“In China, bankruptcy is inextricably linked to the concept of ‘face’.”

Key Takeaways:

- Vanke has secured a temporary reprieve on repayment of its foreign debt, as a full bankruptcy reorganization remains unlikely

- Pet hospital operator Ringpai is seeking a Hong Kong listing despite a difficult path to profitability caused by high operational costs and consumer caution

By Doug Young & Rene Vanguestaine

We’re looking at two distinct corners of China’s economy this week that tell similar stories of adjusted expectations and financial endurance. First, we examine the latest reprieve for embattled property developer Vanke (2202.HK; 000002.SHE), which is battling to stay solvent in a liquidity crisis. We also turn our attention to the consumer sector to discuss Ringpai, a pet hospital operator lining up for a Hong Kong IPO that looks like a bit of a barker — no pun intended.

The long, slow grind for Vanke

Vanke, like many of its peers, has fallen on hard times after once booming in tandem with the Chinese real estate market. The company has been gradually taken over by its hometown government in the southern boomtown of Shenzhen, yet even that state backing hasn’t guaranteed its future as creditors line up.

In the latest twist, a group holding maturing Vanke bonds worth about 3.7 billion yuan, or more than $500 million, granted the company a 30-day grace period from a previous Dec. 28 deadline. This is just the latest delay in a string of similar moves as the company attempts to reorganize its massive debt.

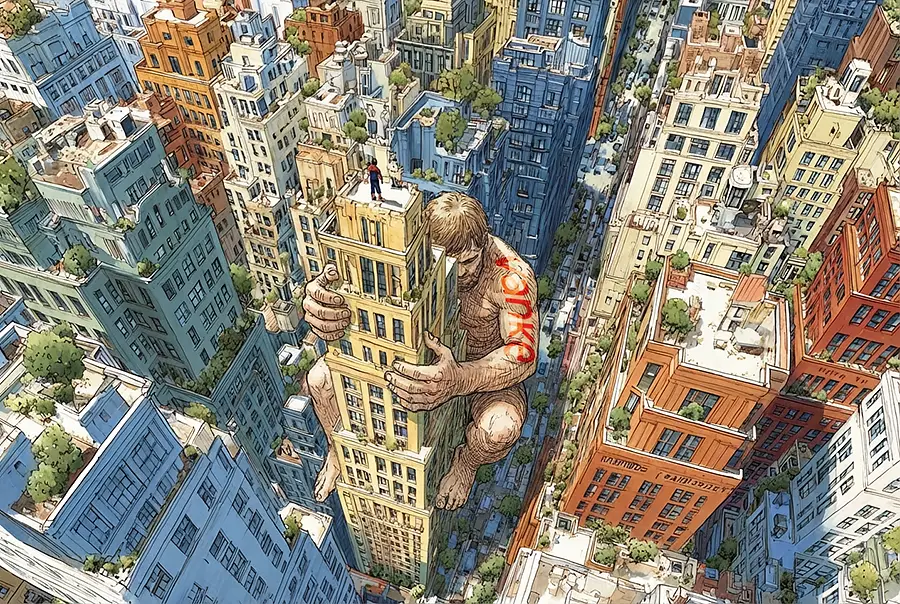

What’s interesting to us is that Vanke and its peers seem intent on a strategy of “death by 1,000 cuts” rather than taking the more obvious route of declaring bankruptcy to work things out under court protection. We believe this aversion to bankruptcy is largely cultural. In China, bankruptcy is inextricably linked to the concept of “face.” When a company goes bust, the immediate assumption is management failure. It is extremely rare for senior executives — founders, chairmen or CEOs — to admit they did something wrong.

While we could debate whether the current debacle stems from management recklessly growing too fast or from regulatory interventions that distorted the market, the outcome remains the same.

There is also a political dimension. The Shenzhen government, through Shenzhen Metro, is a major shareholder. They previously came to Vanke’s rescue with money and power, leading many to believe the developer would survive unscathed. However, the government recently indicated it would not throw good money after bad, signaling that Vanke must navigate these difficult times on its own.

We think the reluctance to file for bankruptcy also stems from the unique “human dimension” of China’s real estate sector. Unlike a factory producing steel rods, a developer’s collapse affects individuals who have paid for apartments that are not yet delivered. Many of these people are paying mortgages on homes they do not possess. In a Western-style Chapter 11 reorganization, a company is protected from creditors. But in China, these would-be homeowners are creditors. We doubt the Chinese legal system would allow a bankruptcy proceeding to say these individuals have no claim.

Consequently, while foreign creditors have petitioned courts in Hong Kong to seize assets outside the Mainland, the vast majority of Vanke’s assets remain inside China, largely untouchable by foreign entities. Domestic investors, meanwhile, may be pressured to give the company breathing space rather than rock the boat.

A dog-eat-dog world for pet hospitals

Switching gears to the consumer market, Ringpai has become the latest in a long list of companies trying to seize on Hong Kong’s hot IPO market. As China’s second-largest operator of pet hospitals, Ringpai boasts 548 centers in 70 cities. Despite its scale, the company was losing money until recently, reporting only a small profit in the first half of last year.

We see a company hamstrung by high costs. Ringpai relies heavily on expensive equipment and imported pet drugs because China lacks many domestic alternatives for animals. Furthermore, the sector faces a high talent cost to keep veterinarians happy in a hyper-competitive market. The company’s rapid growth through acquisitions has also come with significant associated costs, which we believe is a primary reason they have struggled to maintain sustainable profitability.

This situation reflects a classic “consumer story” in China that has lost some of its shine. Years ago, investors were enchanted by the math: 1.4 billion people with growing discretionary income equals a massive pet market. However, that growth story has hit a wall of reality.

China’s post-Covid recovery has been slow, and consumer sentiment is weak. People have become very cautious, focusing on saving money due to uncertainties about life. We suspect that many who wanted pets have decided the timing is unfavorable.

While some still spend ridiculously on premium food and pet toys, the reality of ownership — specifically the big cost of healthcare — is daunting. Without the health insurance available to humans, treating a sick pet can become horribly expensive very quickly. Pet owners are often at the mercy of veterinarians, and we have noted dissatisfaction among consumers who feel services and drugs are overpriced.

Ultimately, whether it’s a property giant or a pet hospital chain, the economic narrative is similar: rapid expansion and high expectations are now facing a period of painful adjustment.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: