China’s new investment playbook: VCs chase crypto as a travel upstart eyes New York

By Doug Young & Johnny Zou

Two recent shifts by smaller venture capital firms and a major IPO plan from a Hong Kong travel upstart signal telling trends for the future. China Renaissance (1911.HK) is making a significant foray into cryptocurrency, while Tian Tu Capital (1973.HK) is pivoting from its consumer goods comfort zone into technology, funded by an unusual bond issue. Simultaneously, online travel agent Klook is preparing a major U.S. listing. These moves, while distinct, paint a broader picture of adaptation and strategic recalibration in a rapidly changing landscape.

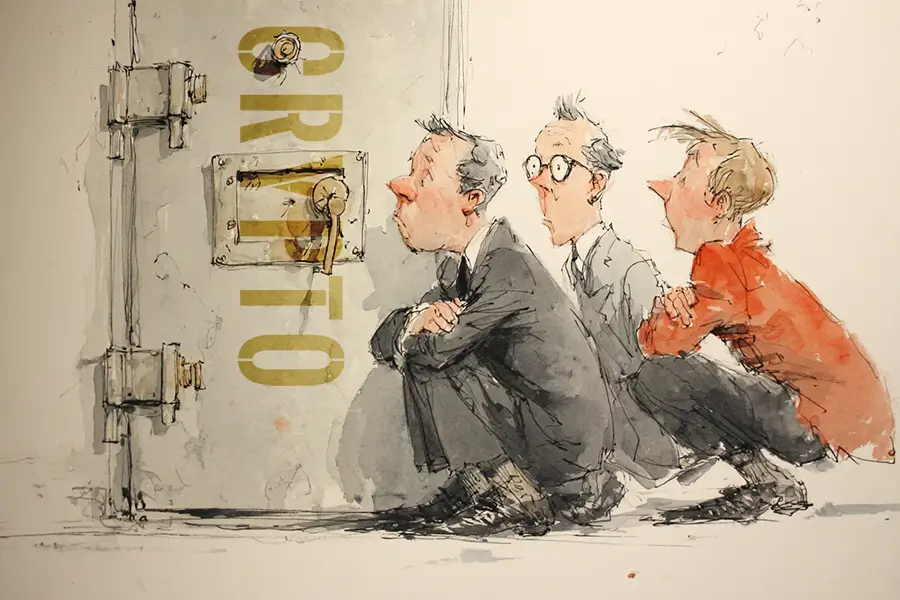

We believe the move by firms like China Renaissance into crypto is, in a word, inevitable. Crypto is no longer a back-alley affair; it has moved to center stage. While crypto trading is technically illegal on the Chinese Mainland, this has not deterred Chinese venture capital. We’ve seen this before, with firms like IDG investing in companies like Circle. The strategy is clear: use Hong Kong as the major platform to access crypto assets and launch related products. It’s a path already being tested by giants like JD.com, which is participating in a stablecoin sandbox scheme in the city. This isn’t an unorthodox maneuver but a prudent one, allowing onshore companies to tap into the trend legally through their offshore entities. We expect to see increasing crypto exposure for venture capital firms going forward, even if not every firm launches a dedicated fund.

Tian Tu Capital’s pivot away from its traditional focus on the consumer sector is equally noteworthy. The consumer story in China has grown complicated. The boom of 2021, which saw a wave of new brands in cosmetics, food, and retail attract huge VC investment, came to an abrupt halt during the 2022 Covid lockdowns, knocking many of these companies out of favor. Regulators also grew hesitant to approve onshore listings for these companies, closing a vital exit path for investors.

Perhaps most importantly, the underlying market assumption for these companies has been upended. The dream was that Chinese consumers would keep moving up the value chain, spending more on premium milk tea, ice cream, and other discretionary goods. Instead, we are seeing a move down the value chain. Consumers are increasingly seeking cost-efficient products and reducing their overall spending.

This has painted a bleak picture for many new consumer companies. That’s not to say the sector is dead. Survivors like Pop Mart (9992.HK) have successfully transitioned from a niche brand to a mainstream powerhouse, and some of the better-performing recent IPOs in Hong Kong have been consumer-related companies. Their appeal is simple: investors find it easy to assess their profitability and revenue. Still, Tian Tu’s move into tech, financed by a new bond issue, shows where they see the future.

This financing method is itself a new development, driven by a central government push to promote a “technology board” within the bond market. The commercial logic is compelling. With a coupon rate under 2%, the cost of capital is significantly lower than the return rates typically demanded by traditional limited partnership (LPs) investors. The main problem, however, is a maturity mismatch. These bonds currently have a three-year term, which is far too short for early-stage tech investments. How this will be resolved — whether through extensions or refinancing at potentially higher rates — remains a critical question. Some VCs may be more inclined toward new LP schemes being set up by commercial banks to invest in deep tech, as the traditional LP-GP structure is more familiar and predictable than the bond market.

A survivor’s bet on Wall Street

Finally, there is the case of Klook, the Hong Kong-based online travel agent reportedly preparing a U.S. IPO to raise up to $500 million. The company successfully carved out a niche by targeting millennial and Gen Z travelers, but as it has grown, its differentiation from giants like Trip.com and Booking.com has blurred. The competition is now increasingly about pricing.

Interestingly, Klook’s founders all came from backgrounds in investment banking, not travel. In the past, this might have been a red flag for VCs, but we believe the barriers between industries have become much thinner than they were a decade ago. The ultimate testament is how they grow the business, and Klook’s founders have proven to be successful and driven. It is obviously a very successful company now, but there was a great deal of luck involved. They managed to survive Covid, a period when the entire travel industry came to a full stop and many businesses went bankrupt.

Their decision to list in New York over Hong Kong is a strategic one and we don’t think Chinese companies are actively avoiding New York. Rather, the main hurdle is the China Securities Regulatory Commission (CSRC), whose approval is required for Mainland-based companies to list in the U.S. and is difficult to get in the current geopolitical climate. As a global company with an offshore structure, Klook likely does not require this approval. We believe the choice of New York comes down to valuation. Hong Kong investors are deeply familiar with online travel agencies and would take a critical view of Klook’s profitability and cost structure. In New York, they can frame themselves as a global challenger, likely fetching a higher valuation. At the end of the day, it’s a very practical move.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: