From Delhi risks to a domestic dairy bust

Some Chinese companies are navigating geopolitical headwinds that are pushing them out of India, and others are adapting to a maturing domestic consumer market where even staples like infant formula are in decline

By Doug Young & Johnny Zou

It’s increasingly clear that China’s corporate giants and its vast consumer base are navigating a period of profound recalibration. This dual challenge is vividly illustrated by two diverging trends: the complex dance of Chinese companies in India, driven by fraught geopolitics; and the unmistakable maturation of China’s domestic consumer market, where the once-booming dairy sector is showing its age. These narratives reveal a new reality where the old playbooks for growth no longer apply, demanding far more sophisticated strategies for survival and success.

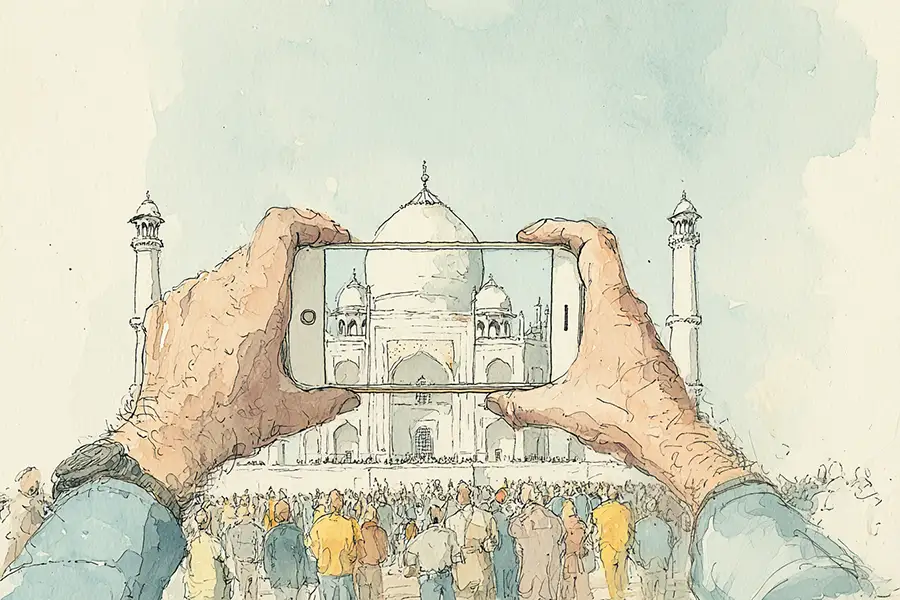

The story of Chinese business in India has become a tale of two cities — one of strategic entry, the other of strategic retreat. On one hand, you have a company like smartphone glass maker Biel, which is diving deeper into India by setting up a major production base. This move is less about India’s consumer market and more about serving a crucial global client: Apple (AAPL.US), which is aggressively moving its supply chain to India. To smooth its path, Biel has even relocated its headquarters from Shenzhen to the more international city of Hong Kong, a clear attempt to distance itself from its Mainland origins.

We believe this reflects a broader, necessary trend. Chinese companies are increasingly diversifying their production bases into Southeast Asia and Europe to mitigate the overhang of tariff risks, particularly from the U.S., and to navigate the souring geopolitical climate. However, this global push is fraught with peril. Operating in a new jurisdiction requires not just good lawyers but a deep respect for local culture and the ability to handle different political systems, especially in heavily unionized countries.

On the other hand, home appliance giant Haier (6690.HK, 600690.SHG) is taking a step back, reportedly looking to sell a 49% stake in its highly successful Indian operations to a local partner. This is not an isolated incident; it follows similar moves, such as Ant Financial reducing its stake in India’s Paytm. We see these decisions as largely politically driven. The tense relationship between New Delhi and Beijing, exacerbated by China’s support for Pakistan, has created a difficult environment for Chinese firms. Non-tariff barriers, such as the extreme difficulty in repatriating profits, make business exceptionally hard. For many Chinese companies, especially in the tech sector, scrutiny from the Indian government has become so intense that a partial or full exit seems like the most prudent course of action.

However, Haier’s proposed solution of a 51-49 joint venture is itself a high-wire act. From our experience, such partnerships are notoriously difficult to manage. A significant minority shareholder with different values and perspectives can easily lead to gridlock, proxy fights, and other complications. While the move may appear smart on paper, we are not optimistic about the structure. This dynamic forces investors to be extra careful. They won’t avoid companies with exposure to tense regions altogether, but are becoming far more cautious and legally prepared to face a host of challenges.

A maturing palate at home

Back in China, a different kind of challenge is unfolding. The domestic dairy industry, once a symbol of the country’s consumption boom, is showing signs of aging. Companies like infant formula maker Feihe (6186.HK) and e-commerce platform Yangtuo have seen their sales slump. The primary driver is demographic: China’s population growth has turned negative, and government incentives have so far failed to spark a baby boom.

This slowdown is compounded by broader economic pressures. With the real estate market in decline, Chinese households are experiencing a “balance sheet recession.” This has made consumers defensive, pushing them down the value chain in search of cheaper products and fueling vicious price wars that only well-capitalized, listed companies can survive. For the dairy industry, this is a double blow, as the cost of imported milk from Europe and New Zealand has also been rising.

Yet, it would be a mistake to write off the Chinese consumer entirely. We believe the market is not collapsing but bifurcating. To say that Chinese people are not consuming is a view we do not support; the key is understanding what they are buying. Consumption patterns are splintering across different age groups and interests.

For instance, parents in their 30s and 40s are still spending, but they are focusing on areas like education. There are cases of huge growth in products like AI-powered learning machines that help children with their studies. For teenagers and young adults, the spending is on products that offer emotional value, like the collectible “blind box” toys from Pop Mart (9992.HK), which provide a unique experience.

Furthermore, new categories are on the rise as consumers become more sophisticated. Whiskey consumption, for example, has been growing for years as people learn to distinguish between a bourbon and a single malt.

The crucial takeaway for any business is to recognize this new, fragmented landscape. We would be very careful about any business with a high price point in discretionary spending, as we expect demand in that area to remain muted for the next few years. The era of easy, across-the-board growth in China is over. Success now depends on navigating a treacherous global stage while simultaneously catering to an increasingly complex and divided domestic market.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: