FAST NEWS: Miniso Shares Plunge After Business Model Questioned By Short-Seller

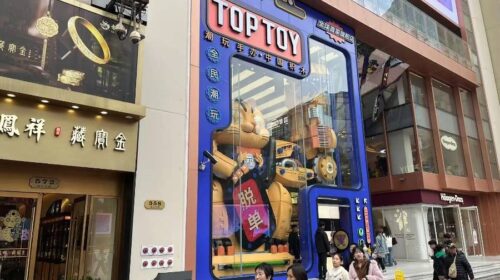

The latest: Blue Orca Capital, a short-selling firm, claimed in a report Tuesday that hundreds of stores under Miniso Group Holding Ltd. (MNSO.US, 9896.HK) are owned and operated by people close to the company’s top management or chairman, which it says shows the company is not truthful about its business model.

Looking up: In a swift response before the Hong Kong stock market open on Wednesday, Miniso refuted that, saying the report is without merit and contains misleading conclusions and interpretations regarding information relating to the Company.

Take Note: The report notes that the U.S. share price of Miniso is worth only a fraction of its current price, which means there is plenty of room for decline.

Digging Deeper: According to the report, after more than seven months of investigation by Blue Orca Capital, it found that according to the Chinese company’s records, more than 620 independent franchisees of Miniso were registered under the names of individuals who were closely related to the company’s executives and even its chairman, Ye Guofu, so there is evidence that the franchisees may have been secretly held and operated by the company, rather than being genuine independent franchisees. The report also alleges that Ye siphoned hundreds of millions of dollars from the company through opaque jurisdictions as a middleman in a tortuous transaction. In denying each of these allegations, Miniso has indicated that it will establish an independent committee to oversee the independent investigation of the allegations in the report.

Market Reaction: After the report was released, Miniso’s U.S. shares plunged 15% to US$6.13 on Tuesday. Its Hong Kong shares followed suit on Wednesday, closing 10.2% softer at noon to close at HK$12.56, a new low since its IPO on July 13.

Translation by Jony Ho

To subscribe to Bamboo Works free weekly newsletter, click here