YSB’s B2B Pharma Platform: Sexier Than the SOEs, But Stodgier Than B2Cs

The drug distributor for pharmacies and community-level medical institutions has filed for a Hong Kong listing, boasting strong revenue growth but also massive losses

Key Takeaways:

- YSB has filed for a Hong Kong listing, operating a B2B drug-selling business model with lower margins than B2C platforms

- Company operates a drug-trading platform and its own proprietary business, with a P/S ratio lower than B2C platforms but higher than traditional drug distributors

By Molly Wen

While selling to consumers can generate big user numbers for e-commerce companies, it also generates big pressure to keep those numbers growing fast. Selling to other businesses, or B2B, is far lower key and offers lower margins, but stable business. You may never be a Taobao or JD.com (JD.US; 9618.HK) with hundreds of millions of customers, but perhaps that’s fine.

One such up-and-comer that’s finding a comfortable niche in the B2B pharma space is YSB Inc., which filed for a Hong Kong IPO last week with heavy-hitters Goldman Sachs and CICC as its joint bookrunners. Unlike consumer-facing pharma platforms like Ali Health (0241.HK) and JD Health (6618.HK), YSB mainly serves pharmacies and community-based medical institutions under its stodgier and lower-margin but steadier B2B model.

Founded just six years ago, the company says it’s the biggest provider of out-of-hospital digital comprehensive services in China’s medical industry, handling 27.5 billion yuan ($4.1 billion) in gross merchandise value (GMV) last year.

Its main business is connecting pharmaceutical companies with pharmacies and clinics that can trade drugs over YSB’s e-commerce platforms. Its revenue roughly tripled from 3.25 billion yuan in 2019 to 10.09 billion yuan last year, logging average annual growth of 76.2%. But like many Hong Kong-listed Chinese internet medical platforms, the company has also been losing money to the tune of a cumulative loss of 2.12 billion yuan in the past three years.

China’s pharmaceutical market consists of in-hospital and out-of-hospital segments. The former features drug makers and wholesalers supplying drugs to hospitals. The latter is more fragmented and beset with supply-demand mismatches due to difficulties faced by big drug makers trying to meet demand from small retail buyers. That’s where companies like YSB come in.

According to data in the company’s IPO prospectus, China’s out-of-hospital pharmaceutical distribution systems are at an early stage of digitalization, with their market value expected to reach 321.3 billion yuan by 2026, growing about 16.7% annually from 2021 to 2026, according to data from the National Medical Products Administration (NMPA).

China had around 560,000 pharmacies at the end of 2020, nearly 80% of those small-and-medium-sized chain stores or single stores, according to the NMPA. YSB is considered the leader in its market, with 305,000 downstream pharmacies and 130,000 community-level medical institutions as well as 256,000 monthly active buyers on its platform at the end of last year. The company says half of all pharmacies across China have conducted transactions on its platforms.

Low gross margins

Like most online pharmaceutical platforms, YSB’s operations revolve around both the platform trading business and its own proprietary business. It makes money from the former by collecting fees from sellers who trade on its platform. By the end of 2021, the platform had attracted around 4,700 sellers and 434,000 buyers, with annual GMV of 17 billion yuan in goods traded. But due to low commission rates, it only derived 490 million yuan from the platform business, accounting for less than 5% of its total.

Since 2019 it has been cultivating a far larger proprietary business, which sees it procure and warehouse drugs on its own, then sell and deliver them directly to downstream pharmacies. Its inter-provincial delivery network can reach major cities within 39 hours and smaller towns within 50 hours.

The proprietary business yielded GMV of 10.5 billion yuan in 2021. Despite fast growth and reaching 9.59 billion yuan in revenue last year, this part of its business had a low margin of only 5.2% due to high procurement costs compared with its platform business. As a result, the proprietary business contributed 96% of the company’s revenue last year but only 50% of its gross profit.

By comparison, the platform business had a far higher gross margin of 83.7% last year, bringing in 410 million yuan in gross profits, or 45% of the total. Those two businesses combined gave the company a total gross margin last year of just 9.1%, much lower than JD Health and Ali Health margins that are higher than 20%. Such differences are typical in B2B versus B2C, since B2B customers usually purchase in far larger volume and thus demand bigger discounts.

The expansion of its low-margin proprietary business has led to quick growth in revenue but not profits. That expansion, combined with investment in 24/7 automated smart drug cabinets, have compelled the company to hire more employees and added to other costs. That caused YSB’s marketing expenses to jump 46.4% last year to 1.06 billion yuan, with administrative and management expenses doubling over two years. Such factors have made it very difficult for the company to turn a profit in its short life.

Murky market positioning

YSB defines itself as a pharmaceutical trading and servicing platform. In real terms that means it’s similar to platforms like JD Health, which also have both proprietary and platform trading businesses. But in practical terms YSB functions more like a distribution link in the pharmaceutical industry.

Such market positioning has important implications for valuations, which are traditionally quite high for online platforms. JD Health and Ali Health have price-to-sales (P/S) ratios of 4 times and 12.8 times, respectively. But traditional state-owned drug distributors like Sinopharm (1099.HK) and China Resources Pharmaceutical (3320.HK) have far lower ratios of just 0.1 times and 0.12 times. That shows company valuations are all over the place, with newer, more high-tech private names getting greater investor attention.

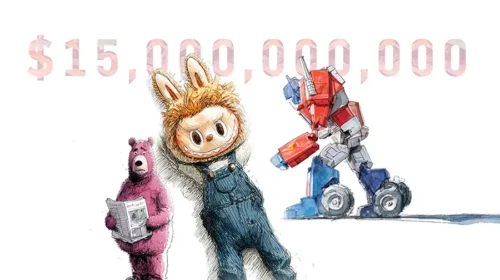

YSB has been attractive to investors ever since its founding and undergone eight rounds of fundraising. Its investors include Fosun Pharma (2196.HK; 600196.SH) and internet giant Baidu (BIDU.US; 9888.HK). In February 2021, the company raised $85.2 million in its latest financing round. Companies like Baidu, Guangdong Pearl River Investment and Sunshine Life Insurance piled in, bringing YSB’s valuation to $1.3 billion, with an implied price-to-sales (P/S) ratio of 0.87 times. That puts it squarely between the highflying B2C companies and the stodgier traditional distributors.

To subscribe to Bamboo Works weekly free newsletter, click here