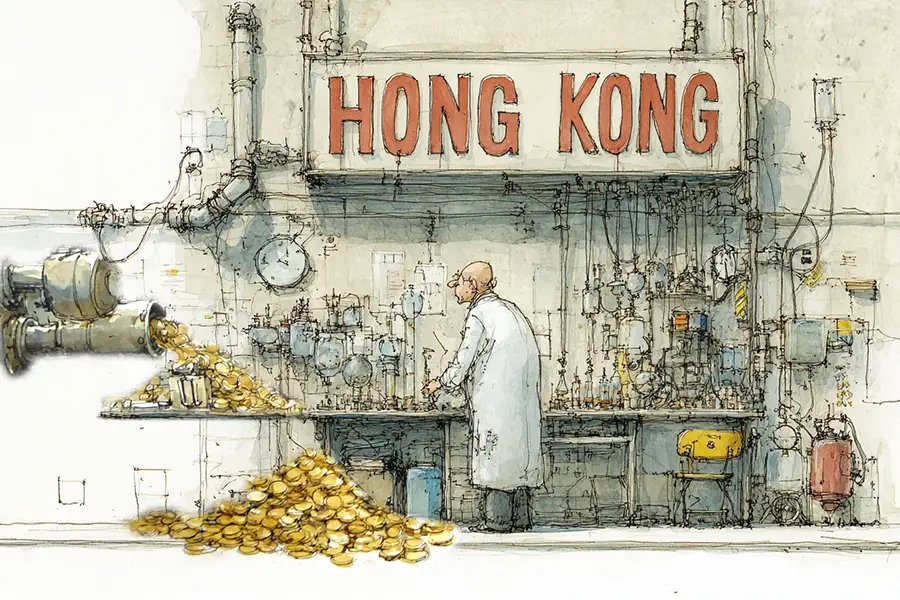

Hong Kong: China’s IPO pipeline and crypto lab

“Beijing is treating Hong Kong as a laboratory: a place to develop expertise in financial technologies that remain forbidden at home.”

By Doug Young & Rene Vanguestaine

A confluence of geopolitical friction and strategic diversification is fueling a remarkable start to 2025 for Hong Kong’s capital markets. The city has reclaimed its position as the world’s top fundraising hub, largely driven by Mainland Chinese companies seeking listings. In parallel, we are witnessing the nascent, cautious steps of Chinese firms into the global cryptocurrency arena, using Hong Kong as a crucial, state-sanctioned laboratory. These two trends, seemingly distinct, tell a unified story about the shifting financial landscape and China’s evolving relationship with global capital.

The roaring start to the year for new listings in Hong Kong, with 44 companies raising $13.6 billion in the first half of 2025, is a phenomenon worth examining. Many of these firms are established players on Mainland exchanges, now pursuing secondary listings, such as the one by electric vehicle battery giant Contemporary Amperex Technology Co. Ltd. (CATL), which alone raised $4.6 billion. We believe several factors are at play in driving this boom.

The primary driver, in our view, is geopolitics. The issues surrounding the availability of American capital for Chinese companies are not transient; they are likely a permanent feature of the financial landscape. This reality has reshaped the calculus for Chinese firms. Unless a company is confident of securing a significantly better valuation in the U.S., which is increasingly rare, Hong Kong presents a far more logical venue.

This is particularly true for smaller Chinese companies. While they might manage an IPO in the U.S., the initial excitement often fades quickly, leaving them with poor valuations in the secondary market. We have seen this even with Chinese companies that have been listed in the U.S. for a long time; they no longer command the valuations they once did. This is partly due to geopolitics and partly to the perception that the Chinese economy is facing headwinds in certain sectors. The appetite among U.S. investors for many Chinese stocks has simply diminished.

But why not list in Mainland China, where there are several large and active stock markets? For companies like CATL that are already listed domestically, a Hong Kong IPO is a clear strategy to diversify their capital sources. It is difficult to attract a significant amount of foreign capital in the domestic A-share market, even with mechanisms like the Hong Kong Stock Connect. A direct listing in Hong Kong provides a gateway to a global pool of capital. The success of this strategy, of course, varies on a case-by-case basis, depending on the company’s quality, sector, and performance. A globally significant and high-performing company like CATL is well-positioned to attract capital it can’t access solely in Mainland China markets.

For private companies not yet listed anywhere, the rationale is different. It is not necessarily easy for all Chinese companies to get approval for a domestic IPO. Mainland China markets are known to prioritize funding for companies that align with the Chinese government’s strategic goals, such as advanced technology and chip manufacturing. If a company doesn’t fit into these categories, it may face a long wait or be denied approval altogether. With the U.S. market becoming less accessible than it was a decade or two ago, Hong Kong becomes the de facto — and perhaps only — viable venue for these companies to go public.

China’s crypto experiment in a Hong Kong lab

At the same time, a fascinating development is taking shape in the world of digital assets. While Beijing maintains its strict ban on cryptocurrency mining and trading, some Chinese companies are beginning to explore the sector. We’ve seen boutique investment bank China Renaissance announce a $100 million investment in crypto-related assets and retail software maker Dmall prepare to apply for a stablecoin license. Notably, these initiatives are happening in Hong Kong.

We believe Hong Kong’s embrace of cryptocurrencies, in stark contrast to the Mainland’s prohibition, is a calculated move. Historically, China was a major hub for crypto mining until the government, wary of an uncontrollable financial instrument, banned the practice. This pushed mining operations and their legal entities abroad, with many landing in Singapore. The long-standing, albeit officially denied, competition between Hong Kong and Singapore created pressure. Voices in Hong Kong began to agitate that the city was being left behind on all things crypto.

In response, the Hong Kong government has been creating a regulatory framework to allow crypto-related activities to flourish. It appears to us, and to many observers, that Beijing is using Hong Kong as a laboratory. This allows China, as a whole, to develop expertise and knowledge in this emerging technology and financial market without permitting it within the Mainland itself. The core issue remains control; we do not foresee China relaxing its crypto stance on the Mainland anytime soon, given its tight grip on monetary and fiscal matters. The government is simply not going to allow synthetic, uncontrollable currencies to circulate freely.

Will we see more Chinese firms follow the path of China Renaissance and Dmall? We think so, for two reasons. First, it is in the nature of Chinese business that once a new idea emerges, a thousand companies will jump on it. Second, many companies will venture into this space primarily to signal to investors and stakeholders that they are on the leading edge of technological development. We know of one company, entirely outside of finance, that recently announced it would invest 20% of its treasury cash into crypto assets, framing it as a forward-looking move.

Of course, it is crucial to distinguish between different types of crypto assets. On one hand, you have bitcoin, which most rational observers would agree is a high-risk, speculative asset with no underlying economic value. On the other hand, you have stablecoins, which are typically pegged to real assets, like the U.S. dollar. This link provides an underlying economic support that makes them inherently safer and more stable, though still subject to the volatility of the asset they are tied to. While the crypto world remains a volatile one, the strategic moves being made by Chinese firms in Hong Kong signal a trend that is impossible to ignore.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: