Damai rides China’s offline leisure boom to bumper profits

The company’s dominance in live entertainment ticketing and IP franchises has turbocharged its revenue, despite persistent consumer complaints and monopolistic behavior

Key Takeaways:

- Damai’s profit rose around 50% in the six months through September on the back of strong gains for its event ticketing and IP businesses

- The company’s booming live event ticketing business faces potential risks from slowing youth discretionary spending, as well as user backlash over technical glitches and scalping

By Xia Fei

In the post pandemic era, Chinese consumers appear to be skimping on virtually everything, from smartphones to dining out. But even as that happens, their willingness to splurge on live entertainment like concerts, comedy shows and soccer matches is hitting new highs.

Damai Entertainment Holdings Ltd. (1060.HK) has reaped a big bounty from that collective pursuit of offline leisure activities, even in the face of China’s economic slowdown and difficult job market. The company gave a hint of just how well things are going in an upside profit alert last week, revealing a strong double-digit increase in its profit during the first half of its fiscal year through September.

Damai started out as an online movie ticket seller in 2004 and was acquired in 2017 by e-commerce giant Alibaba, which folded the company into its separately listed film unit, Alibaba Pictures. That listed entity changed its name to Damai Entertainment in July this year, reflecting the rising prominence of the Damai live ticketing service in Alibaba’s entertainment business mix.

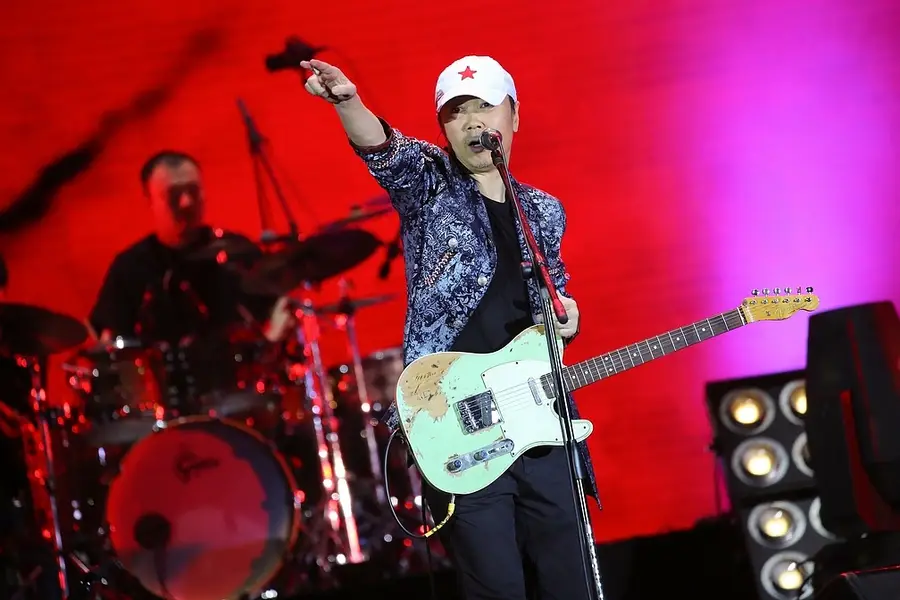

The listed company’s stock has been on a tear lately as it helped to stage events for top-tier artists from Ed Sheeran to Jay Chou. Its share price has more than doubled since January, far outstripping the 30% gain in Hong Kong’s benchmark Hang Seng Index, and easily beating out archrival Maoyan (1896.HK), whose shares are down about 8%.

Much of the gains reflect a second act for the Damai ticketing service, which is finally bouncing back dramatically after years of uninspired performance. The service’s revenue more than tripled to 2.06 billion yuan ($290 million) in its latest fiscal year through March, compared to 613 million yuan a year earlier. That made the Damai service the listed company’s most lucrative unit, contributing nearly one-third of overall revenue for Alibaba’s entertainment arm.

