TSMC profits from AI development, no matter which way political winds blow

Despite being continually caught in tensions between the U.S. and China, the Taiwanese chipmaker’s latest results demonstrate its prowess as an AI powerhouse

Key Takeaways:

- TSMC reported revenue of $26.88 billion in the fourth quarter of 2024, up 38.8% year-on-year, fueled by strong demand for its cutting-edge chips

- The company plans to increase capital spending to a new high of up to $42 billion this year as it seeks to maintain its position as the world’s leading contract chipmaker

By Lee Shih Ta

Two big questions were on the minds of many when Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC) (2330.TW; TSM.US), the world’s largest contract chipmaker, released its latest quarterly results last week, followed by a briefing. The first involved the AI that has turbocharged its business lately, and whether a boom for related products will continue. The second is whether the “T” for Taiwan in its name may start to lose relevance during a new administration of U.S. President Donald Trump that wants to see more manufacturing in America.

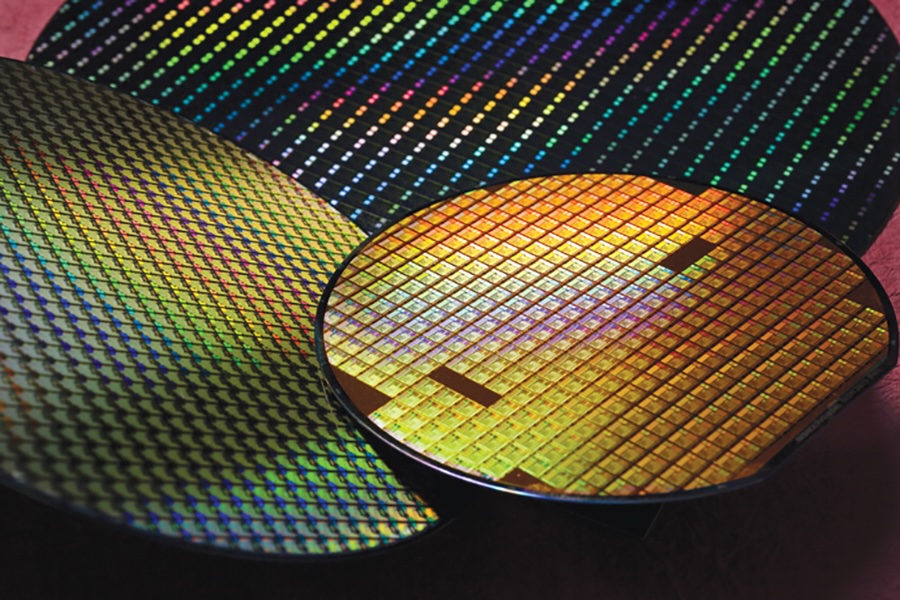

The first question stems from the recent cooling of AI concept stocks and rumors that chip superstar Nvidia is cutting down its chip on wafer on substrate (CoWoS) orders, referring to an advanced packaging technology developed and owned by TSMC. The company has been expanding its CoWoS production capacity in recent years to meet AI demand, since the technology is expected to be used almost entirely for AI-related products.

On that question, Nvidia’s CEO Jensen Huang, speaking in a separate interview in Taiwan the same day, and TSMC’s Chairman C.C. Wei, both clarified that orders weren’t being reduced but were actually growing. Huang explained that overall orders are still growing as Nvidia’s Blackwell-architecture chips are being gradually shifted from CoWoS-S to the more advanced and complex CoWoS-L process.

TSMC’s latest breakout performance attests to the boom’s continuation, including 38.8% year-on-year revenue growth to T$868.4 billion ($26.88 billion) in the fourth quarter, and 57% profit growth to T$374.68 billion. The headline figures not only exceeded market expectations but also represented a new record.

Meantime, the company’s gross margin for the quarter increased by 6 percentage points year-on-year to 59%, while its net margin rose 4.9 percentage points to 43.1%. The fourth-quarter results brought TSMC’s annual revenue to just over $90 billion, another high in its three decades as a listed company.

Its booming business has helped to lift TSMC’s shares by about 81% over the past year, not only outpacing the 28.5% gain for Taiwan’s benchmark index, but also marking the company’s own biggest annual gain since 1999. TSMC controlled over 92% of the global market for advanced process chips in the first three quarters of last year, and many now see it as a bellwether for the semiconductor and AI sectors.

Bullish on the future

TSMC’s AI-related business continues to grow rapidly. In last year’s fourth quarter, its high-performance computing (HPC) business, which includes chips for AI-related uses, contributed 53% of the company’s revenue and was up 19% quarter-on-quarter. HPC accounted for 51% of TSMC’s revenue in all of 2024, with a year-on-year growth rate of 58%. AI accelerators, including AI GPUs, AI ASICs and HBM controllers, contributed about 15% to 17% to TSMC’s total revenue last year, and the company expects that part of the business to double again this year.

Benefiting from strong AI-related demand and moderate recoveries in other end markets, the overall global semiconductor industry is expected to grow 10% in 2025, Chairman Wei said at the post-results investor conference. TSMC also gave revenue guidance of $25 billion to $25.8 billion for this year’s first quarter and forecast a gross margin of 57% to 59% for the period. It forecast revenue growth of 24% to 26% for all of this year, and 20% compound growth over the next five years.

To maintain its edge, TSMC said it plans to boost capital spending to a record $38 billion to $42 billion this year, showing its bullishness on its future.

Chip thieves

Despite so much good news, geopolitical risk continues to dog the company. Given Trump’s one-time comment that “Taiwan has stolen U.S. chip technology,” many now wonder what kinds of attacks his new administration may launch on the island’s chip industry during his second term.

It’s worth mentioning that, while tech giants like Apple, Meta, Google and Microsoft all gave big donations to Trump’s inauguration committee, TSMC neither contributed nor did it have any C-suite representative at the inauguration. Despite living under the spotlight lately, the company decided to keep a low profile that has become its signature approach to publicity.

Trump’s return to office comes as outgoing President Joe Biden announced yet more semiconductor export controls against China on his way out. Those included new measures that may expand current restrictions from 7 nm node technology to more mature 16 nm node processes. That will further erode TSMC’s ability to support its large Mainland China operation.

At the same time, TSMC’s plant in the U.S. state of Arizona officially launched mass production of 4 nm chips this year. Taiwan economic officials stated they won’t limit the company’s investment on its most cutting-edge processes in the U.S, which many believe means that TSMC will move more of its advanced production capacity to the U.S. under possible pressure from Trump. If and when that happens, some jokingly say the company may need to rebrand to the U.S. Semiconductor Manufacturing Co.

“No way” said Wei said, responding to such suspicions, adding that the company’s most cutting-edge R&D and initial mass production must be conducted in Taiwan.

Chips and savory dumplings

Comparing chip manufacturing to savory dumplings from Din Tai Fung, a leading Taiwan restaurant chain, Wei said that making such dumplings, called xiaolongbao, requires a high level of skill and concentration. Din Tai Fung doesn’t try to excel in other food areas and focuses on its core strength, and the same is true for TSMC in chip manufacturing, especially at its core base in Taiwan, he said.

He emphasized that TSMC improves its technology and changes its entire production line design once every two and a half years. But changes in the U.S. must wait until a roadmap is ready, an application sent, and an approval comes from the United States. Therefore, the most advanced production will certainly stay in Taiwan, together with leading R&D, he said.

Nikkei Asia previously disclosed that TSMC’s Arizona plant only achieved its recent mass production ability with the help of retired U.S. military personnel, leveraging their mechanical and electrical engineering background, and most importantly, their strong work discipline.

TSMC’s latest strong quarterly performance demonstrates that demand for its chips is still growing rapidly and that the heyday of AI chips is still to come. Facing ongoing geopolitical risks, the company’s only answer is to keep innovating with new technology. Even if the U.S. boosts its efforts aimed at stifling China’s chip sector, growth in other markets will eventually offset the demand gap. The only way forward is by focusing on its core strength.

“In the AI boom, no matter how the world changes, there will be a place for TSMC’s advanced technology,” said Wei.

To subscribe to Bamboo Works free weekly newsletter, click here