Miniso rings up dividend policy to lure investors

The Chinese budget lifestyle retailer will pay out 50% or more of its profits as a regular dividend, though the company has lost money in three of the last four years

Key Takeaways:

- Miniso’s new dividend policy with a payout rate of 50% or more will please shareholders, including the company’s chairman and his wife who own 62% of its stock

- The dividend pledge could help Guangzhou-based Miniso attract new investors as it aggressively expands its network of budget lifestyle stores

By Edith Terry

Investors were hardly impressed when Miniso Group Holding Ltd. (MNSO.US, 9896.HK) announced a new dividend policy of returning 50% or more of its adjusted net profit to shareholders last week. The company’s New York-listed shares rose by just 3% that day, while its Hong Kong-listed stock actually fell 1.3%.

On the one hand, the lack of strong reaction could reflect investor indifference towards a company whose shares have more than tripled over the last year, but are just roughly on par with their 2018 New York IPO price. Then again, investors may want to see whether Miniso can become consistently profitable before getting too excited.

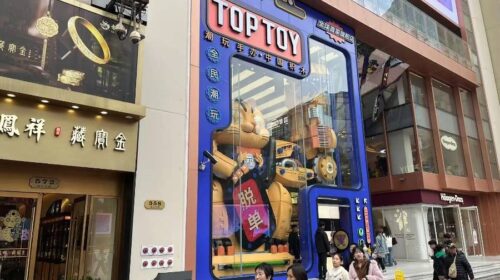

Meanwhile, founder and Chairman Ye Guofu has been busy spinning Miniso’s global prospects. The retailer, which operates mainly through franchise partners, has grown from its first store in 2013 to 5,514 stores as of March 31, including 2,131 outside China. Its latest crown jewel is its global flagship store that opened in New York’s Times Square on May 19. Apart from its namesake chain, Miniso also operates a newer store brand, Top Toy, targeting children and teens.

Chairman Ye and his wife Yang Yunyun, will be prime beneficiaries of the new dividends, since they collectively own 62% of Miniso’s shares.

But taking the minority shareholder view into account, Ye, like other decisionmakers at listed Chinese companies, may be looking for ways to counterbalance the fading of a China story that once attracted global investors purely for its growth potential. Chinese tech giant Tencent Holdings (0700.HK) has declared dividends for years, but e-commerce peer JD.com (JD.US, 9618.HK) only began paying dividends last year. Most of China’s other tech majors have yet to join the trend.

Small caps like Miniso, with a market value of $6.75 billion, were also more reluctant to part with their cash until the last few years, choosing to pump any profits back into the company. But that could be changing now as China’s domestic economy shows signs of slowing and investors become impatient with companies that have yet to make any profits.

Miniso’s original stores were a joint venture with a Japanese designer, and its trademark is often said to resemble that of the much larger Japanese fast fashion giant Uniqlo. Its houseware line is reminiscent of Muji, another Japanese retailer. It has intellectual property (IP) deals with iconic brands including Disney and Pokemon.

As the company expands aggressively, Ye has expressed his hopes of following in the footsteps of the big Japanese companies Miniso imitated.

“In the future, every consumer in the world will use Miniso’s products like they turn to Nike for clothes and sneakers, Starbucks for coffee and Coke for drinks,” he once said in an interview with the South China Morning Post. Overseas stores generated 986.5 million yuan ($143 million) in revenue for Miniso in 2022, or two-fifths of its total, and Ye wants to raise that to 50%.

Volatile earnings

While the new dividend pledge sounds grand in theory, investors have reason to wait for proof that it will actually means something. That’s because Miniso’s earnings record has been volatile since it first listed in New York in 2018, and later followed with a second concurrent listing in Hong Kong last year.

Miniso posted a profit of 639.7 million yuan for its latest fiscal year through June 2022. But that was after three years of deep losses, including a massive 1.4 billion yuan net loss in 2021, preceded by losses of 260 million yuan and 294.4 million yuan in 2020 and 2019, respectively.

But following those three money-losing years, Miniso seems to be on a more profitable track, which may explain its decision to announce a dividend policy now. The company’s most recent earnings for the first three months of this year, the third quarter for the company’s fiscal 2023 year, showed an adjusted net profit of 483 million yuan, up 29.5% sequentially. Its revenue for the period rose 18.4% sequentially to 2.95 billion yuan.

Miniso previously reported adjusted profits of 373.1 million yuan and 417.4 million yuan for the its December and September quarters last year, respectively, and has 315.9 million shares outstanding. Thus, if it reports a strong fourth quarter the company could end up paying out around 2.64 yuan per share, or about 37 U.S. cents, equating to a yield of about 1.8%, based on its current stock price.

This is not the first time Miniso has paid dividends. It declared a cash dividend of $0.039 per share in August 2021 and followed with another of $0.043 per share in August last year. Previous outlays were ad hoc, however, while the latest announcement points to more regular dividend payments in the future, declared by Ye as “a milestone moment” in the company’s brief history.

A growing list of Chinese firms have quietly started making dividend payments as part of their governance, though it’s still relatively unusual to see a small cap like Miniso make such a strong commitment. Dividend payments by Shanghai- and Shenzhen-listed companies listed in the CSI 300 hit a record 1.2 trillion yuan last year, according to S&P Global Market Intelligence, partly the result of Beijing’s encouragement to deliver better returns to shareholders.

The S&P report doesn’t track H-share listings for Chinese companies in Hong Kong, even though such listings make up nearly 80% of the market’s total capitalization. Many major U.S.- and Hong Kong-listed Chinese tech companies like Alibaba (9988.HK, BABA.US) and Baidu (9888.HK, BIDU.US) have yet to pay dividends. But state-owned companies have issued dividends since 2007, when the Ministry of Finance mandated payment of up to 10% of earnings for profitable companies.

As China’s economy slows and geopolitical pressures increase, more listed Chinese companies may be pressured to follow Miniso’s lead and give more than just vision statements and talk of big growth prospects to keep investors interested in their stories.

Have a great investment idea but don’t know how to spread the word? We can help! Contact us for more details.

To subscribe to Bamboo Works weekly free newsletter, click here