The stunning run for Damai, which is fast emerging as the listed company’s crown jewel, may be far from over. The company alerted shareholders last week that its net profit for the six months through September will exceed 500 million yuan ($70 million), up 48% or more from a year earlier. It attributed the strong performance to its Alifish intellectual property (IP) business as well as reduced investment losses.

Not just movies

The Damai and Alifish services are clearly what’s driving the broader company’s growth right now. The Damai service’s skyrocketing revenue owes to its strategic shift away from its original business of selling movie tickets, which suffered from pandemic shocks and anemic demand more recently amid a broader economic slowdown.

In 2024, China’s box office receipts fell 22.6% to 42.5 billion yuan ($5.8 billion) from a year earlier, official data show. While China’s box office has regained some strength this year, the film industry’s overall sluggishness led to a 37% plunge in the profit for Maoyan, which still relies mostly on movie ticketing and production, in the first half of the year.

By contrast, Damai’s signature service has morphed into China’s go-to online ticket seller for live activities like concerts, talk shows, and visiting museums and exhibitions. According to the China Association of Performing Arts, commercial performances grew nearly 11% last year to 488,400, with shows drawing more than 5,000 attendees grossing 29.6 billion yuan ($4.2 billion). At Alibaba Picture’s rebranding event in May, Damai President Li Jie hinted that he envisioned people will turn to Damai for just about any kind of tickets in the future except for transportation.

Beyond its ticketing business, the listed company’s other big growth engine, the Alifish service, is notching big growth among Gen Z consumers through its heavy investment in IP merchandising, including popular Japanese franchises Sanrio, Pokemon and Chiikawa. The unit’s revenue grew 73% to 1.43 billion yuan in the company’s latest fiscal year. The rapid growth of the IP business looks aimed at trying to copy the success of Pop Mart (9992.HK), the mastermind behind the global sensation Labubu dolls.

Monopolistic behavior

While its stock has performed strongly this year, Damai’s deteriorating relationship with consumers is a potential red flag showing that good times can quickly change. Boasting a vast base of 170 million users, the Damai ticketing service has run afoul of fans frustrated by tech glitches as well as the platform’s lax measures to deter scalpers.

In June, angry fans of Chinese singer Lu Han flooded Damai’s official ticketing page on the popular Weibo platform after it failed to allow some users to purchase tickets on time, causing the service to cancel all tickets and eventually postpone the concert. In some cases, scalpers have swarmed the platform to buy up tickets, and then jacked up prices on the secondary market. The company has also been fined twice this year for failing to fulfill obligations. During some concerts, fans chanted “go bankrupt” when singers thanked Damai near the end of their shows.

Yet public outcry has done little to undermine Damai’s near monopoly in China’s live performance industry. According to Questmobile, monthly active users of Damai surpassed 24.4 million in February this year, nearly six times its main rival Moretickets. Its market dominance has emboldened Damai to dictate its terms to concert fans.

Already trading at a meteoric 12-month trailing price-to-earnings (P/E) ratio of more than 100, Damai gets strong reviews from the analyst community, including three “strong buys” and nine “buy” recommendations from 12 analysts polled by Yahoo Finance, who are especially impressed by its booming IP franchising business.

In many ways, Damai’s business is less comparable to Tencent-backed Maoyan and closer to Live Nation Entertainment (LYV.US), the U.S.-based live event company that also currently trades at a lofty P/E ratio of 101.

But investors should remember all euphoria has limits. A softer job market could quickly curb Gen Z willingness to splurge on live events. The cooling of Labubu sales shows how fast youth‑led demand can slip into reverse. Regulatory risk also looms for companies that dominate their industries like Damai. Live Nation is already battling a lawsuit with the U.S. market regulator over alleged scalper‑related profits. If frustration with fees, queues, or resale abuse lingers, China’s antitrust watchdog may also eventually come knocking on Damai’s door.

To subscribe to Bamboo Works weekly free newsletter, click here