CHINA BULLETIN: Europe Calls on China

In this week’s issue EU leaders come calling on China, Evergrande restructures and Airbus invests. On a scale of 1 to 10, we give the week a 5 for offshore-listed China stocks.

Doug Young, Editor in Chief

You can sign up to get China Bulletin weekly in your inbox.

MACRO

Europe Calls on China

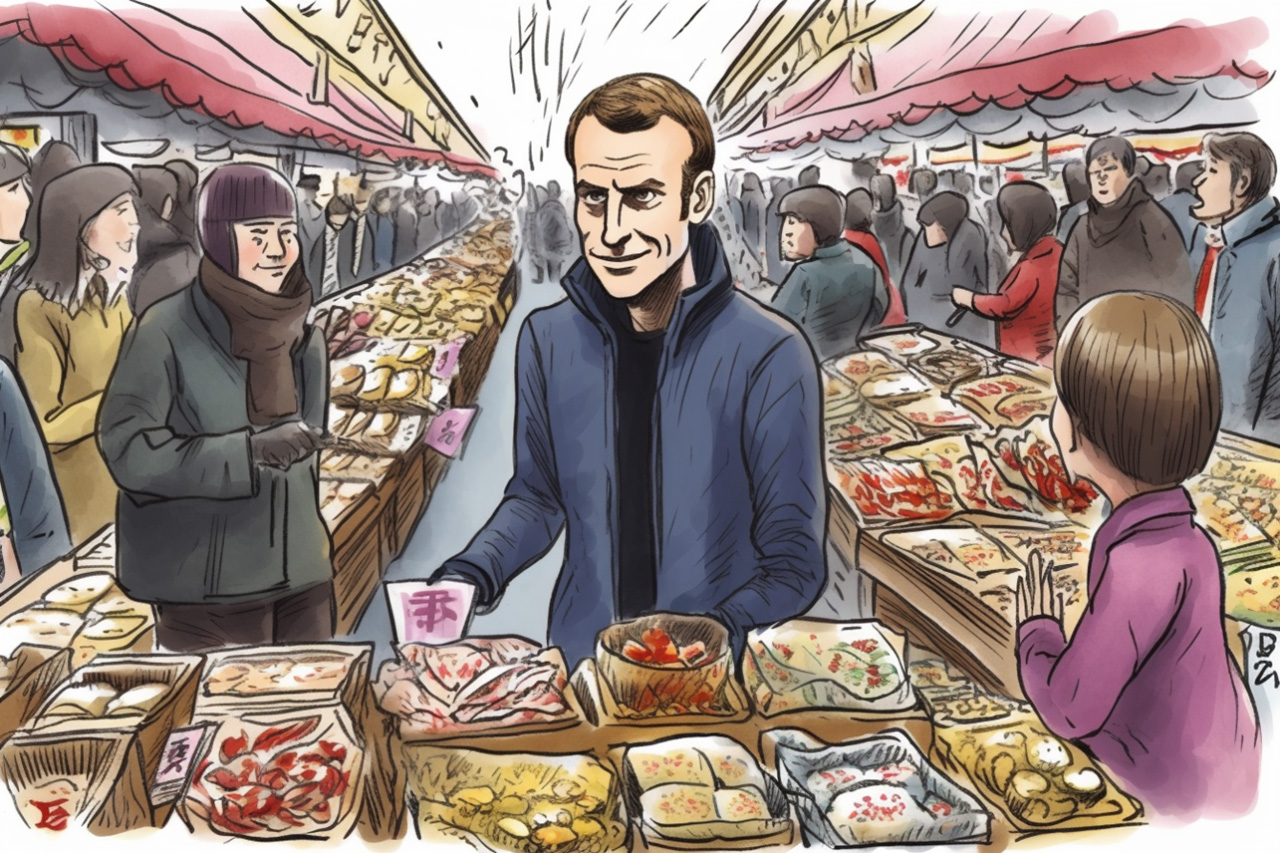

The big macro story last week was a visit to China by French President Emmanuel Macron and European Union chief Ursula von der Leyen, who met with Xi Jinping in Beijing. Macron bought a large contingent of French companies with him, including airplane maker Airbus, which counts China as one of its largest markets. The EU is trying to carve out its own relationship with China that’s slightly different from the recent U.S. “decoupling” agenda. The EU wants to maintain trade ties, realizing China will be an important supplier for the foreseeable future, even if the two sides disagree on politics. It also wants China to use its leverage with Russia to help end the war in Ukraine.

Manufacturing Stalls, But Services Soar

The latest editions of a pair of economic indicators sponsored by financial media Caixin gave off mixed signals, with manufacturing stalling even as services activity soared. The Caixin manufacturing PMI came in at 50 for the month of March, while the services gage roared ahead to 57.8. Any reading above 50 represents expansion, while below that is contraction.

So, why the big discrepancy? Nobody addressed that directly in the reports we read, but at least one cause is likely the importance of exports to Chinese manufacturers. Overseas demand has been quite weak lately, leading to several months of declines for exports. By comparison, services are more reflective of domestic demand, which has been steadier.

China Stocks Pause After Winning Streak

Offshore-listed Chinese stocks took a breather last week, with the indexes we follow moving slightly downward during a holiday-shortened three-day trading week in Hong Kong and a four-day week in the U.S. The Hang Seng China Enterprises Index dropped 1.1% during the week, while the iShares MSCI China ETF and broader Hang Seng Index both fell by 0.3%.

