Policy forces shift offshore Chinese IPO tide to Hong Kong from New York

New listings raised $36 billion on the Hong Kong Stock Exchange in 2025, accounting for nearly one-quarter of IPO fundraising worldwide

Key Takeaways:

- Hong Kong took the global crown for IPO fundraising last year, as Chinese companies flooded the market

- The listing frenzy has been largely propelled by policy changes, and looks set to continue this year with nearly 400 active IPO applications in Hong Kong’s pipeline

By Doug Young

The tide of offshore listings by Chinese companies turned sharply back to Asia in 2025, lifting Hong Kong to the world’s leading IPO market in terms of fundraising for the year, as New York rapidly lost momentum. Policy shifts, both at the government and stock exchange levels, were the main driver of the sea change, leading many to forecast the shift would accelerate this year and continue into the foreseeable future.

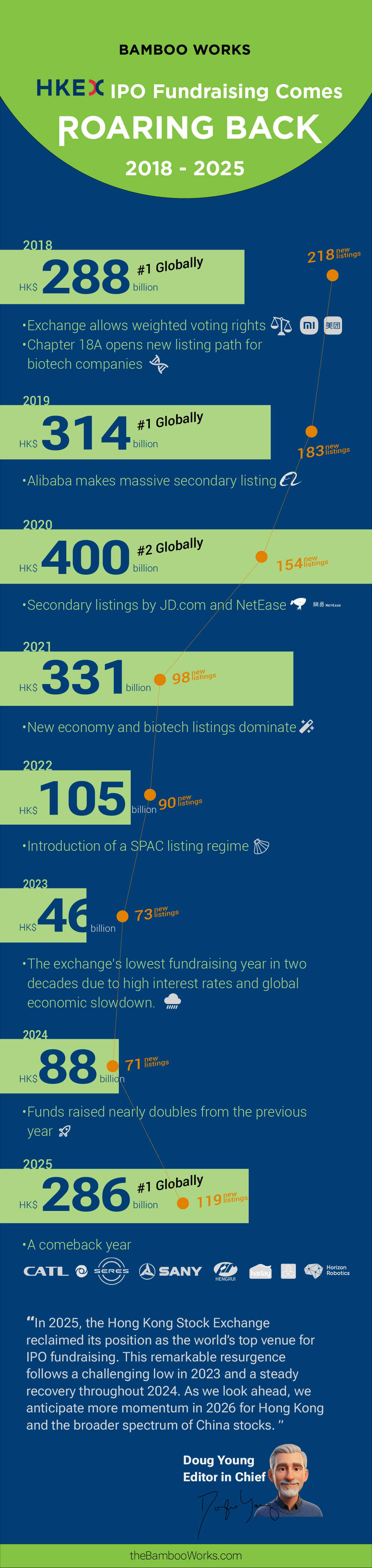

Companies, the vast majority of them Chinese, raised about HK$280 billion ($36 billion) through Hong Kong IPOs last year, equal to nearly a quarter of the roughly $160 billion raised worldwide, according to annual reports by the world’s top accounting firms. That made Hong Kong the world’s top IPO market by fundraising, ahead of the Nasdaq, which was the second with about $26 billion raised, according to Deloitte.

The banner year ends a losing streak that saw Hong Kong raise just HK$239 billion in the previous three years combined. Much of that poor performance owed to China’s rapidly slowing economy, compounded by deteriorating relations between China and the West, most notably with the U.S.

The abrupt turnaround, which saw the benchmark Hang Seng Index rise nearly 30% last year, began toward the end of 2024 when China began unveiling a series of measures designed to stimulate its flagging economy. A steady series of policy changes by the Hong Kong Stock Exchange boosted the tide of Chinese companies coming to the city, making listings there more attractive.

Those changes date back as early as 2018, the year Hong Kong began allowing a dual share class structure popular among private Chinese companies like Alibaba (BABA.US; 9988.HK), which allows founders to maintain control of their companies even while holding relatively small stakes. That step has been followed by a steady stream of other new policies making it easier for high-growth but money-losing companies to list, which was previously forbidden.

Most recently, the city streamlined rules allowing companies already listed on China’s domestic A-share markets in Shanghai and Shenzhen to make second listings in Hong Kong. Last year, it also formally launched a “specialist technology listing” channel making it easier for certain early-stage but high-potential tech and biotech companies to list.

The result has been a flood of companies into Hong Kong’s IPO pipeline, following the exchange’s roughly 110 new listings last year. More than 200 companies currently have Hong Kong IPO applications pending with the China Securities Regulatory Commission, which must formally approve all such listings, according to the latest list on its website. The Hong Kong Stock Exchange’s own website currently has about 400 active IPO applications from the last six months, guaranteeing the stream of IPOs is almost certain to continue into at least the first half of 2026.

Reflecting that, six companies made their trading debuts on the exchange this week alone, with 11 set to complete listings in the first half of January, typically a slow month due to the Christmas and Lunar New Year holidays. The listing frenzy reached a crescendo late last month when six companies made their trading debuts on a single day, Dec. 30, marking a high not seen since seven companies debuted on one day in July 2020.

Dual listing boom

The relaxation of the path for domestically listed companies to make second IPOs in Hong Kong was a major factor behind the city’s IPO boom. The exchange hosted 19 such listings last year, including eight that raised HK$10 billion or more, four of those among the world’s 10 biggest lPOs for the year.

Leading that group was the listing in May of CATL (3750.HK; 300750.SZ), the world’s largest electric vehicle (EV) battery maker, which raised $5.2 billion. CATL was representative of the type of new economy stocks that were some of last year’s hottest IPOs, covering sectors from new energy and biotech, to robotics and AI. By comparison, stocks traditionally favored by Hong Kong investors from traditional industries like restaurants and consumer products got more tepid receptions.

While Hong Kong generally boomed, the opposite was true for new listings by Chinese companies in the U.S., which raised just $1.12 billion last year, down sharply from $1.91 billion in 2024, according to Deloitte. What’s more, fundraising by the average Chinese IPO in the U.S. last year dropped to just $18 million from $32 million a year earlier, showing more major new offshore-bound Chinese listings were setting their sights on Hong Kong.

Reflecting the moving tide from New York to Hong Kong, EV maker Zeekr delisted from the New York Stock Exchange in December, just a year and a half after raising $440 million in its 2024 IPO, as it was privatized by Hong Kong-listed parent Geely Auto (0175.HK).

The U.S. has grown increasingly hostile towards Chinese listings, which previously flourished on Wall Street in the first two decades of the 21st century. Many of China’s fastest growing private tech firms had found comfortable homes on Wall Street after their dual class structure and losses made it difficult or impossible to list in Shanghai, Shenzhen and Hong Kong.

But a growing chorus of calls by U.S. politicians to delist Chinese stocks has scared off many potential listing candidates. Adding to the anti-China fever, the Nasdaq last year announced new rules that would require new Chinese listings to raise at least $25 million from their IPOs, and would expedite forced delistings of companies that failed to maintain public floats of at least $5 million. Those rules are still being reviewed by the U.S. securities regulator, and are likely to take effect later this year.

While Hong Kong’s steady stream of policy relaxations has boosted new listings, one area that has fallen notably short is its regime launched in 2022 to host more backdoor listings using special purpose acquisition companies (SPACs). The stock exchange welcomed just its third SPAC listing in December, when autonomous driving technology firm Seyond (2665.HK) completed its merger with the TechStar Acquisition Corp. SPAC to become officially listed.

To subscribe to Bamboo Works weekly free newsletter, click here