Russia’s Chinese car indigestion, and the fall of a Chinese chip magnate

“The world outside the U.S. has become deeply concerned that products unable to reach American markets will flood their own territories instead.”

By Doug Young & Rene Vanguestaine

The latest data reveals a telling shift in global sentiment toward Chinese overcapacity. China’s car exports to Russia — one of Beijing’s most important allies — plunged 44% in the first quarter to just 99,000 vehicles after Moscow imposed new trade barriers. Meanwhile, a suspended death sentence for former semiconductor superstar Zhao Weiguo illustrates the spectacular waste and corruption that often accompanies China’s state-directed industrial policies.

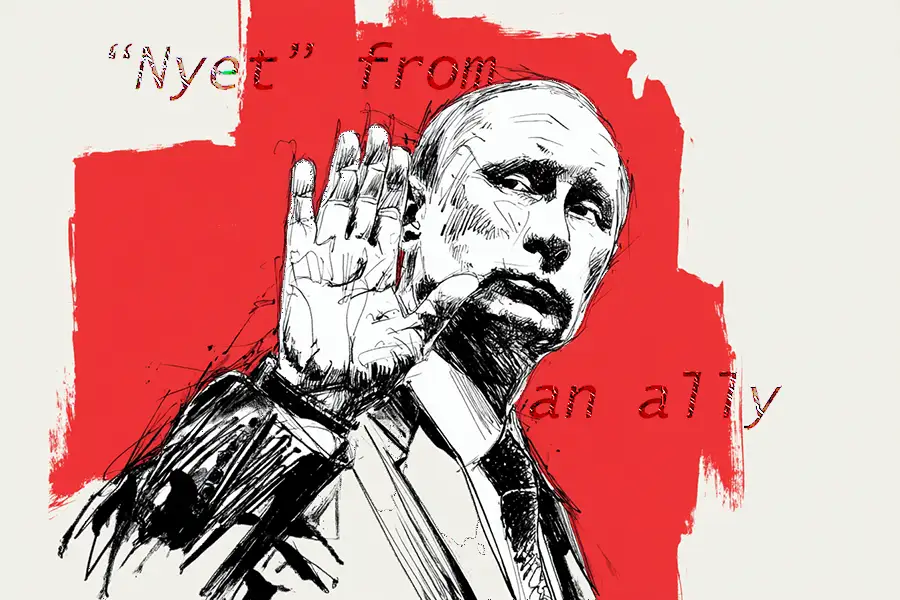

When even Russia says ‘nyet’

The Russia story shows how even geopolitical allies won’t indefinitely absorb China’s excess production capacity – a pattern that’s spreading globally. Turkey imposed import duties on Chinese EVs last year, while Brazil slapped tariffs on Chinese steel to protect its domestic industry. We believe this reflects a fundamental reality: the world outside the U.S. has become deeply concerned that products unable to reach American markets will flood their own territories instead.

The underlying problem remains Beijing’s unwillingness to address systematic overproduction and overcapacity across many of its manufacturing sectors. Chinese authorities typically intervene only when domestic companies start damaging themselves, not when they’re hurting global markets.

We think China will continue this export-driven strategy for as long as possible because domestic consumption remains weak. Our recent conversations with a consumer credit company revealed a troubling dynamic: while loan originations and outstanding balances increased significantly in the fourth quarter of last year and first quarter of this year, this hasn’t translated into substantial consumption growth. The impression we’re getting is that much of this borrowing simply helps people maintain their current lifestyle rather than spurring additional spending — especially given widespread job losses and pay cuts.

With real estate no longer supporting the economy and consumption remaining sluggish, exports and technology represent the country’s primary growth drivers. We don’t expect Beijing to meaningfully address overcapacity until domestic consumption becomes a much larger share of GDP — yet authorities have been reluctant to implement aggressive measures to boost consumer spending.

The high cost of state-led development

The case involving a man named Zhao Weiguo perfectly encapsulates the risks of China’s state-directed approach to strategic industries. Under his leadership, assets of the company he led, UniGroup, ballooned from 1.3 billion yuan ($180 million) in 2009 to nearly 300 billion yuan by 2019, making him a business celebrity in the process. But the growth came at enormous cost — not just from the hundreds of millions of yuan he allegedly embezzled, but also from the massive value destruction he spearheaded as a result of UniGroup’s failed investments and acquisitions.

We believe Zhao received a death sentence not merely for the scale of his corruption, but because of the embarrassment he created for the system. This case involves an “untouchable” figure in a highly visible sector that represents a top priority for President Xi Jinping’s administration. When you operate at that level and things go spectacularly wrong, accountability becomes about saving face as much as deterring future misconduct.

The semiconductor sector illustrates both the promise and perils of central planning. While the chip industry remains strategically critical — especially given U.S. export controls — the state-led approach consistently produces inefficiency and waste. We’ve seen this pattern before: everywhere in the world, governments struggle with accountability in investment decisions. As one telling example, when the Obama administration invested billions in a solar company that went bankrupt within a few years, no one faced real consequences.

Despite these inefficiencies, we expect China to maintain heavy state involvement in the chip sector. With the U.S. treating advanced semiconductors as strategic weapons in its competition with China, Beijing has little choice but to pursue domestic development regardless of cost. A few heads may roll to discourage future misconduct, but the underlying model isn’t changing anytime soon.

About China Inc

China Inc by Bamboo Works discusses the latest developments on Chinese companies listed in Hong Kong and the United States to drive informed decision-making for investors and others interested in this dynamic group of companies.

Subscribe to China Inc on your favorite app: