Hong Kong chip frenzy enters AI lane with Iluvatar IPO

The maker of general purpose GPUs used in AI computing has made its first public filing and passed its listing hearing for a Hong Kong IPO that could raise around $300 million

Key Takeaways:

- Iluvatar CoreX has filed for a Hong Kong IPO and passed its listing hearing, following a similar filing by rival Biren, seizing on strong investor appetite for GPU listings

- The AI chipmaker’s sales increased by 64% in the first half of this year, but its loss for the period was nearly double its revenue.

By Hugh Chen

Call it microchip mania or a silicon feeding frenzy. Whatever you name it, China’s AI chip sector is having its moment, feeding on the glory of global superstar Nvidia, which lived in obscurity for years before breaking out to become the world’s most valuable company.

Two homegrown AI chipmakers captivated investors this month with spectacular stock debuts that made them some of the hottest properties on China’s domestic stock markets. Moore Threads (688795.SS) saw its shares surge over 400% when it debuted in Shanghai this month. Two weeks later, rival MetaX (688802.SS) soared by an even bigger 700% in its Shanghai debut.

But the story doesn’t end there, as envious competitors clamor for their own piece of the investor pie. Into that mix comes Shanghai Iluvatar CoreX Semiconductor Co. Ltd., which last Friday made its first public filing for aHong Kong IPO, the same day it also passed its listing hearing. Iluvatar’s move came just two days after rival Biren Semiconductor made its own first public filing for a Hong Kong IPO. Those two filings follow an announcement by search leader and autonomous driving specialist Baidu this month that it was evaluating a potential spinoff and listing of its AI chip unit, Kunlunxin, also in Hong Kong.

Reports of Iluvatar’s Hong Kong IPO plans first surfaced in August, saying the company planned to raise about $300 million.

The success of Moore Threads and MetaX suggests there’s strong appetite in China for general purpose graphic processing unit (GPU) stocks – a dynamic that Iluvatar and Biren hope will translate to similar demand from Hong Kong’s more internationally focused investor base. The Shanghai rallies were driven by investors wagering on Beijing’s push for technological self-sufficiency in AI chips, at a time when Nvidia and other international leaders face growing restrictions on what products they can sell to companies in China.

However, investors will need to weigh a series of risks before piling in. Those include not only challenges posed by U.S. sanctions but also a major technology gap that will limit these upstarts, most with less than a decade of history, in their ability to capture market share.

We’ll explore these issues in more detail shortly. But first, we’ll take a closer look at Iluvatar, which is quite typical of this group of AI chipmakers whose actual experience and sales are far smaller than their big dreams.

The company was founded in 2015 by Li Yunpeng, a previous R&D director at U.S. database giant Oracle. Its management team also includes Zheng Jinshan, a former researcher at leading chipmaker AMD. Such leadership teams, featuring executives with experience at major U.S. tech firms, is common among Chinese AI chip startups. MetaX, for instance, was founded by AMD veterans, while Moore Threads was established by a former Nvidia executive.

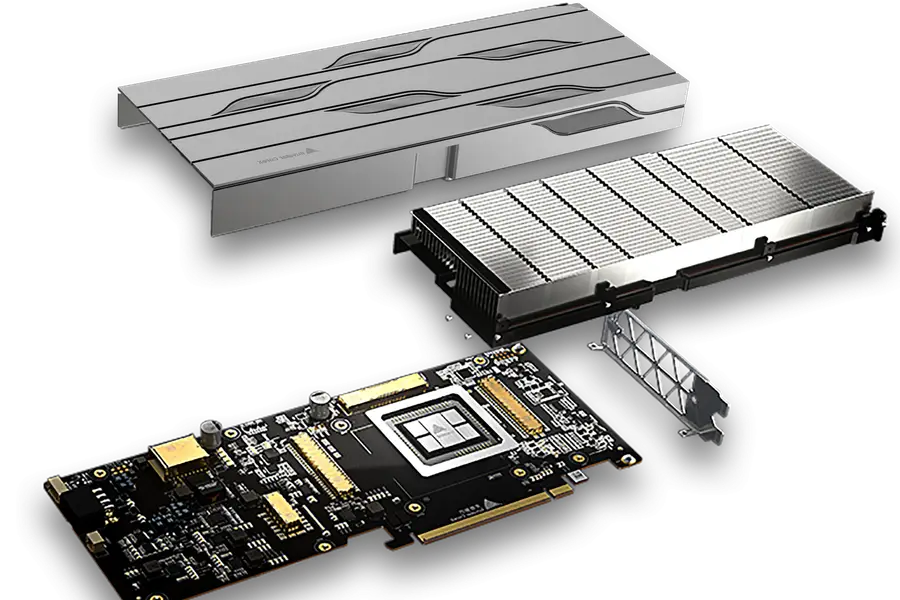

Like its peers, Iluvatar designs GPU products for AI workloads, including chips for training new AI models as well as inference chips used for deploying those models. And like others in the sector, it is a “fabless” company that outsources chip manufacturing to third-party foundries while focusing its efforts on chip design and marketing.

Tiny scale

Iluvatar’s listing document reveals the company is still quite small in terms of sales, though the figure is growing rapidly. Its revenue reached 539.5 million yuan ($76.6 million) in 2024, nearly double the 289 million yuan it recorded in 2023. Its revenue jumped another 64% year-on-year to 324 million yuan in the first half of this year.

While that growth appears impressive, the absolute numbers are still quite small. In terms of actual chips shipped, Iluvatar delivered just 52,000 units as of June – a tiny fraction of the nearly 2 million chips Nvidia moved in China in 2024 alone, according to IDC.

Most of Iluvatar’s Chinese rivals are also just blips on the global AI chip radar. MetaX posted revenue of 743 million yuan in 2024, while Moore Threads recorded an even smaller 438 million yuan, and Biren clocked in at just 337 million yuan.

The group faces a series of difficulties, led by their lack of access to advanced chip manufacturing technology. U.S. sanctions implemented in late 2024 effectively cut off Chinese AI chip companies from working with contract chip foundry TSMC, which dominates the global market for advanced chip manufacturing.

Lacking such access, many have shifted their production back to Mainland China, turning to domestic foundries like industry leader SMIC. But that approach presents significant challenges. First, U.S. sanctions have capped SMIC’s capabilities at around 7 nm technology – several generations behind TSMC, which has already begun producing 2 nm chips. This means companies like Iluvatar will lack the ability to produce upgraded products even as their design capabilities catch up with U.S. peers.

SMIC also has limited capacity to make 7 nm chips due to inability to buy additional advanced manufacturing equipment, forcing Chinese chipmakers to compete fiercely for the foundry’s scarce manufacturing slots. Those slots typically go to larger players like Huawei, leaving smaller firms struggling for access and often forced to look elsewhere.

Given their relatively small revenue base and the high costs associated with designing and producing chips, it’s no surprise that Iluvatar and its peers have yet to turn profits. In the first half of this year, Iluvatar posted a net loss of 609 million yuan, nearly double its revenue for the period.

The potential upside for investors betting on Chinese GPU stocks is clear: Chinese demand for AI chips is massive and growing. Iluvatar cites third-party research in its prospectus forecasting the market will reach 898.1 billion yuan by 2029, quadruple the 217.5 billion yuan in 2024.

Domestically made general purpose GPU products are expected to capture over 50% of that market by 2029, up from 17.4% last year and just 8.3% in 2022. Beijing will almost certainly continue supporting domestic GPU makers through various means, including financial subsidies and policy measures that carve out protected areas of the market.

However, as investors weigh the massive upside, they should also consider the intensely fierce competition building in the market. Beyond the names we’ve already mentioned, Iluvatar and its peers face more formidable rivals in the likes of Huawei, along with mid-tier players like Cambricon (688256.SH) and Hygon (688041.SH).

These larger competitors not only command priority access to SMIC’s limited capacity, but also lead in technology and product development, and possess far deeper financial resources. But all signs of a building chip bubble, which seems destined to burst in the next five to 10 years, are beside the point. For now, at least, shares of all the new names like Iluvatar seem destined to do well in the beginning, snapped up by investors looking for big short-term gains.

To subscribe to Bamboo Works weekly free newsletter, click here