A Bagel success story, and a Red Bull slayer

Tim Hortons is tasting some new success in China with a bagel formula. Will this mark the start of a turnaround for the struggling chain? And a Red Bull killer named Eastroc has filed to list in Hong Kong. What’s the secret to its success, and will it attract investors to its story?

Delisting speculation, and a new tea listing

Speculation is growing on a potential delisting of Chinese shares from New York in the growing US-China trade war. Could such a mass delisting really happen? And a purist premium tea maker named Chagee raises $400 million in a Nasdaq IPO. What sets this company apart from its many rivals?

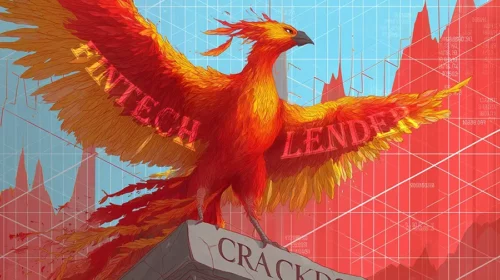

A fintech lender rebound, and a hotel mess

Fintech lenders are entering a new golden era, with Jiayin reporting 46% growth for its core consumer lending business in last year's fourth quarter and forecasting similar gains this year. What's driving this rebound? And hotelier H World is still trying to fix a German acquisition from 2019 that wiped out its profit in the fourth quarter of last year. Will the Chinese hotelier be able to turn around this money-losing offshore asset?

TikTok in limbo, and Xiaomi’s EV crisis

Two prominent Chinese tech giants, TikTok and Xiaomi, currently face separate but equally critical crises, each testing their resilience overseas and at home. While TikTok battles regulatory uncertainty in the U.S. amid national security concerns, Xiaomi is confronting repercussions of a tragic accident involving its electric vehicles and autonomous driving technology.

A hydrogen listing, and a new China toy story

A young company called Scage is close to listing in New York through a backdoor SPAC merger. Is it really worth the high valuation it's seeking? And 52Toys has hired an investment bank for a Hong Kong IPO. Will it be able to sell investors on its toy story of rapid expansion and hot collectibles?

Soaring stock brokers, and rising tobacco

Online brokers Futu and UP Fintech have recorded banner results, with revenue up by 75% or more for both in the fourth quarter. What's driving the growth, and is it sustainable? And the international arm of China's tobacco monopoly reported 10% revenue growth last year, even as the number of Chinese smokers fell. What's driving the increase?

New solar policy support, and a stock market cleanup

It’s too soon to think that the bottom for the solar sector is there. But if you're a long-term investor and you're patient, you may have to wait a year or so before you start getting some meaningful appreciation in the stock price.

The Nationalism Factor, and a Forced Asset Sale

The huge success of "Ne Zha 2," partly due to national pride, has lit a fire under the stock of the movie's producer, Enlight Media. How important is the nationalism factor when choosing Chinese stocks? And Hong Kong's CK Hutchinson has sold its two port operations in the Panama Canal after coming under pressure from Donald Trump. Are we likely to see more such forced asset sales over national security concerns going forward?

China’s Takeout Delivery Market Gets a Shakeup

China's takeout dining duopoly of Ele.me and Meituan will start offering social benefits for their more than one million of riders. What's driving this change of heart and what will it mean for the market? And JD.com has announced its entering the fray, aiming to take on this established duopoly. What are its chances of success, and what does this mean for the industry?

China’s Box Office Devil Ne Zha, and Burger King’s China Flip

A hit animated film about a devil child called "Ne Zha" is breathing new life into China's moribund box office. Is this the start of better days for movie theaters? And Burger King's owner buys out its China franchising partner. What's driving this move, and what does it mean for Burger King in China?

An Apple Anti-Trust Probe, and Hong Kong’s Second SPAC Merger

China is reportedly preparing to attack Apple on anti-trust grounds related to its app store operation. What's driving this probe? And steel trader ZG Group nears a Hong Kong listing through a SPAC merger, only the second since the city launched its SPAC program three years ago. Why has progress been so slow?

McKinsey Weighs China Exit, and Shenzhen Rescues Vanke

Some partners at U.S. consulting giant McKinsey are questioning the wisdom of staying in China. What's driving their doubt, and what would a withdrawal signify? And Shenzhen rescues struggling developer Vanke. What is the city demanding in return for its assistance?