Fading revenue fails to cast shadow over Xinzi’s IPO ambitions

Despite reporting a net loss and falling revenue last year, the thin-film solar packaging firm has doubled the size of its Nasdaq share sale

Key Takeaways:

- Xinzi Optoelectronics has filed for a Nasdaq IPO, reporting its revenue fell last year as China’s solar industry suffers from massive overcapacity

- The company is banking on robust demand, citing forecasts that predict sales of its core thin-film solar products will more than double between 2019 and 2029

By Edith Terry

Hangzhou Xinzi Optoelectronics Technology Co. Ltd.’s (XZ.US) new decision to supersize its Nasdaq IPO may be raising some eyebrows, especially given its weak financials and growing wariness by U.S. investors towards Chinese companies.

Instead of joining the recent stampede by Chinese companies flocking to Hong Kong, the relatively small solar film maker packaging chose the Nasdaq, where it first filed to list in March. Now, Xinzi disclosed last week it is raising its offering by 150%, from an original 1.5 million shares to 3.8 million, giving it a potential market cap of up to $116 million.

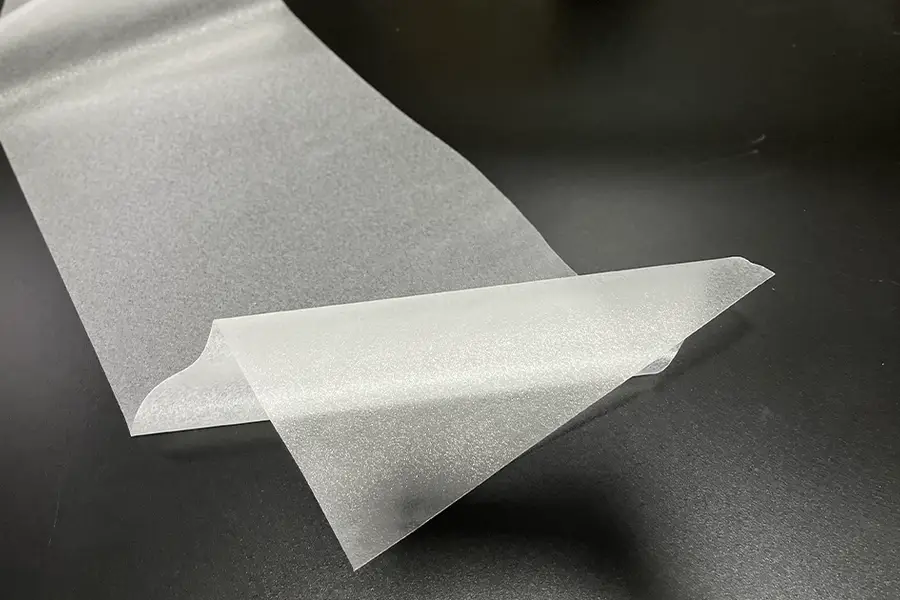

Xinzi is a niche player in the market for thin-film products, making packaging that is used to protect thin-film solar cells. Its two core products help to protect the cells from weathering and also reflect sunlight onto the cells to boost their efficiency. Such cells can be mounted on windows, curved surfaces and rooftops

Xinzi’s confidence behind its upsized offer may come from a growing market for its thin film products, whose global sales were worth 9.9 billion yuan ($1.4 billion) in 2024 and are forecast to rise to 15.5 billion yuan by 2029, according to third-party market research in its prospectus. The company is focusing on customers in the Suqian Economic Development Zone in Jiangsu province, including industry major Trina Solar (688599.SS).

Xinzi says companies in the zone have the annual capacity to produce solar panels with up to 40 GW of power generation, or 400 million square meters of panels annually, which would require 800 million square meters of co-extrusion film as packaging. We should point out that a big portion of that capacity is probably sitting idle right now due to huge overcapacity in China’s solar sector, though that glut should ease over time.

Xinzi plans to build eight co-extrusion film packaging production lines, anticipating growing demand for its products. It also began exporting its products in 2022, with a focus on the Vietnamese market that has become a favored destination for Chinese solar manufacturers looking to avoid Western tariffs on panels made in China.

A successful listing would make Xinzi the second Chinese solar company to go public on the Nasdaq this year, following Skycorp Solar Group’s listing in March. Skycorp’s shares are down 35% since its listing, which doesn’t bode too well for Xinzi.

Xinzi’s own business hardly looks encouraging over the last three years. Its revenue has been dropping steadily, from $38 million in 2022 to $32.8 million in 2023 and $25 million last year. Over that period, it slipped from a $1.8 million profit in 2022 to a loss of $340,050 last year.

Like everyone else in its sector these days, Xinzi is suffering from falling prices due to overcapacity, with many companies now producing at a loss. The average selling prices for two of Xinzi’s core products, transparent and white ethylene vinyl acetate (EVA), and polyolefin elastomer (POE), declined by 26% and 21% last year, respectively.

Stabilizing business

On a more positive note, Xinzi’s cost of sales declined by 23% from $29 million in 2023 to $22.5 million in 2024. And revenue remained stable from the first half to the second half of 2024, with $12.6 million in sales in the first six months and just a slightly smaller $12.5 million in the second half. Similarly, the company returned to the black toward the end of last year, reporting a $360,000 profit in the second half after a $700,000 loss in the first half.

Xinzi says it was the ninth largest manufacturer of transparent PV film packaging in 2023. Market leader Hangzhou First Applied Material (603806.SH) has a current market cap is 36.7 billion yuan, and a relatively strong price to sales (P/S) ratio of 2.07. A ratio at that level would value Xinzi at just $50 million – quite a bit lower than the valuation it’s aiming for between $75 million and $112 million.

China controls over 80% of the solar power supply chain, which makes it vulnerable protectionist tariffs by the U.S. and others. But the biggest problem facing the industry right now is overcapacity, after producers aggressively expanded their output over the last few years in anticipation of booming demand. The industry lost a combined $40 billion in 2024, said Trina chairman Gao Jifan at a recent industry event in Shanghai, adding that most manufacturers are now losing money.

China’s National Development and Reform Commission (NDRC), its top planning agency, held an on online meeting in February calling for a ban on the addition of new capacity. While that hasn’t happened, Gao called for sector cleanup through mergers and production cutbacks.

Despite the industry’s recent pains, there’s no doubt that solar power is the wave of the future. Installed capacity for the green power source is doubling every three years, accounting for 40% of global electricity demand growth in 2024, according to Ember, an energy think tank. Installed capacity grew by 33% in 2024 to over 2 terawatts (TW) worldwide, though the growth rate is expected to slow to 10% this year, according to SolarPowerEurope, an industry association.

Part of the slowdown will come from the U.S., which represents about 8% of the global solar power market. Last year, the U.S. added a record 50 GW of capacity, up 21% over 2023. That is unlikely to be matched in the next few years, as President Donald Trump phases out incentives for new solar installation.

Xinzi plans to sell its IPO shares for $4 to $6 each, which would raise about $19 million at the middle of that range. It could use some of that money to expand its production lines and cultivate exports. It has gradually expanded its customer base, with revenue from its largest customer decreasing from 55% of its total in 2023 to 32% in 2024.

At the end of the day, Xinzi is a relatively small fish in China’s massive solar pond, with unsteady sales and profits over the last three years. Still, its situation appears to be stabilizing, and its upsized fundraising goal could show that someone believes in the company’s future. Now, it will be up to mainstream Wall Street investors to decide if they agree with that more upbeat outlook.

To subscribe to Bamboo Works weekly free newsletter, click here

This story has been updated to better describe Xinzi’s products