Yangtze Memory overhauls share structure in preparation for IPO

China’s leading memory chip maker was worth $23 billion after its recent shareholding overhaul, and is likely to list in either Shanghai or Shenzhen

Key Takeaways:

- YMTC has completed a shareholding restructuring, attracting 16 institutional investors ahead of an expected IPO

- Despite U.S. sanctions forcing it to rely on domestic production equipment, the memory chip maker recently doubled its global market share from 4% to 8.3%

By Hugh Chen

China has pumped billions into its semiconductor industry in the last decade, seeking to localize supply chains to shield it from increasingly stringent U.S. technology restrictions. That effort has yielded a cohort of companies now starting to mature, providing stock market investors with a wide range of new semiconductor options.

An addition to that group could soon be Yangtze Memory Technologies (YMTC), which stands out as China’s homegrown champion in the highly competitive global market for flash memory that’s a critical component in smartphones and other electronic gadgets. YMTC was founded in 2016 — just two years before the U.S. launched the first salvo in its prolonged war to stifle China’s semiconductors development — and has weathered years of escalating restrictions since then.

Nearly a decade after its launch, the company is now eyeing its next major milestone, this time on the capital, rather than technology, markets, as it edges towards an IPO. The company held its inaugural shareholder meeting late last month and elected its first board, completing a shareholding reform process that brought it one step closer to a listing, local financial outlet Caixin reported, without providing any additional timeline.

With an AI boom driving demand for memory and China erecting its own restrictions on foreign chip makers, most notably U.S. leader Micron (MU.US), YMTC hardly needs to worry about demand for its products at home and increasingly abroad. As long as it can produce competitive products, orders will follow.

Still, the company’s long-term success will depend on how quickly the domestic chip industry advances — particularly the equipment manufacturing sector that provides essential production tools. This is precisely the area where the U.S. is seeking to deny China access to core technology needed to make the most advanced chips.

YMTC’s listing would most likely occur on one of China’s domestic markets in Shanghai or Shenzhen due to the company’s strategic importance. Local media reports suggest the company initially considered Hong Kong, which is hosting a growing number of chip makers like stalwart SMIC (0981.HK; 688981.SH), as well as newer arrivals like InnoScience (2577.HK) and Fortior Technology (1304.HK; 688279.SH).

But YMTC reportedly adjusted course following regulatory requirements that major domestic chipmakers list domestically, giving the government greater control over who can invest in the strategically important group.

Team China investors

Beyond electing a board, the recently completed shareholding reform brought in 16 institutional investors — mostly state-owned entities, including investing arms of leading lenders Agricultural Bank of China and China Construction Bank. Those investors purchased new shares that raised YMTC’s registered capital from 105 billion yuan ($14.76 billion) to 112 billion yuan.

One investor’s contribution of 1.6 billion yuan for a 0.99% stake of YMTC’s holding company implies a valuation of 161.6 billion yuan for the parent entity.

Following the transaction, the local government in the Central Chinese city of Wuhan, where YMTC is based, remains the company’s majority shareholder. Hubei Changsheng Development and Wuhan Xinfei Technology Investment, both local entities in Hubei province, continue as the company’s top two shareholders, though their stakes were diluted to 26.89% and 25.69%, respectively.

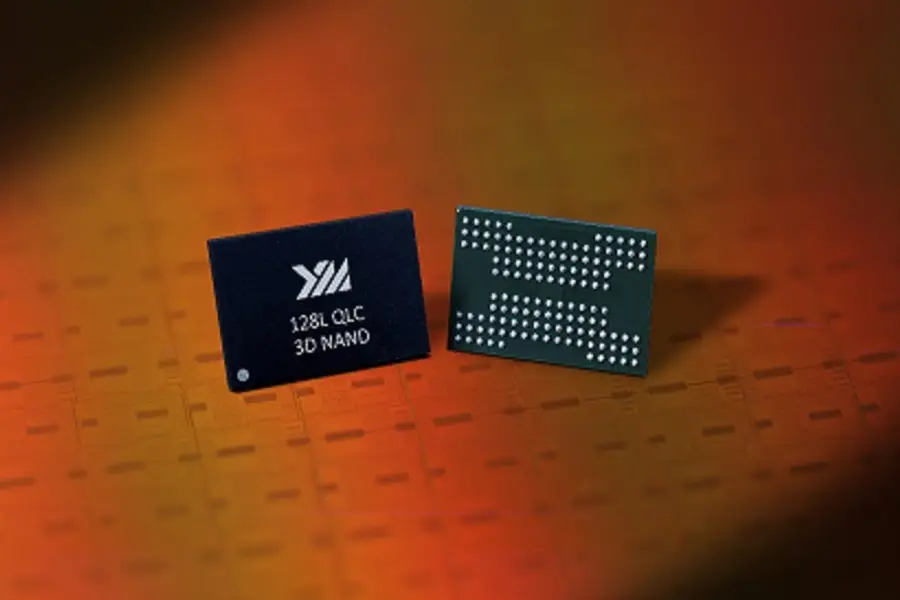

YMTC specializes in 3D NAND flash memory, which is used in smartphones, computers, and data storage devices. Bloomberg reported last year the company’s prominent clients include Huawei, the leading smartphone seller in China.

YMTC took a significant hit in October 2022 when the U.S. implemented new export controls, including a ban on the sale of American equipment capable of manufacturing the most advanced NAND memory chips containing 128 or more layers. At the end of that year, YMTC was also added to the U.S. “Entity List,” further restricting its access to U.S.-made chip manufacturing equipment, materials and software.

Despite these sanctions, the company has continued making progress by finding domestic substitutes, Bloomberg reported last September, citing research from TechInsights. The domestic equipment makers YMTC now partners with include AMEC and Naura — companies it only began cooperating with in earnest following the U.S. sanctions.

YMTC has successfully upgraded its “Xtacking” technology, which stacks memory cells in layers, to a level where its NAND chips match industry leaders in terms of performance. However, new chips made with YMTC’s Xtacking 4.0 technology actually have 70 fewer layers than the 232-layer chip produced with its earlier-generation technology, even as the company says they deliver comparable performance.

The reduced layer count likely reflects constraints caused by U.S. equipment restrictions, forcing YMTC to optimize performance within the limitations of available domestic manufacturing tools.

A research note from Chinese brokerage Bocom International last month estimated that YMTC has recently gained significant share in the global NAND market, growing from 4% in the fourth quarter of 2024 to 8.3% in the first quarter of this year. It attributed the sudden gains to growing demand from domestic buyers.

That said, the global NAND market remains dominated by South Korean and U.S. companies, with Samsung (005930.KS), SK Hynix (000660.KS), and Micron holding a combined 64% share in the first quarter of 2025.

YMTC has not disclosed detailed operational data. However, according to an earlier disclosure report from an investor, the parent company recorded a net profit of 531 million yuan in 2023, but then swung to a loss of 84.21 million yuan in the first three quarters of 2024.

That negative turn would hardly be surprising given that YMTC must continue investing heavily in domestic equipment that has yet to achieve the high yields needed for cost-effective chip production. The memory chip sector is also notoriously cyclical, with the latest downturn in 2022 and 2023, before prices began to rebound last year. That rebound is expected to continue in the years ahead with rising demand from AI, which could play to YMTC’s advantage as it edges closer to its IPO.

Despite the recent losses, YMTC’s net assets continued growing from approximately 133 billion yuan in 2023 to about 135 billion yuan in the first three quarters of 2024, likely reflecting its substantial spending on domestic equipment procurement.

At the end of the day, YMTC’s trajectory will serve as a crucial test for China’s broader semiconductor ambitions. While the company has demonstrated resilience in navigating U.S. sanctions and gaining market share, its reliance on less advanced domestic equipment underscores remaining technological gaps. The upcoming IPO may provide some additional capital, but YMTC’s ultimate success will depend on whether China’s domestic supply chain can advance quickly enough to supply the company with technology needed to keep it competitive with global leaders.

To subscribe to Bamboo Works weekly free newsletter, click here