Foreign firms face China’s cutthroat competition, while AI threatens knowledge platform Zhihu

“It’s not just about Chinese manufacturers competing with foreign manufacturers… even the Chinese government views that as disruptive, value-destroying competition.”

Key Takeaways:

- Foreign companies are facing a new era of “involution” characterized by savage price cuts by local rivals

- Knowledge platform Zhihu faces an existential crisis as users shift towards AI-driven search engines that offer faster and often more comprehensive answers

By Doug Young & Rene Vanguestaine

For years, the narrative regarding foreign business in China was consistent: the market was vast and lucrative, but bureaucracy was a big bottleneck. But now the ground is shifting beneath the feet of foreign and domestic companies alike, as they face existential threats from rapid, disruptive changes in the local landscape. On one hand, foreign manufacturers are being squeezed out by a ferocious mix of rising local quality and savage price wars. On the other, internet companies like Zhihu (ZH.US; 2390.HK) are finding their hard-won profitability eroded by the sudden ubiquity of artificial intelligence.

We’ve long heard complaints from the foreign community about government obstacles blocking their market access. But a recent survey by the German Chamber of Commerce in China highlights a stark change in recent sentiment. According to the data, 58% of companies cited intense domestic competition as the biggest barrier holding them back from investing more in China.

This is no longer just about standard market rivalry. We believe this reflects a phenomenon known in China as “involution” – a state of intense, disruptive, and value-eroding competition. Until a few years ago, foreign companies could rely on a distinct advantage over domestic peers in quality, reliability, and technology. That gap has closed. Chinese competitors have upped their game, particularly in sectors like electric vehicles (EVs), reaching parity with or exceeding foreign standards.

However, the progress of Chinese domestic products in quality and attractiveness is only half the story. The other half is ferocious price wars. Chinese companies are competing by savagely cutting prices rather than solely focusing on technological advantages. In a normal market, such a distorted environment would force a correction; companies losing money would eventually rationalize or exit. Yet, in China, the financial system – often with government encouragement – appears to continue funding this destructive game.

For giants like Volkswagen (VOW.DE), General Motors (GM.US), and even Tesla (TSLA.US), the environment is becoming increasingly inhospitable. It is difficult to compete against rivals who are willing to drop margins and lose money indefinitely. While we have seen the government step in to rationalize specific industries, such as solar, the damage for foreign companies across other sectors is largely done.

Compounding this is a shift in consumer sentiment. Chinese buyers are increasingly enamored with domestic brands, moving away from the historic captivation with foreign names. When you add the long-standing exclusion of foreigners from state procurement, the picture becomes clear. Despite lip service from Beijing about welcoming foreign companies, foreign direct investment (FDI) is on a downward slope. We don’t expect a rebound to previous golden-era levels; the trend is simply no longer in favor of building investments in China.

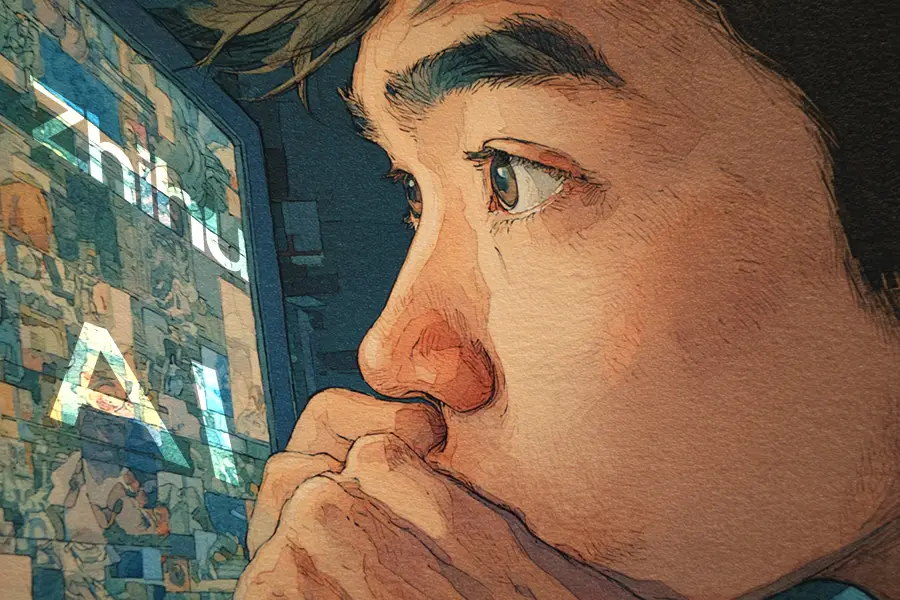

AI poses existential threat to knowledge-sharing darling Zhihu

The disruptive force of technology is not limited to manufacturing. We are also looking at Zhihu, often called the “Quora of China,” which is facing its own crisis. After finally finding a path to profitability last year by monetizing its Q&A and content service, the company is sliding back into the red. Its revenue plunged 22% in the third quarter.

The rise of generative AI models has fundamentally altered how users seek information. In the U.S. and China alike, users are increasingly defaulting to AI engines rather than traditional search or Q&A platforms. Zhihu’s founder has attempted to pivot, claiming the company will evolve into a “trusted information infrastructure” provider, leveraging its community for diverse, reliable perspectives.

We find this argument difficult to swallow. While it’s true that AI models aggregate data from across the web – including unverified social media content – the idea that Zhihu is inherently more “trustworthy” is debatable. All content is curated, whether by an algorithm or the people designing it. Furthermore, the economics are challenging. Users who can get “good enough” information for free or cheaply via AI are less likely to remain captive in Zhihu’s paid ecosystem.

Investors must also consider the perennial regulatory risk. As a content provider in China, Zhihu faces constant scrutiny. Unlike a pure tech play, they are feeding information to the public, which invites significant regulatory exposure – a risk that has destroyed shareholder value in the past.

Ultimately, both topics point to a tougher reality in China Inc. Whether it’s a manufacturer facing “involution” or a tech platform fighting AI algorithms, the era of easy growth appears to be over for domestic and foreign firms alike.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: