Yalla sees ‘inflection point’ next year as new gaming initiative takes flight

After a year of preparations, the Middle Eastern social media company launched its first self-developed midcore game during the third quarter

Key Takeaways:

- Yalla kept its revenue growth streak alive in the third quarter, and suggested its new gaming initiative could start contributing to its top line in the first half of 2026

- The company said its recently launched self-developed midcore game has been well received in its core Middle East market, as well as in North America and Europe

By Doug Young

Gentlemen, start your engines.

That was the sound coming from Yalla Group Ltd. (YALA.US) in the third quarter, as the leading Middle East and North Africa (MENA) social networking and gaming company launched a highly anticipated midcore game that it hopes will jumpstart its growth. The company said that title, a car-themed midcore game called “Turbo Match,” is off to a relatively strong start, not only in its Middle Eastern base but also in other markets.

It also held out the possibility that the new title, plus two others set for launch by the end of the year, could start making noticeable contributions to its revenue as early as the first half of next year.

“For those expecting a notable revenue impact from these new games, we see the second quarter of 2026 as a key inflection point,” said Yalla COO Jeff Xu, speaking on the company’s earnings call following the release of its results on Monday after markets closed.

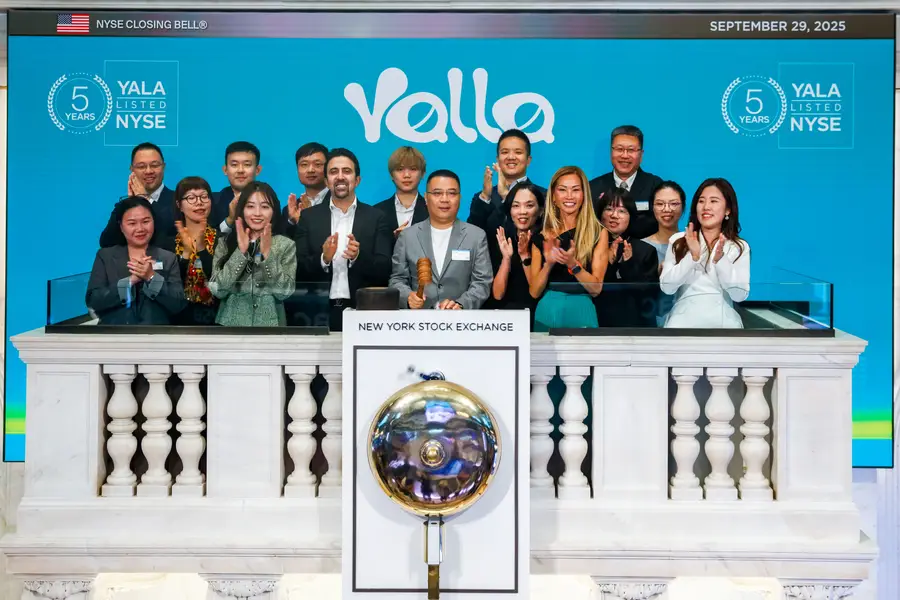

Xu made his remarks as Yalla released its latest quarterly results that showed it managed to post another quarter of revenue growth, even after previously forecasting the figure could fall, keeping alive its streak of gains for that key metric in every quarter since its public listing on the New York Stock Exchange in 2020. The company recently attended a fifth anniversary bell-ringing ceremony to commemorate the event.

While the company’s revenue growth has recently slowed, it is not resting on its past glory days. Instead, Yalla is trying to get investors excited about the future as it leverages its large base of casual gamers to carve out a place in the more lucrative midcore and hardcore gaming spaces.

Yalla isn’t feeling any financial pressures as it makes that move, as it’s already quite cash rich thanks to its generally conservative approach. It had $739.5 million in cash at the end of September, up substantially from $656.3 million at the end of last year, and remains quite profitable with enviable margins. What’s more, it’s also using its abundant cash to repurchase its shares.

Instead, the company is feeling pressure from its own slowing growth, and is trying to get investors excited about its potential to reignite that growth with its entry to midcore and hardcore games. Its efforts in that direction have had a clear effect, with Yalla’s stock up about 75% this year as the company kept investors updated on its new gaming initiative.

Yala’s stock currently trades at a price-to-earnings (P/E) ratio of 8.7, which is firmly in between the 7.6 for Weibo (WB.US; 9898.HK), one of China’s leading social media platforms, and a 9.6 for the similar-sized U.S.-based Pinterest (PINS.US). But it’s still well behind the 19 for NetEase (NTES.US: 9899.HK), one of China’s leading online game companies, showing there could be big potential upside for Yalla’s stock if its gaming initiative bears fruit.

Third-quarter launch

COO Xu said “Turbo Match” had its soft launch in the third quarter. The emphasis on the game by both Xu and Yalla founder and Chairman Yang Tao showed the company is particularly optimistic about the title, which Xu described as a “unique blend of car modification and simulation operations gameplay.”

Xu added that based on initial feedback, the company is adding new levels and diversifying side gameplay options to “Turbo Match,” “setting the stage for the next wave of large‑scale user acquisition.” Chairman Yang added that Turbo Match” has gotten good reception not only in the Middle East, but also in North America and Europe.

“Given this positive user feedback, we certainly plan to increase marketing budget for markets where performance is strong,” Yang said.

In addition to the launched game, Yalla also expects to debut a self-developed roguelike game called “Boom Survivor” and a strategy game (SLG) under a Middle East licensing agreement with a “leading game studio” by the end of this year.

Yalla began as a social media company with a focus on voice-based chat services, and still counts such services as its largest revenue source. It also developed a concurrent business for casual gamers, which lately has been growing faster than its original chat services, and is serving as the foundation for its latest gaming initiatives.

Those two services combined generated $89.6 million in revenue during the third quarter, well ahead of the $78 million to $85 million from the company’s guidance three months earlier, which was up 0.8% from the $88.9 million it reported a year earlier. Within that overall figure, chatting services accounted for about 62% of the total, while gaming accounted for the rest.

The company’s average monthly active users rose 8.1% year-on-year to 43.4 million, while paying users declined slightly compared to the same period last year.

Yalla is quite fiscally disciplined, giving it margins that would make most other companies envious. Its cost of revenue fell 10.7% year-on-year in the latest quarter, even as its actual revenue grew, with the result that its cost of revenue fell to 31.7% of revenue from 35.8% a year earlier. It credited the improvement to lower commission fees to third-party payment platforms.

Its total costs and expenses also fell 1%, which helped to boost its net margin by 1.3 percentage points to 45.4%, as its net income rose 3.9% to $40.7 million from $39.2 million a year earlier. The company said it had bought back $51.9 million worth of its stock this year through Nov. 7, outpacing its earlier target of $50 million for the whole year, leaving another $48.6 million it can spend for more buybacks under a $150 million plan first announced in 2021.

Such buybacks can help to support a company’s stock, and are almost certainly a factor behind Yalla’s rally this year. But to really get investors excited about its prospects, the company will need to start showing some results from its new gaming initiatives, which, if things go according to plan, could come in the first half of next year.

The Bamboo Works offers a wide-ranging mix of coverage on U.S.- and Hong Kong-listed Chinese companies, including some sponsored content. For additional queries, including questions on individual articles, please contact us by clicking here

To subscribe to Bamboo Works free weekly newsletter, click here