“In the current economy… this whole thing seems to me to be almost a zero-sum game. There’s a finite amount of money that Chinese consumers can or are willing to spend on discretionary items.”

By Doug Young & Rene Vanguestaine

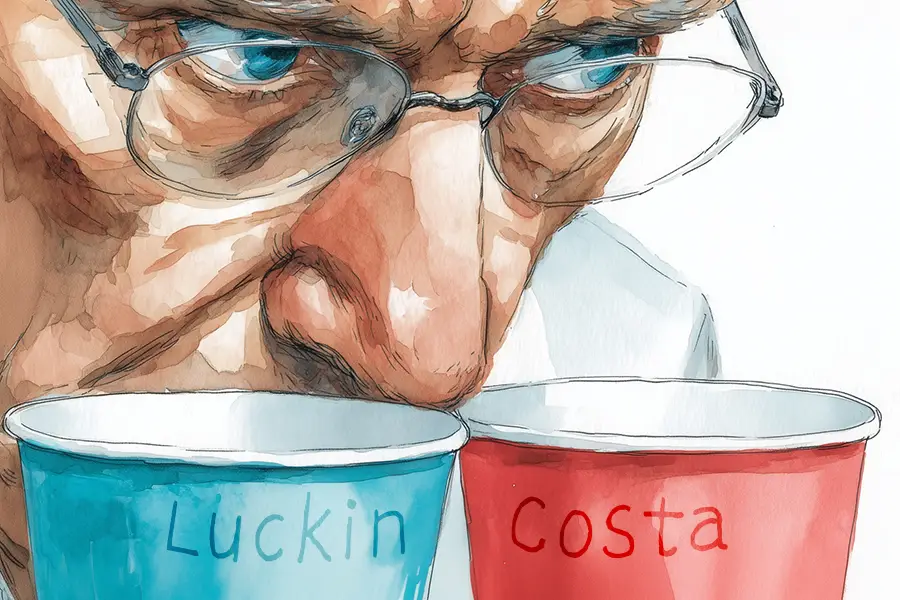

Diverging fortunes on China’s retail landscape have been on full display recently, characterized by a coffee giant’s audacious global ambitions and the quiet fizzling of what was once the world’s largest shopping extravaganza. On one hand, Luckin Coffee, having already eclipsed Starbucks domestically, looks poised for a massive international breakout with reports linking it to a bid for the British chain Costa Coffee. On the other, the “Double 11” shopping festival – once billed as China’s answer to Black Friday – rang hollow this year, marked by muted media coverage and a lack of concrete sales data. They offer a combined snapshot of the current Chinese economy: a saturated, cautious domestic consumer market driving fierce competition at home, compelling the strongest players to seek growth beyond China’s borders.

A caffeinated global ambition

Luckin Coffee’s (LKNCY.US) growth has been nothing short of lightning-fast. With more than 29,000 stores globally – the vast majority in China – it has firmly established itself as the nation’s largest coffee chain. However, reports suggesting Luckin may bid for Costa Coffee, currently owned by Coca-Cola (KO.US), indicate a strategic pivot. While Costa is significantly smaller by store count, with roughly 4,000 shops, its footprint spanning 52 countries and regions would immediately propel Luckin onto the global stage.

We believe such a deal is plausible, despite the ghosts of Luckin’s past. It’s true that the company faced a major accounting scandal in 2020 involving fabricated sales. However, that occurred under a previous management regime. The individuals responsible for that era’s strategy and malfeasance are long gone. The current leadership has spent years cleaning up the business and pursuing an aggressive expansion strategy, not only to compete with Starbucks but to distance themselves definitively from domestic rivals like Cotti Coffee.

There’s a limit to expansion within China, particularly given the depressed state of consumer sentiment. For a company pursuing high growth, international expansion is the logical next step. While Luckin has begun opening stores in Southeast Asia and the United States, organic growth is slow. Acquiring a well-established chain in Europe offers a shortcut to a global logistics network and 4,000 points of sale.

If this deal proceeds, we suspect Coca-Cola would prioritize two things: valuation and a clean break. Given Luckin’s history, a cash deal seems most likely, as the seller would presumably wish to avoid holding Luckin stock. Luckin appears cash-rich and capable of securing financing, making a purchase feasible.

The question remains: What would Luckin do with Costa? The British brand has struggled to thrive under Coke’s ownership, often criticized for closing stores rather than opening them. We see multiple paths forward. Luckin could leverage its superior technology – particularly in mobile ordering – to modernize Costa’s operations. While rebranding is risky given Costa’s existing following, a co-branding strategy or a holding company structure could allow Luckin to manage the assets without alienating European customers or investors wary of the Luckin name.

However, challenges abound. Expanding into Europe involves navigating a cultural landscape vastly different from China’s. European unions are powerful, and we have seen many Chinese companies stumble in the region due to challenging labor relations. Furthermore, while Costa has a presence, the brand quality is debatable.

The fading glory of the shopping marathon

While Luckin looks outward, the domestic retail scene is suffering from fatigue. This year’s Double 11 festival might be dubbed as “Dud Ball 11.” In the past, this event was a sensation, with e-commerce giants releasing breathless updates on sales figures. This year, the silence was deafening. JD.com vaguely claimed turnover reached a new high, and Alibaba noted that 35 brands logged more than 100 million yuan ($14 million) in sales during the first hour, but specific gross merchandise value (GMV) totals were largely withheld.

We view this not merely as a temporary blip, but as a sign that the novelty has worn off. The “ship has sailed” on the excitement that once defined the event. While consumers everywhere love a bargain, the Chinese consumer economy is not in the robust shape it was pre-Covid. Shoppers are significantly more cautious.

Furthermore, the event itself has diluted its own impact. What began as a single day of frenzied shopping has morphed into a marathon lasting over a month, filled with confusing pre-sales and post-sales. Much like Black Friday in the U.S., which has extended into a longer seasonal promotion, Double 11 has become a routine part of the calendar rather than a “circus.” The days of Jack Ma dressing like a rock star to celebrate sales records are over, partly due to the government’s crackdown on such extravagance in recent years.

Ultimately, in the current economic climate, Double 11 has become a zero-sum game. There is a finite amount of money Chinese consumers are willing to spend on discretionary items. With more platforms joining the fray, they are simply taking business from one another rather than growing the overall pie. This saturation explains the muted numbers and suggests that we should not expect the festival to bounce back to its former glory anytime soon.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: