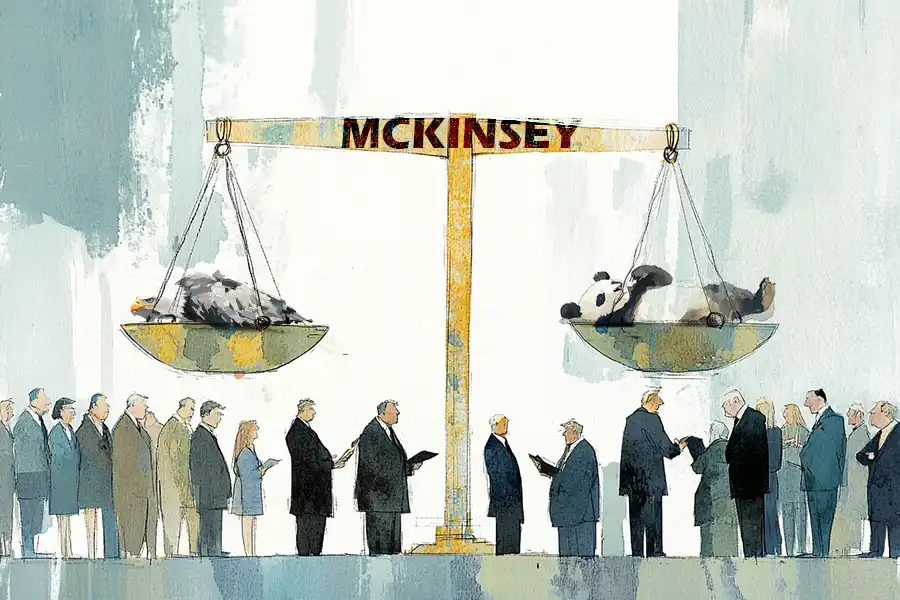

McKinsey Weighs China Exit, and Shenzhen Rescues Vanke

By Doug Young & Rene Vanguestaine

As we enter 2025, one of the world’s largest consulting firms, McKinsey & Co., is grappling with its presence in China — a market that has historically been a key player in its global business strategy. A recent report from Bloomberg indicates that a vocal group of McKinsey partners are advocating for a potential pullout from China, a move that would not only mark a significant shift for the consulting giant but also reflect broader shifts in geopolitical and economic trends.

The arguments for such a move stem from both economic realities and geopolitical tensions. McKinsey, like many foreign companies in China, has seen its revenues decline in recent years. The Chinese government’s growing preference for domestic firms — especially in sectors involving state-owned enterprises (SOEs) — has increasingly isolated high-end foreign consultants. Over the past several years, global companies, including investment banks and law firms, have found it more challenging to maintain their presence and influence in China. The government’s emphasis on reducing reliance on foreign consultants in favor of domestic alternatives has intensified, signaling a challenging environment for global firms like McKinsey.

While it’s difficult to assess the scale of McKinsey’s business in China, one can estimate that it’s a far cry from the substantial revenues it may have enjoyed a decade ago. The shifting economics of doing business in China, alongside heightened geopolitical tensions, are prompting companies to reassess their footprint in the country. For McKinsey, the pullback could be offset by stronger business prospects in its home North American market, where the firm has a long-established client base.

Beyond the economic factors, geopolitical considerations cannot be ignored. Over the past few years, both Republicans and Democrats in the U.S. have taken a stronger stance on reducing American businesses’ exposure to China — especially when those companies engage with entities that may pose national security risks. The uncertainty surrounding U.S.-China relations, particularly in light of rising tensions, has fueled concerns among McKinsey partners in the U.S. about the long-term viability of maintaining ties with Chinese companies, particularly those seen as having dual civilian and military roles.

From China’s perspective, McKinsey’s potential departure might seem like a loss, given the prestige associated with having such a global name in the market. However, China’s priorities have shifted in recent years. National security and technological self-sufficiency now take precedence over maintaining relationships with foreign consultants. The Chinese government has repeatedly assured the world of its openness to foreign investment, but the focus has increasingly been on technology transfer and job creation rather than fostering a robust consulting ecosystem that benefits global firms.

The eventual impact on China’s economy may not be as significant as it once would have been, especially as foreign companies continue to pull back or reduce their presence in the country. The broader trend of companies shrinking their operations or exiting entirely from China reflects a larger, more complex set of challenges that are now in play.

While McKinsey’s potential pullout from China remains speculative, the company’s retreat from the world’s second-largest economy would be part of a larger wave of disengagement by foreign firms, driven by a combination of shifting economic factors and increasingly difficult geopolitical dynamics.

State power in action

In a separate but equally important development, the city of Shenzhen has stepped in to support one of its most prominent property developers, Vanke, in the face of severe financial distress. Vanke, once a leading player in China’s booming real estate sector, has found itself teetering on the edge of insolvency as the broader real estate crisis in China continues to wreak havoc. In a strategic move, Shenzhen Metro Group, a government-owned entity, has taken over one of Vanke’s major unfinished projects, injecting capital to stabilize the company.

However, this rescue comes with strings attached. Shenzhen Metro Group has placed its own personnel in key management positions at Vanke, signaling a shift in control and raising questions about the company’s future. While most of Vanke’s current executives remain in place at the highest levels, it is clear that Shenzhen Metro intends to assert considerable influence over the company’s operations. This raises the question of whether this move is merely temporary or the beginning of a broader shift towards increased government control over private enterprises in China.

It is not unusual for state-run entities to intervene in struggling state-owned enterprises. But the involvement of a government-linked organization in rescuing a private company like Vanke is a notable departure. With the Chinese real estate sector still reeling from a series of defaults and financial difficulties, the Chinese government appears willing to step in wherever necessary to prevent major players like Vanke from collapsing. This raises the prospect of further state involvement in the private sector, particularly in industries that are seen as strategically important to China’s economic stability.

As China grapples with its ongoing real estate crisis, it may increasingly look to state-owned entities to step in and take control of struggling private firms, particularly those in key sectors. This trend could have long-lasting effects on the balance between the public and private sectors in China, and potentially reshape the future of the country’s economic landscape.

Both McKinsey’s potential departure and the rescue of Vanke illustrate the complex interplay of economic, political, and geopolitical factors that are reshaping business operations in China. As the world’s second-largest economy continues to evolve, foreign firms and domestic companies alike will need to navigate these shifting dynamics with caution and strategic foresight.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: