Aulton swaps out narrowing losses for falling revenue

The battery swapping specialist has applied for a Hong Kong IPO, with investors including Nio Capital, Japan’s Toyota Tsusho and Shanghai Shine-Link International Logistics

Key Takeaways:

- Aulton New Energy has applied for a Hong Kong listing, despite reporting persistent losses and shrinking revenue

- The battery-swapping company is exploring overseas opportunities, but could face challenges due to the niche nature of its product

By Bai Xin Rui

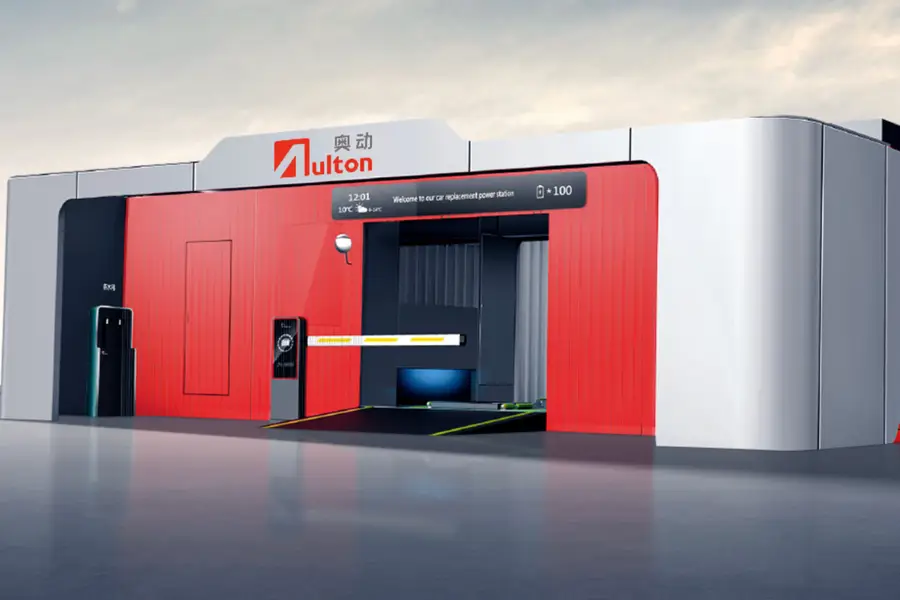

Its business may be sputtering, but that isn’t stopping Aulton New Energy Co. Ltd. from trying to sell its story to investors. China’s largest independent provider of third-party battery-swapping solutions, designed for electric vehicle (EV) owners on the go without time for the usual recharge, is looking for a cash recharge of its own with its application for a Hong Kong IPO filed earlier this month.

Aulton was established in June 2016 by Cai Dongqing, whose background is in culture and entertainment, and Zhang Jianping, from a battery swapping technology background. The company launched its signature Aulton brand that year, as well as its “100 Battery-swapping Station Plan” for taxis in Beijing.

Cai and Zhang are the company’s two largest shareholders, with 39.11% and 13.24% of its stock, respectively, before the listing. The company has also attracted several Chinese and Asian corporate investors, including Nio Capital, the investment arm of one of China’s leading EV makers; Japan’s Toyota Tsusho Corp.; Jingde Guangzhou, which is part of South Korea’s Korea Investment Partners; and Shanghai Shine-Link International Logistics.

Serving people on the go

Battery swapping and charging are the two main methods for replenishing energy in pure EVs. Charging became the dominant solution during the EV industry’s early stages due to lower infrastructure costs and standardized technology, and remains the dominant force today. But compared to charging, battery swapping offers a significant speed advantage by allowing users to instantly replace a depleted battery and be on their way without waiting for a charge-up.

A typical battery swap can often be completed within 10 minutes, compared with charging that takes anywhere from 15 minutes or even hours, depending on the charger and level of charging. Consequently, swapping minimizes vehicle downtime, significantly boosting appeal to users in a hurry or who simply don’t want to wait. What’s more, swapped batteries are typically recharged during off-peak hours, helping to ease pressures on the electric grid.

Driven by such advantages, sales of vehicles whose batteries can be swapped in China have grown from 66,000 units in 2020 to 269,000 units in 2024, representing 42% annual growth. The market is expected to keep expanding rapidly in sync with global adoption of new energy vehicles, reaching 1.14 million units by 2030.

Demand for battery-swapping stations has risen in step with growing sales of battery-swappable vehicles. The number of such stations jumped from 600 in 2020 to 4,400 in 2024, representing 68.2% annual growth, and is expected to reach 24,000 by 2030, according to third-party market data in Aulton’s listing document.

The battery-swapping industry comprises upstream, midstream, and downstream segments. Upstream includes battery manufacturers, swapping equipment suppliers, and grid operators. Midstream encompasses swapping station operators and battery asset management providers. And downstream covers end-users and the battery recycling process.

The battery-swapping sector’s current domination by commercial users also makes it somewhat subject to seasonal behaviors, with demand peaking during major holidays when ride-hailing and taxi services are in high demand. EV batteries also get depleted faster in the winter, reducing range and increasing the frequency of need for energy replenishment, further boosting demand for swapping during those colder months.

Aulton’s business includes battery-swapping station operation services and actual equipment sales. Based on revenue generated from its station operations in 2024, it ranks as China’s largest independent third-party battery-swapping services provider. But the landscape is more competitive in equipment sales due to a high degree of fragmentation. In that more crowded market, Aulton is still a relatively small fish with only 5% of the market in 2024.

Despite its broader leadership in battery-swapping, Aulton has yet to charge up its own coffers with profits. That said, its loss narrowed by nearly half to 157 million yuan in the first half of 2025 from 283 million yuan in 2024. Still, the improvement was driven mostly by cost and expense reductions rather than by revenue growth – not the most encouraging sign for potential investors.

Reversing revenue

Perhaps most worrisome for potential investors is Aulton’s stalling revenue, which has slipped into reverse. Its revenue fell to 926 million yuan in 2024 from 1.16 billion yuan the previous year, down 19.8%. The contraction accelerated in the first half of 2025, with revenue plunging 31.7% year-on-year to 324 million yuan. The company attributed the accelerating slide to slower sales of swapping stations and modules in cities like Changchun, alongside strategic adjustments being deployed at stations across multiple cities.

Currently concentrated in China, the EV battery-swapping market presents limited diversification opportunities into other areas beyond the core business. To broaden its revenue base, Aulton is exploring new opportunities in Southeast Asia and Latin America. It plans to launch pilot swapping stations in these regions and is negotiating partnerships with local clients, including in Hong Kong and Mexico. It has already signed a memorandum of understanding with one Hong Kong company, it says.

No pure-play battery-swapping company is currently listed globally. However, U.S.-listed charging station firms like ChargePoint Holdings (CHPT.US) and Blink Charging (BLNK.US) could be useful references, currently trading at price-to-sales (P/S) ratios of 0.5 and 1, respectively. Aulton could quite possibly fall within that range. But it may have to price its shares at an even lower multiple to attract investors, given its falling revenue and the fact that battery swapping remains only a niche solution outside China.

To subscribe to Bamboo Works weekly free newsletter, click here