China bets big on stocks as consumers fret over pre-made food

“This is the Chinese government seeking redemption for having destroyed value in the real estate market.”

By Doug Young & Rene Vanguestaine

Two narratives are currently unfolding in China that speak volumes about the state’s priorities and the public’s anxieties. The first is a staggering, direct intervention by Beijing to prop up its domestic stock markets, a move of a scale that would be unheard of in the West. The second, a seemingly minor social media tempest, involves a public outcry over a popular restaurant chain’s use of pre-made food. While one is a multi-billion-dollar macroeconomic strategy and the other a debate over dinner, both reveal a fundamental challenge for China: the difficult task of building and maintaining public confidence, whether in financial markets or the food on one’s plate.

We were struck by a recent report from Chinese brokerage Huatai Securities, which estimated that state-owned entities, led by top government investment arm Central Huijin, now hold nearly 4 trillion yuan — or more than $550 billion — in Chinese stocks. This quiet buying binge amounts to a staggering 4.8% of the entire market capitalization of the Shanghai and Shenzhen exchanges. The fundamental question is not whether this is happening, but why.

We believe this is Beijing’s attempt at redemption. Having presided over a crisis that destroyed immense value in the real estate market, the government is now faced with a population that is saving, not spending. With persistent deflationary pressures threatening to stall the economy, a new engine for wealth creation is needed. For the average Chinese citizen, who would have to be a glutton for punishment to pour more money into property, the stock market is being positioned as the next best alternative.

The logic is twofold. First, a rising stock market makes people feel wealthier, which in turn should unlock the vast reservoir of household savings and spur the consumption the economy desperately needs. Second, a healthy, performing domestic market is essential for funding the companies in sectors Beijing deems critical for national security and future growth — namely technology, AI, chips, and healthcare. With access to U.S. capital markets largely severed, building a robust domestic alternative is not just a choice, but a necessity.

This is not Beijing’s first attempt. Since the post-Covid reopening, the government has tried to guide the market with supportive policies and encouraging words. Each time, the market would rally briefly before running out of steam. It seems officials have decided that words are not enough and have moved on to a much stronger effort: deploying the “national team” with massive amounts of state capital. This is the equivalent of manually cranking an old-time car engine, hoping that after enough effort, it will start running on its own.

To support this, regulators have also pushed reforms to incentivize dividend payments and improve corporate transparency. Yet, the crank is turning against a strong headwind of public anxiety. After years of economic uncertainty, job losses, salary cuts, and high youth unemployment, it could take more than a rising index to convince people to invest their life savings. The market is up substantially this year, but for this strategy to be truly sustainable, the economic engine must eventually fire on its own. If the hype around sectors like AI fades before real profits materialize, we believe investors will inevitably start asking, “Where’s the beef?”

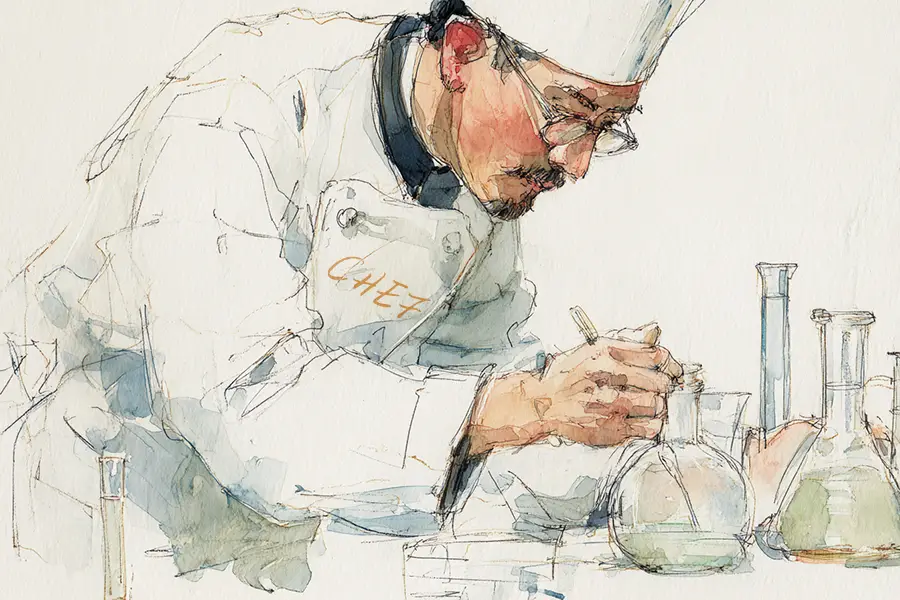

A tempest in a central kitchen

While the government attempts to engineer confidence on a macro scale, a recent brouhaha over pre-made food shows how easily trust can be shaken at the consumer level. A popular blogger recently “outed” the restaurant chain Xibei for using pre-made dishes, sparking a wave of online criticism. The company’s response was to deny the practice, stating all its dishes are prepared fresh in its restaurants.

Frankly, our reaction to the initial criticism is: So what?

The use of central kitchens by large restaurant chains is not a scandal. It’s an industry best practice, one that Beijing itself encourages to improve standardization and quality control. The outrage seems to stem from a romanticized notion of “freshness,” even if on-site preparation can lead to inconsistency and dishes that are too oily, salty, or overcooked.

What this debate misses is the most crucial benefit of a centralized model: enhanced food safety. In a country with a well-documented history of food safety issues, including the infamous use of “gutter oil” in smaller restaurants, the consistency and traceability offered by a central kitchen are invaluable. We believe that for any large chain with hundreds or thousands of outlets, this model is the only way to ensure consistency of taste, quality, and, most importantly, safety at a reasonable cost. Global giants operating in China, like Yum China and McDonald’s, have followed this model for decades for this very reason.

The real problem here is a profound lack of consumer education. Instead of issuing a defensive denial, a company like Xibei has a golden opportunity to lead and educate. It should proudly explain why it uses this model — to deliver food that is safer and more consistent than what many smaller kitchens can offer. It is a chance to turn a perceived negative into a powerful statement about its commitment to quality.

In our view, both the state’s market intervention and the restaurant’s PR fumble highlight a shared theme. Beijing is using its financial might to crank-start economic confidence, while businesses are struggling to communicate the merits of their modernizing practices to a skeptical public. In both cases, success will ultimately depend not just on the action itself, but on the ability to build genuine, lasting trust.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: