With so many new IPOs, Quantgroup looks better left for high-risk investors

The operator of the Yangxiaomie lifestyle platform has filed to list in Hong Kong – its seventh such attempt – hoping it can succeed in the current hot market

Key Takeaways:

- Quantgroup has filed to list in Hong Kong, reporting a profit of 126 million yuan for the first five months of this year

- The operator of two consumer-facing online platforms has net current liabilities of more than 770 million yuan

By Lau Chi Hang

Hong Kong’s red-hot IPO market shows few signs of cooling, with even the more mundane among of a flood of new listings often attracting frenzied demand. As for investment value, the prevailing attitude seems to be: Who cares? Speculate first!

Quantgroup Holding Ltd., an online consumer website operator, is hoping to capitalize on that market momentum by dusting off and refiling its Hong Kong listing application, aiming to overcome earlier setbacks. Its goal: Raising funds to stabilize its sizable debt.

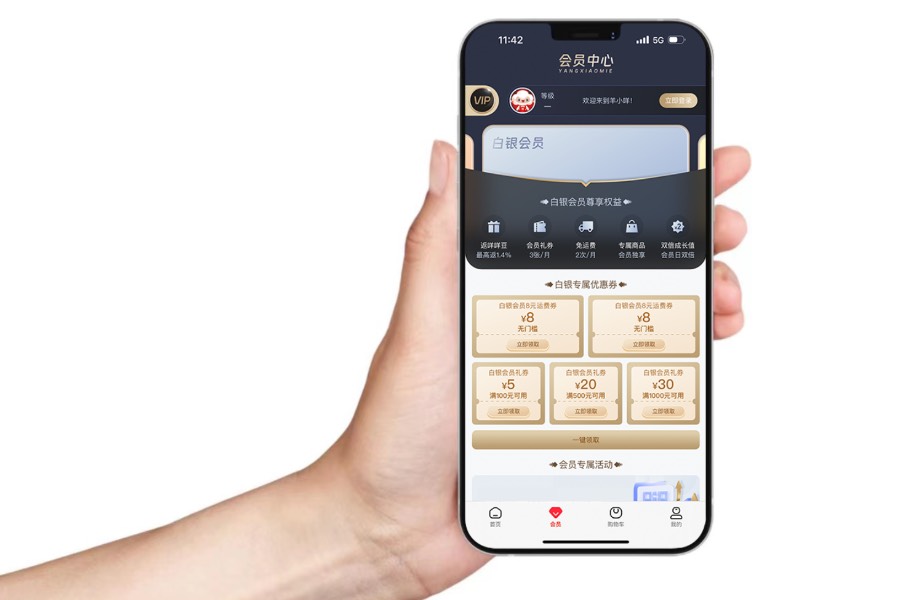

Quantgroup operates two core businesses: its Yangxiaomie lifestyle platform, and its online-to-offline (O2O) auto retail Consumption Guide. It generates money by matching merchants with consumers through product displays, online payments, order processing and logistics.

Quantgroup is hoping the seventh time will be the charm for its latest listing application, having filed and failed in its previous six attempts. The company was founded in 2014 by Zhou Hao, who was on this year’s Forbes list of “China Pioneer Innovators in Industry Development.” Its original platform, Credit Wallet, was a peer-to-peer (P2P) lending platform that linked financial institutions with borrowers, both businesses and individuals, with Quantgroup collecting handling and service fees.

That business was part of an early group of P2P lenders that thrived as China opened its financial services market to private companies. But the government cracked down on such lending starting in 2017, worried about fraud and also companies’ inability to manage risk. That forced Quantgroup to transform from a lending platform into a digital solutions provider, which it did by setting up Yangxiaomie in 2020. Two years later it launched Consumption Guide, connecting local merchants and consumers by distributing government consumption vouchers and merchant subsidies. More recently, that platform has shifted to auto-related consumption.

The most recent transformation hasn’t been easy, creating volatility for the company’s business. Its revenue has been on a relatively steady growth track, rising from 475 million yuan ($66.6 million) in 2022 to 530 million yuan in 2023, and then jumping to 990 million yuan last year. Its bottom line has also been improving, rising from a loss of 281,000 yuan in 2022, to profits of 3.64 million yuan and 147 million yuan in 2023 and 2024, respectively. In the first five months of this year, its revenue rose 38.1% year-on-year to 414 million yuan, while its profit jumped 261% to 126 million yuan.

Mounting marketing costs

While Quantgroup’s transformation looks successful on the surface, a closer look at its financials could be cause for concern.

The company’s revenue has grown steadily in the last three years, but its sales and marketing expenses have risen even faster. Such spending more than doubled, rising 127% from 47.92 million yuan in 2022 to 109 million yuan in 2023. Then, the figure more than quadrupled to 470 million yuan last year, far outpacing its 87% revenue growth that year. Clearly, the company’s impressive revenue growth is being driven by even more impressive promotional spending.

What’s more, revenue from the company’s Consumption Guide has fallen steadily in the transition to its new auto focus, dropping from 200 million yuan in 2022 to just 32.81 million yuan last year. The erosion continued in the first five months of this year, with the figure tumbling 43% year-on-year to just 7.92 million yuan. The company blamed the declines on its business transformation to 4S auto retail.

Advertising revenue from the Consumption Guide site has taken an especially hard beating as China’s auto sector suffers from massive overcapacity that has pushed many companies into the red, causing them to slash their marketing budgets. The site’s revenue tumbled by more than half from 7.17 million yuan in 2022 to 3.05 million yuan in 2024. And in the first five months of this year, it plummeted to just 123,000 yuan from 2.24 million yuan a year earlier.

Low returns, heavy debt

The company’s return on equity (ROE) has also been alarmingly low, at just 0.1% in 2022, before dropping into negative territory with figures of negative 0.3% in 2023 and 14.7% in 2024. It eroded further still to negative 36.1% in the first five months of this year.

Liability concerns also exist. The company’s current liabilities have swollen over the last three years, from nearly 1.5 billion yuan in 2022 to about 2 billion yuan by the end of May this year. It remains submerged in a state of negative equity, with net current liabilities exceeding 1 billion yuan in 2022 and 2023. While that situation has improved in the last two years, the company still had net current liabilities of 770 million yuan at the end of May this year.

Adding to its woes, the company’s receivables ballooned from 258 million yuan in 2022 to 638 million last year, and escalated further still to 743 million by the end of May. While the company reduced that amount by 123 million yuan as of the end of July, its receivables still stand at an elevated level of more than 600 million yuan.

Controversial related-party dealings

The swelling receivables owes partly to money the company is owed by Yingtan Xinjiang Guangda — a microlender controlled by Quantgroup’s major shareholder Zhou Hao until he sold his stake in April this year, not long before the latest IPO filing. That timing, coinciding with Quantgroup’s extension of its credit terms to Guangda, has inevitably raised some red flags among investors.

The challenges it’s facing are clouding Quantgroup’s outlook. As an operator of consumer-facing platforms, the company must vie with far more aggressive giants like Meituan, JD.com, and Douyin — which can use their scale, brand dominance and massive user bases to get new business and pressure customers to pay their bills. Critically, Quantgroup’s platforms lack the breadth of content and related user appeal, making it harder to attract consumers that are key to bringing in new business customers.

At the end of the day, even if Quantgroup finally makes it past the IPO finish line this time, it may have a hard time winning over investors, despite the current appetite for just about any new shares. Even short-term traders may shun the stock, especially given the steady flow of other new IPO flavors entering the market.

To subscribe to Bamboo Works weekly free newsletter, click here