After Roller Coaster Year, Yidu Stock Settles Down Post-IPO

Big-data healthcare services provider’s operating loss widened in its latest reporting period as revenue grew 62%

Key Takeaways:

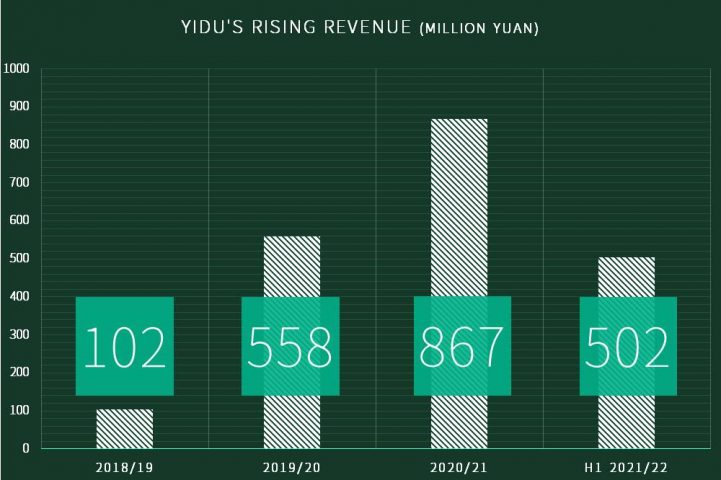

- Yidu’s revenue rose 62% in the six months through September

- Company’s health management platform and solutions business grew 6.4 times in the period, becoming its biggest breadwinner

By Liu Ming

A “fall to earth” may best describe the ride that healthcare big data specialist Yidu Tech Inc. (2158.HK) has taken since its IPO at the start of this year. The company started the year on a turbocharged note with a 165% stock rise, riding a wave of hype around the “Internet + healthcare” concept. But growing concerns over Beijing’s tightening oversight of data security and personal information protection, coupled with growing loses in its first post-IPO financial statement, have taken most of the wind out of the company’s sails.

Yidu’s latest interim financials for the six months through September seem to suggest that despite having its wings clipped early on, the company has started to heal. Its revenue for the first half of its latest fiscal year rose 62.3% year-on-year to 500 million yuan ($78 million) and its overall gross margin increased by 3.4 percentage points to 20%.

Within its business portfolio, revenue from its big-data platform and solutions business, the oldest of its businesses, increased by 21.1%; its newer life science solutions business doubled to 146 million yuan. But the big story was a 6.4 times rise for its health management platform and solutions business to 190 million yuan, as it overtook the big-data business to become the company’s top revenue source. The growth showed a “trio” revenue structure taking shape for the company.

Yidu’s life science solutions business provides pharmaceutical, biotechnology and medical device companies and contract research organizations (CROs) with data-driven solutions in areas ranging from clinical development to post-launch marketing, helping customers reduce their development time and costs. Its health management business provides clinical research and management tools to physicians as well as insurtech and disease management solutions to insurance agencies.

Sales expenses double

The company’s strong revenue growth in the first half of its fiscal year came on the back of even faster-rising operating expenses. During the six-month period, its administrative expenses increased by 29% to 175 million yuan, while sales and marketing expenses grew by a much faster 1.2 times to 230 million yuan. R&D expenses also outpaced revenue growth, rising 94.7% to 190 million yuan. As a result, the company’s operating loss grew to 442 million yuan, up from 256 million yuan during the same period last year.

China’s recent heavy investment in its healthcare information systems has created a big pool of healthcare data. But because that data is held by a wide range of actors in the healthcare system, it has become siloed and inefficiently managed. Yidu’s systems aim to tackle that disconnect by aggregating diverse amounts of information, converting it into useful data and developing products for companies and organizations in the healthcare industry.

The company’s big network and ecosystem of three major businesses is conducive to both its rapid expansion and customer retention. The system becomes smarter and produces more valuable data solutions as it attracts more participants and processes more data. Once it reaches economies of scale, the company’s sales and marketing costs are expected to fall drastically as a proportion of its overall revenue. Reflecting that, administrative costs as a percentage of revenue have already come down from 44% in the first half of Yidu’s last fiscal year to 34.9% during the same period this year.

As of September, the company had provided its solutions to 78 leading Chinese research hospitals, 21 regulatory bodies and policymakers, and had 127 active customers for its life science business with more than 8 million paying customers who had made purchases at least once on its health management platform.

After years of development, healthcare big data solutions are playing an increasingly important role in clinical and scientific research and are expected to keep growing rapidly in coming years, according to “China Healthcare Big Data Solutions Market Shares, 2020: Advancing Adoption in Medical Treatment and Clinical Research,” a report released by International Data Corp. (IDC) in September.

Yidu’s YiduCloud subsidiary ranked No. 1 among Chinese healthcare big data solution providers with a market share of 18.6% in 2020, and is well-positioned to benefit from the growth of the market, according to data previously released by the company.

Among Hong Kong listed companies, Yidu does not have any direct peers for benchmarking. But it shares some similarities with Alibaba Health Information Technology Ltd. (0241.HK) and Ping An Healthcare and Technology Co. Ltd. (1833.HK), which both saw similar rapid revenue growth, but also falling gross margins due to fast rising sales and management expenses in the first six months of this year. By comparison, Yidu’s gross margins were relatively stable. Its customers are mostly professionals or institutions that tend to be more loyal. And the fact that it operates in a very promising segment of the healthcare market also helps. Accounting firm Ernest & Young has forecast compound annual growth of up to 40% during the 2020-2024 period for the healthcare big data solutions market.

Profitable in 2024

Winning Health Technology Group Co. Ltd. (300253.SZ) and B-SOFT Co. Ltd. (300451.SZ) are two Shenzhen-listed companies that could be considered highly comparable with Yidu. The pair recorded profits of 260 million yuan and 230 million yuan, respectively, in the first three quarters of the year, giving them price-to-earnings ratios (P/E) of 60 and 38 by the end of November. Yidu has yet to turn a profit, so it lacks such a positive P/E.

Using a price-to-sales (P/S) ratio for comparison, Yidu’s 16 is higher than the 13 for Winning and 7 for B-SOFT, reflecting a premium for Yidu’s stock relative to its industry peers even after its post-IPO roller-coaster ride. Now we’ll have to wait and see whether the company can find its way into the profit column while maintaining its rapid growth to prove itself worthy of its high valuation.

Yidu’s shares closed at HK$20.45 on Dec. 2, down 71% from their HK$69.80 peak, and also 22% lower than its IPO price in January. After all the hype and later skepticism, the stock now trades not far from where it started. Its ability to rediscover some excitement will hinge on its ability to keep growing rapidly while also finding profits. Goldman Sachs forecast Yidu would maintain compound revenue growth of more than 50% between its 2021 to 2026 fiscal years. It expects the company to reach the break-even point in its 2024 fiscal year, meaning profits are still at least three years away.

Will investors be patient enough to stick around that long? That’s the million-dollar question for Yidu right now.

To subscribe to Bamboo Works free weekly newsletter, click here