“You can also go play in Macao with your money. You’ll get the same odds as investing in a state-owned bank.”

Key Takeaways:

- Meta’s acquisition of AI startup Manus explicitly excludes Manus’ Chinese operations, signaling a trend of Chinese entrepreneurs moving to Singapore

- A local government’s decision to buy Weihai Bank shares at a premium rather than a discount is aimed at maintaining confidence in the lender

By Doug Young & Rene Vanguestaine

In the latest edition of China Inc., we examine a massive acquisition by a global tech giant that explicitly excludes Chinese assets, alongside a peculiar bailout of a regional lender in Northeastern Shandong province. On one side, we see highflying tech entrepreneurs maneuvering to exit the Chinese regulatory sphere; on the other, we see a regional bank inextricably bound to local government policy, regardless of market logic.

The great decoupling: Meta and Manus

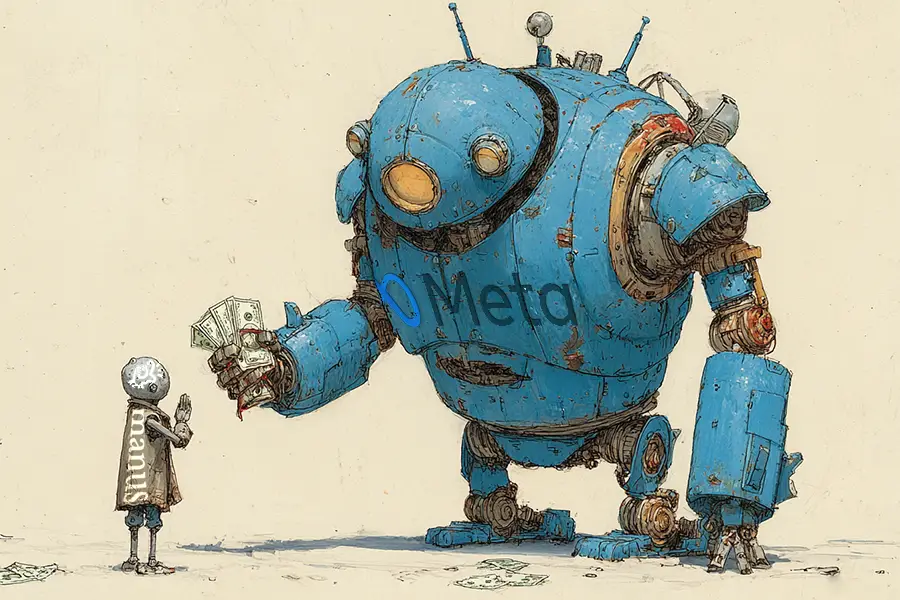

The big business headline last week was Meta’s (META.US) decision to purchase AI company Manus in a deal valuing the startup at between $2 billion and $3 billion. Manus made waves last March by unveiling what it described as the world’s first general AI agent — a digital assistant capable of performing multiple tasks across various platforms.

However, the deal comes with a significant twist: Meta does not want any of Manus’ Chinese operations, nor will the company have any Chinese ownership post-transaction. While Manus was originally based in both Beijing and Singapore, it is now officially headquartered only in Singapore.

We believe this separation makes perfect sense for the Facebook parent. Meta is essentially unable to operate any of its products — be it Instagram or Facebook — within China. Acquiring a domestic Chinese business would likely only result in that division being banned by the government, mirroring the fate of other foreign internet services.

This move by Manus is part of a broader trend of Chinese tech companies moving their headquarters to Singapore, similar to the path taken by fast-fashion giant Shein. However, unlike Shein, which retains a vast supply chain in China, Manus appears to be cutting ties more thoroughly. We view this as a clear signal that Chinese entrepreneurs are increasingly looking to build successful businesses outside the Mainland to avoid perceived heavy-handed regulation, oversight or control. This exodus mirrors the crypto industry, where companies were forced to relocate to Singapore or beyond after Beijing banned the sector.

We expect to see more entrepreneurs following this type of “success story” as company founders witness the wealth generated by Manus’ exit and its ability to get paid outside of China.

However, the deal is not yet closed. We suspect Beijing may try to interfere. The Chinese government has made a concerted effort to develop advanced technology, and losing a successful AI business is not in its interest. Until the transaction closes, Manus still has Chinese shareholders and business operations, characteristics the government could seize upon to have a say in the approval process.

Local government pays premium to prop up a regional lender

Turning to the financial sector, we look at the latest in a growing string of bailouts for regional lenders. Weihai Bank (9677.HK), located in the coastal city of Weihai in Northeastern Shandong province, announced a 1 billion yuan ($140 million) infusion from an investment vehicle attached to the local government.

In a move that defies standard market logic, the government is buying newly issued Weihai Bank stock at a premium to its latest closing price. Typically, such cash-raising efforts occur at a discount.

We believe this unusual pricing is less about economics and more about confidence. State-owned enterprises (SOEs) and government-owned banks are primarily instruments of government policy. In the post-Covid economic slowdown, banks like Weihai Bank have likely been strongly encouraged to lend to local companies to support the provincial economy, regardless of a borrowers’ health. This has created a vicious cycle where a bank’s assets grow, but its profitability stagnates due to non-performing loans.

By injecting equity at a premium, the local government is improving the bank’s Tier 1 capital ratio while sending a powerful message to depositors in Shandong: The bank has the government’s backing. This is a strategic move to prevent panic and stop a potential run on the bank. For investors, however, this underscores the risks of the sector. As we noted, investing in state-owned banks is akin to gambling in Macao. Third-party investors will always find themselves low in the pecking order behind government policy objectives. While these entities may offer yields — as the government mandates dividend payments — they are not designed for shareholder growth. Whether it’s banks, oil companies, or airlines, the primary mandate of Chinese SOEs is to execute government policy, leaving independent investors in for a bumpy ride.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: