Rebounding Vobile explores AI, in further move from content-protection roots

The company’s revenue rose 27% in the third quarter, as it explores new opportunities from an anticipated explosion in demand for trading services related to AI-generated video

Key Takeaways:

- Vobile posted strong third-quarter results, including 27% revenue growth and 28% growth in monthly recurring revenue

- The company has shifted its focus from video content protection to helping clients better monetize their products, with China rising to account for half of its revenue

By Hugh Chen

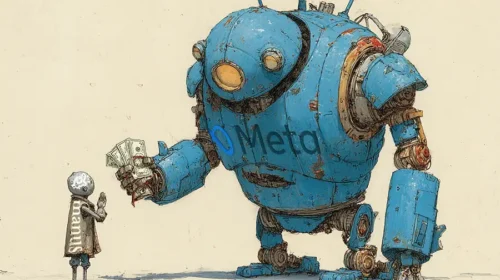

The video industry is facing unprecedented upheaval as AI tools like OpenAI’s Sora enable anyone to create sophisticated content, encroaching on ground once dominated by professionals. While the tide is democratizing content creation, it’s also creating major new challenges for intellectual property (IP) protection and the tracking of copyright infringement across digital platforms.

That AI boom could also present major new opportunities for content-protection and management specialists like Vobile Group Ltd. (3738.HK), which last week reported strong financial results for its current business in the third quarter, as it also explores new AI-era opportunities that could power its future. Founded in 2005 as a specialist in fingerprinting and watermarking technologies for video platforms, Vobile began emphasizing AI-content opportunities this year by launching a digital platform that allows content creators to distribute tradeable digital assets.

While this model remains nascent and has yet to generate significant revenue, it could position Vobile for a future where AI-generated content becomes the norm. For now, however, the company continues to rely on its core content protection services, which have grown steadily as Vobile expanded beyond its original focus on long-form videos to include short-form content, music, and other audio formats.

The company’s limited third-quarter operating data released last week shows its revenue grew 27% year-on-year, while its monthly recurring revenue grew by a similar 28%, indicating strength for its subscription-based income streams. This builds on strong results in the first half of the year, when its revenue grew by a similar 23% and its net income surged 119%.

In the latest announcement, Vobile highlighted that its China revenue grew approximately 22% year-over-year in the third quarter, as its home market contributed to a growing portion of its business that previously came almost entirely from overseas.

Investors appeared relatively unimpressed with the latest limited results, with Vobile’s stock rising just 1.2% to HK$5.07 on the day after the release. Over a longer timeframe, the company’s shares peaked at around HK$9 in mid-2021 before sinking as low as HK$1 during a downturn for Hong Kong stocks in 2023 and 2024, before recovering with a rally for the market from this year. For Vobile, this recent rebound reflects growing investor confidence as it increases its China sales and expands beyond its original long-form video focus.

Revenue shift

Vobile started out in the U.S. market by providing software services to video content creators and platforms seeking content protection technologies like fingerprinting and watermarking to identify potentially infringing content and reduce revenue losses from piracy. Back in 2016, the U.S. accounted for over 95% of Vobile’s total revenue, with clients including such big names as Disney, Warner Bros, Netflix, and YouTube.

But the company has shifted its sights in recent years to focus more heavily on its home China market, taking specific aim at Chinese video platforms expanding overseas. One key growth area for the company has been micro dramas — series with episodes lasting just several minutes — whose popularity has spread from China globally through platforms like ReelShorts.

For the first half of this year, China accounted for 49.9% of Vobile’s total revenue of HK$1.46 billion ($188 million), becoming a key market for the company. If Chinese platform content continues gaining international traction, China sales are expected to grow further to become the company’s single biggest revenue source.

Beyond geographic expansion, Vobile’s revenue mix has transformed significantly through a shift from traditional content protection to helping its clients monetize their products using advertising. Instead of simply removing videos that its technologies identify as using clients’ copyrighted material, the company offers services that generate advertising revenue from its clients’ videos, which is then shared between copyright holders and Vobile.

Vobile’s rapid move into this newer business stems largely from its 2019 acquisition of ZEFR, whose two products, RightsID and ChannelID, specialize in contextual targeting services for brands. The RightsID platform enables monetization of copyrighted content, while ChannelID provides comprehensive channel management services for clients on platforms like YouTube and TikTok, including content uploading, data analytics, and fan engagement.

The company has since categorized these two services as “value-added services,” which generated HK$846 million, or 58% of total revenue for the first half of this year, remaining its major revenue contributor as its older subscription services for traditional content protection business stood at just 42%.

Vobile clearly believes its content monetization business has greater potential than its older content protection services, returning us to our previously mentioned AI-generated content topic. The company believes that as AI creation tools drive the emergence of a new wave of secondary products based on film and TV intellectual property — such as plot adaptations and mashups — additional monetization opportunities for the company will emerge.

Vobile said it manages 4.29 million active assets on social media platforms, referring to client-authorized videos that generated revenue during the first half of 2025. The company noted it is already seeing growth in AI-created assets, though it did not disclose any specific numbers.

It has big ambitions with AI, aiming to build its own platform by announcing two new services in May called VobileMAX and DreamMaker.

Vobile calls VobileMAX a marketplace where creators can buy and sell digital content. It helps creators register their work, prove ownership, and distribute content across platforms while tracking earnings. The platform uses blockchain technology to verify ownership and enable trading of content rights.

DreamMaker is an AI tool that creates videos and music. Users can type in what they want to create, and the AI makes it for them. It automatically stamps the content so people know who created it.

Still, the goals and objectives of these two AI platforms remain somewhat unclear as the company figures out how to adapt to the AI era. For now, it’s more realistic for Vobile to focus on expanding its older copyrighted content businesses.

The company has broadened beyond videos to include music, particularly after acquiring technology and workers earlier this year from PEX, an audio content identification technology company. The acquisition gave Vobile 120 million music asset fingerprints and 23 billion internet audio fingerprints to add to its system.

The rise of China as an equally important market for the company as the U.S. is also encouraging for investors looking for a more diversified global footprint to keep Vobile growing. Such geographic diversification, combined with the expansion into new content types like music, suggest Vobile has multiple avenues for continued growth, which could be complemented by eventual revenue from longer-term AI opportunities it’s exploring.

To subscribe to Bamboo Works free weekly newsletter, click here