Labubu fever, and a skincare brawl

“In any speculative bubble, there is a period of time where lots of people make money and then the whole thing runs out of steam and people start losing money.”

By Doug Young & Rene Vanguestaine

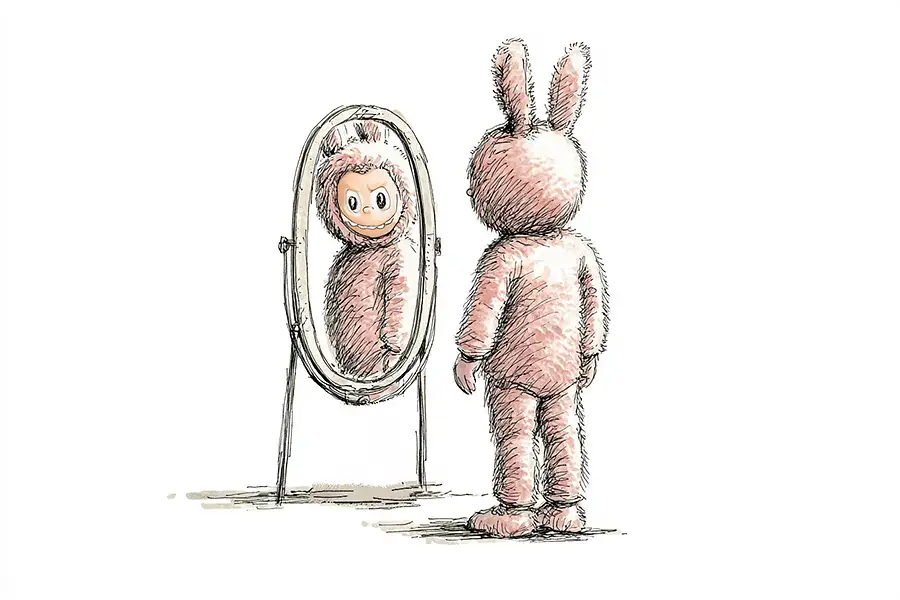

In all the recent economic gloom, two unrelated lighter stories have captured the public’s imagination. Both offer a familiar lesson in China’s fast-moving consumer landscape. The first is the speculative frenzy surrounding a collectible toy named Labubu, which has sent its creator’s stock soaring. The second is a vicious public battle between two leading skincare empires that has left one of them badly bruised. Together, they paint a vivid picture of markets driven as much by sentiment as by substance, where fortunes can be made — and lost — in an instant.

We’ve seen this story before. The latest craze lighting up China is for collectible toys, and the current star is Labubu, produced by a company called Pop Mart. The mania reached a fever pitch last week when one of the toy’s earliest models fetched a staggering $150,000 at a Beijing auction. This is just one example of a broader trend that has sent stocks of toy makers rallying sharply. But the crucial question for any investor is whether this rally has legs or is merely a passing fad.

From our perspective, this has all the hallmarks of a classic speculative bubble. We need only look to the West for historical parallels. The Labubu phenomenon echoes the Beanie Babies craze of the mid-1990s, the Pokémon boom, the Tickle Me Elmo frenzy of 1996, and the more recent mania for Funko Pops and NFTs. The common thread is clear: most toy speculation bubbles eventually burst, leaving latecomers holding overvalued items. While truly rare and culturally significant items can retain long-term value, the line between genuine collecting and pure speculation is often blurred, and it typically doesn’t end well for the majority.

A toy in itself doesn’t create tremendous economic value. Its worth is often based on sentiment and the thrill of collection — a passion characterized by knowing when to start but not when to stop. For a company like Pop Mart, this business is fundamentally about intellectual property, much like movies, music, or video games. The challenge is that creating a hit is one thing; delivering a successful encore is another. Very few companies or artists are able to consistently produce hits with no flops. At some point, Pop Mart will have to come up with something new, and we will see if they are capable of a second smash hit before sales of the first one come crashing down. Our advice for investors would be to treat these stocks as speculation. You can make money, but only if you can afford to take the risk and, crucially, time your exit before the bubble bursts.

A skincare slugfest reveals deeper truths

While toy collectors chase the latest fad, a different kind of drama has been captivating China: a public battle between two of the country’s richest women and their skincare empires. The fight began when Bloomage, whose products are based on the older ingredient hyaluronic acid, publicly attacked its rival, Giant Biogene, which uses the popular new ingredient recombinant collagen. The slugfest, which included accusations of false advertising, ultimately knocked about 30% off Giant Biogene’s stock.

In our nearly 25 years of working with Chinese companies, we have seen this kind of corporate warfare many times. It is a classic tactic in China, where a public attack is often aimed at limiting a competitor’s access to cheap capital. Interestingly, this corporate spat seems far more efficient than a short-seller report; we have seldom seen a research report knock 30% off a stock so quickly.

The core vulnerability for Giant Biogene may not be the accusations themselves, but the underlying challenge of its product. Producing recombinant collagen requires a complex process of fermentation and purification to be both effective and safe, and mastering this at scale remains a significant challenge. We are surprised the competition hasn’t focused on this angle yet. If we were to caution investors, it would be on this particular aspect of scaling production. Ultimately, these kinds of public attacks are spontaneous and difficult to predict. We’ve seen them emerge just days before a company’s IPO, aiming to depress the pricing. While they rarely derail a deal entirely, they can have an impact. The extreme 30% drop in Giant Biogene’s case may reflect a simple truth: the stock was likely already seen as overvalued in the minds of enough investors, making it a prime target for a fall.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: