Kanzhun’s World Cup marketing bet keeps paying dividends

China’s leading online recruitment platform has posted its third straight quarterly profit, reaping the rewards of an advertising campaign during last year’s soccer championships

Key Takeaways:

- Kanzhun doubled its profits in the third quarter and surprised investors by paying out around $80 million in special dividends

- The market for blue-collar jobs has become the company’s main growth driver, supplying 35% of revenue

By A. Au

When many Chinese companies were tightening their belts last year, the country’s leading recruitment services firm took a contrarian view, preferring to apply the maxim that you have to spend money to make money.

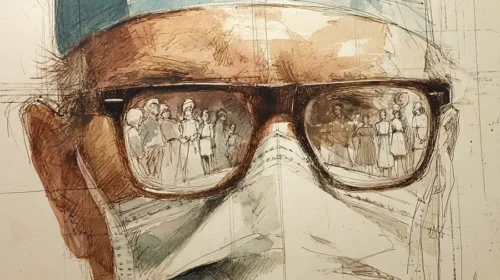

Kanzhun Ltd., also known asBOSS Zhipin (BZ.US; 2076.HK), spent a fortune on brand advertising during the soccer world championships last year, when China had been struggling through months of tight Covid controls. The decision drove up marketing costs and stained its accounts with red ink, but once pandemic restrictions were lifted Kanzhun found itself in a position to profit from a rebound in the jobs market.

The owner of the BOSS Zhipin recruitment app endured a 70% jump in operating costs in the fourth quarter of last year and posted a loss of 185 million yuan ($25.9 million), while net cash inflows tumbled 70%.

But the World Cup marketing wager started to pay off this year. The recruitment giant has just posted its third straight quarterly profit and delivered another gift for investors in the form of a special cash dividend totaling about $80 million, working out to $0.09 per ordinary share or $0.18 per American Depositary Share (ADS). Not stopping there, Kanzhun announced it was planning to buy back up to $150 million worth of its shares over the next year.

The Nov. 14 earnings release said revenues rose 36% in the third quarter to 1.61 billion yuan from the same period last year, while net profit doubled to 426 million yuan. Adjusted net profit for the three months to end September jumped just under 90% to 714 million yuan. Over the nine months, revenue rose 27.5% to 4.37 billion yuan, while net profit surged 163% to 768 million yuan.

Moreover, Kanzhun issued an upbeat forecast for the fourth quarter, predicting revenue would range from 1.51 billion yuan to 1.55 billion yuan. The revenue growth of between 39.6% and 43.3% would be even faster than the pace of the first three quarters. The flurry of good news went down well with investors. The company’s U.S. stock opened with a gain of more than 5% after the results and ended the day 7.2% higher.

The market’s confidence is also reflected in the company’s valuation, with a forward price-to-earnings (P/E) ratio of about 53 times for Kanzhun, higher than the 34.2 times for talent platform Tongdao Liepin (6100. HK) and dwarfing the 13 times for U.S. recruitment giant ManpowerGroup (MAN.US).

Breaking down Kanzhun’s results, total operating costs and expenses rose 30.1% from the same period last year to 1.36 billion yuan, yet marketing expenses rose by a smaller margin of 15.2% to just 457 million yuan.

User numbers indicate the marketing money has been well spent. Average monthly active users rose 37.7% year on year to 44.6 million in the third quarter, and total paid enterprise customers for the 12 months to the end of September increased 32.4% to 49 million. The growing user base meant the company’s biggest source of revenue, online recruitment services for enterprise customers, rose 36.7% to 1.59 billion yuan.

Investors who keep an eye on Chinese stocks may have noticed that some companies have bucked the overall market weakness. For example, PDD Holdings (PDD.US), the parent of ecommerce platform Pinduoduo, has seen its shares jump more than 36% this year, leaving online shopping titans Alibaba Group (BABA.US; 9988.HK) and JD.com (JD.US; 9618.HK) trailing in its wake. One driver of the rally has been PDD’s focus on the so-called “sunken market” of China’s third- and fourth-tier cities, an area that Kanzhun is also targeting, especially with a focus on recruitment for manual and services jobs.

Blue collar becomes big earner

The company told investors in a conference call that the revenue proportion from the blue-collar market has risen to nearly 35% of total income. The growth in job openings and job seekers is most pronounced in second-tier cities and below, as the company focuses on penetrating the “sunken market”.

In fact, when Kanzhun listed in Hong Kong last year its prospectus had flagged up the business potential in lower-tier cities and among the blue-collar population, generally defined as workers in manual and skilled trades or those in the service sector. The number of Kanzhun’s certified users in this category rose from 10.7 million in 2019 to 33.4 million by the third quarter of 2022, with a faster growth rate than for white-collar workers and highly skilled professionals.

With China’s economy still in the doldrums, many jobs in sectors such as real estate, education and training, the digital economy, finance, and entertainment have been disappearing. The latest wave of graduates has been forced to consider less prestigious jobs in blue-collar businesses amid high rates of youth unemployment.

Meanwhile, Chinese government stimulus efforts have left the economy in need of a slew of workers in manual and other trades, or service roles. An official survey of sectors with labor shortages, carried out in the last three months of 2022 and released in January, put blue-collar positions at the top of the list. The three job types with the biggest labor gap were salespeople, auto production line operators and couriers. The government has not released any updated sectoral research into labor shortages this year.

However, Kanzhun data indicates that job openings in the service industry are growing at the fastest pace, with rising demand for waiters, salespersons, cooks and other positions related to offline consumption. The growth rate for couriers, truck drivers, warehouse managers and distribution workers is also very fast, providing job placement opportunities for Kanzhun if China’s economy perks up.

Guotai Junan Securities said in a research report that recruitment demand is picking up among leading companies, helping to accelerate Kanzhun’s sequential profit growth over the last few quarters. But it said customers’ willingness to pay still needs to be improved, as revenue from the blue-collar service sector becomes a key growth driver.

In addition, Kanzhun has reaffirmed a core strategy of boosting user volume. The company is starting to enjoy the scale benefits from its marketing investment, as a rising user base should drive increased market share and profits, Guotai Junan said, maintaining an “overweight” rating on the stock.

The investment bank also raised its forecasts for Kanzhun’s annual earnings, predicting adjusted net profits of 1.92 billion yuan in 2023, 2.48 billion yuan next year and 3.19 billion yuan in 2025. Factoring in a recruitment boom and the overall state of Hong Kong stocks, Guotai Junan assigned a target price of HK$83.6 to Kanzhun’s shares.

Have a great investment idea but don’t know how to spread the word? We can help! Contact us for more details.

The Bamboo Works offers a wide-ranging mix of coverage on U.S.- and Hong Kong-listed Chinese companies, including some sponsored content. For additional queries, including questions on individual articles, please contact us by clicking here.

To subscribe to Bamboo Works free weekly newsletter, click here