Sungrow powers up to meet soaring demand from AI data centers

The Chinese maker of photovoltaic inverters is tapping investors to fund a deeper push into the energy storage and supply business as AI demand takes off

Key Takeaways:

- The company supplies a quarter of the world’s photovoltaic inverters and nearly 12% of energy storage systems

- The energy storage business accounted for 41% of the firm’s revenue in the first half, surpassing its inverter income for the first time

By Lee Shih Ta

With the rise of artificial intelligence, energy is becoming an increasingly coveted commodity for the power-hungry computing industry, creating new opportunities for China’s solar sector.

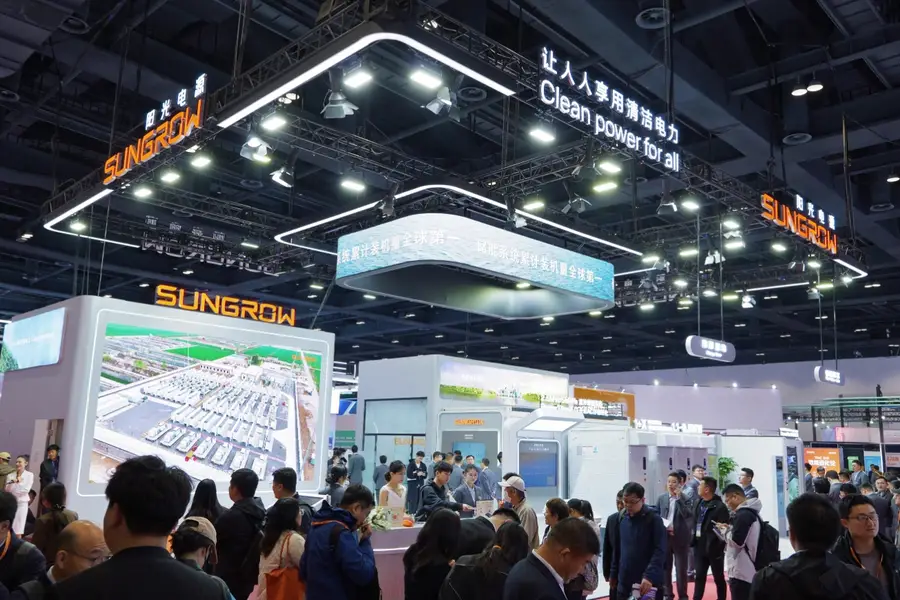

A Chinese leader in the photovoltaic technology that turns solar power into usable electricity is now targeting the energy needs of AI data centers. Hefei-based Sungrow Power Supply Co. Ltd. (300274.SZ) has applied for a secondary listing in Hong Kong to further its ambitions in the AI energy space.

Clean energy giant Sungrow has been the world’s biggest supplier of photovoltaic (PV) inverters for a decade, boasting a 25.2% global market share in 2024, according to a study commissioned for the listing application. Its products are sold in more than 170 countries, with overseas markets delivering around 58% of revenue in the first half of 2025.

From its base in Anhui province, Sungrow has grown in tandem with China’s new energy sector. Its signature PV product converts the direct current generated by solar panels into alternating current for use by the power grid. However, intense competition is shrinking PV margins, prompting the company to switch its focus to AI-related power supply and energy storage to maintain its growth momentum.

Sungrow’s revenue rose from 40.11 billion yuan ($5.63 billion) in 2022 to 77.7 billion yuan in 2024, representing a compound annual growth rate (CAGR) of 37%. The pace carried through to the first half of this year, when revenue jumped 40% from the same period a year earlier. Meanwhile, gross margin expanded from 20.4% in 2022 to 32.9% in first half of 2025, tracing a steady upward path.

From supplying to managing power

The rise was powered by rapid growth of its energy storage business, which generated revenues of 17.8 billion yuan in the first half. That figure accounted for 41% of total revenue, overtaking the 35.3% from PV sales and making energy storage the firm’s biggest earnings driver for the first time.

The milestone marks Sungrow’s pivot from the business of power supply to power management, through the value-added fields of energy storage and control.

An energy storage system (ESS) typically captures excess energy for later release using batteries or other mechanisms to help smooth out supply and strengthen power grid stability.

The prospectus said Sungrow held 11.9% of the global ESS market in 2024, placing it among the top five suppliers. Sungrow has delivered hundreds of megawatts of ESS projects across North America, Europe and the Middle East, with total new energy capacity exceeding 57 GW.

Meanwhile, the vast data centers enabling AI have boosted global electricity demand, driving what has been called the electrification of computing power. Sungrow said it would invest the proceeds from its Hong Kong listing into developing next-generation PV and energy storage products, as well as building overseas production facilities, to meet expected demand.

Citigroup estimates that global AI computing demand will require an additional 55 GW of power capacity by 2030, translating into a need for around $2.8 trillion in incremental investment.

AI power player

Sungrow has launched a suite of products tailored for AI data centers and power stations on the electricity grid, including its PowerTitan 2.0 liquid-cooled ESS. The company unveiled several next-generation solar and storage solutions for the North American market at a U.S. trade fair this year, including the SG4800UD-MV-US modular inverter and the PowerTitan 3.0 storage unit with silicon carbide power conversion technology, billed as achieving more than 93% energy efficiency and supporting fast restart after any power shutdown.

However, the heavy investment needed to develop energy storage is slow to deliver a payoff. By mid-year, Sungrow’s accounts showed signs of pressure on working capital, with accounts receivable at 29.15 billion yuan and current liabilities accounting for more than 80% of total liabilities. A net operating cash inflow of 12.07 billion yuan in 2024 had fallen to around 3.4 billion yuan in the first half of 2025. The company’s cash position remains adequate, with 17.91 billion yuan in cash and equivalents at the mid-year mark.

Sungrow has performed strongly on the Shenzhen stock market, where its share has risen about 120% in the year to date, reflecting investor optimism over its prospects for supplying AI power. The firm’s market value stands at 335 billion yuan, with a forward price-to-earnings (P/E) ratio of 24.3 times, far above the 5 times and 3.3 times for Hong Kong-listed peers Xinyi Solar (0968.HK) and Solargiga Energy (0757.HK).

The market could struggle to digest an IPO price benchmarked to Sungrow’s A-share level, given the broader discount for Hong Kong’s new energy sector.

But investors may be attracted by the long-term potential for Sungrow to experience another golden age, as it aims to evolve from being a solar equipment manufacturer into a major player in AI energy.

To subscribe to Bamboo Works weekly free newsletter, click here