The small losses look like a pause after a three-week winning streak, and now the big question is how the winds will blow as people return to work this week. Uncertainty over the condition of China’s manufacturing sector is likely to weigh on sentiment, though that could be partly offset by the mostly positive meeting in Beijing last week between Xi Jinping and EU leaders.

Industry

EVs Get Support from Price Wars, Sagging Lithium Prices

The latest monthly sales data show China’s electric vehicle makers had a surprisingly strong March. Tesla’s sold 88,869 EVs during the month, up 35% from a year earlier, while BYD’s EV and hybrid sales nearly doubled to 206,089. Those sales are probably getting a lift from recent price cuts that many brands have been making to clear out inventory.

At the same time, separate reports show the price of lithium, a key component in EV batteries, have continued a downward trajectory and are now down 57% this year. That should provide some relief to EV makers in the months ahead by lowering the price of batteries. On the whole we expect the combination of price cuts and falling lithium costs to help to support the market this year.

China Slows Down U.S. Merger Reviews

U.S. companies with pending global mergers in progress are suddenly finding their anti-trust reviews taking longer than usual in China. That’s what the Wall Street Journal is reporting, anyhow, calling the development Beijing’s way of expressing its dissatisfaction with recent U.S. restrictions aimed at stifling China’s chip sector.

The Journal pointed to a number of deals being affected, all from the chip space, including ones involving Intel and Tower Semiconductor. This kind of passive-aggressive behavior is quite typical of China, which prefers not to take more aggressive actions in this kind of situation. Such behavior killed the pending 2018 purchase of Dutch firm NXP by U.S. telecoms chip giant Qualcomm.

Pfizer, Merck Cut Covid Drug Prices

In the latest sign of the fading impact from Covid in China, global drug giants Pfizer and Merck have reportedly cut the prices of their Paxlovid and molnupiravir drugs in the market. The cuts are actually pretty small, and both drugs are still quite expensive in China. After the cuts Paxlovid sells for 1,790 yuan per box of 30 pills, while molnupiravir costs 1,426 yuan for 40 capscules.

The cuts may owe partly to China’s decision to stop including both drugs in the national health plan as of March 31. But it also probably reflects the fact that the Covid wave has come and gone after China scrapped its strict Covid controls in early December. New infections have dropped dramatically since the peak, and demand for both drugs is no longer what it used to be.

Company

Evergrande Debt Restructuring Moves Forward

We’re still far from convinced that Evergrande will emerge from its crisis intact, as it will still have to pay its creditors huge amounts of money it doesn’t have. In the meantime, no one will want to lend it more money, and the prospects of getting much money from its own business activity also look very slim.

Airbus Finds More Reason to Invest in China

Global aircraft giant Airbus used last week’s visit by French President Emmanuel Macron to Beijing to announce a major new investment in China. The company said it will double its capacity for manufacturing its most popular jet, the A320, at its facility in Tianjin. The expansion will allow it to produce up to 75 A320 neo jets per month by 2026.

Airbus’ approach to China has been quite different from archrival Boeing, which has been far more careful about moving key production to China due to concerns about technology theft. Boeing’s China sales have also been collateral damage in bigger U.S.-China tensions, and it could take a further blow in the market as China ramps up production of its own homegrown rival to the 737.

Huawei’s Sputtering Smart Car Drive

Smart car technology was supposed to be the savior for embattled tech giant Huawei, after its core telecoms-related businesses received a near-fatal blow from U.S. sanctions. But now the company is candidly admitting that things aren’t turning out quite as it planned, once again putting its future at risk.

The admission that business has yet to move into the fast lane for Huawei’s smart car technology business came from Richard Yu, who also oversees the smartphone division that was once one of Huawei’s crown jewels. Yu explained that Chinese car makers are reluctant to use Huawei technology over fears of losing control of the “soul” of their products.

AND FROM THE PAGES OF BAMBOO WORKS

| Xiaomi Finds Cash-Burning Black Hole in EV Drive EVs were also featured prominently in our deep dive last week into the latest earnings from Xiaomi another former smartphone sensation whose sales have started to slow. Unlike Huawei, which is just making smart car tech, Xiaomi is going full throttle into the sector by developing its own new energy vehicles. The only problem is Xiaomi’s campaign is burning huge amounts of cash, even as revenue and profits from its older smartphone business slow sharply. Xiaomi hopes its new car drive can return it to stronger growth from headier times. But observers say it’s coming late to the game and will face stiff competition, not to mention a cooling Chinese EV market. |

| Fosun Pharma Feels Post-Covid Hangover We also looked at how Fosun Pharma, arguably one of China’s most prominent private drug companies, is feeling a bit of pain these days with dying demand for its comirnaty Covid vaccine. The company’s stock once soared after it received rights to sell the mRNA vaccine developed by BioNTech in Greater China. Fast forward a couple of years, and Fosun Pharma never made a penny from the vaccine sales in mainland China, despite investing in a state-of-the-art production facility, because Beijing never approved it. It did make some money by selling the vaccine in Hong Kong, Macau and Taiwan, but even sales to those markets are dropping sharply as the Covid threat fades. |