Stealthy eLong Power sneaks closer to U.S. listing

China’s securities regulator has cleared the lithium battery maker’s SPAC-listing plan, even as the company’s public financial disclosures remain scant

Key Takeaways:

- China’s securities regulator has registered eLong Power to list on the Nasdaq, paving the way for its planned SPAC merger with TMT Acquisition Corp.

- The maker of batteries for commercial EVs has disclosed little or no financial information about itself, making it hard for investors to determine its worth

By Warren Yang

A key part of a company’s going public is opening up about its financial health to the investment community. But a planned backdoor listing by electric vehicle (EV) battery maker eLong Power Holding Ltd. looks far stealthier than usual cases, as the company sneaks closer to its goal of trading on the Nasdaq.

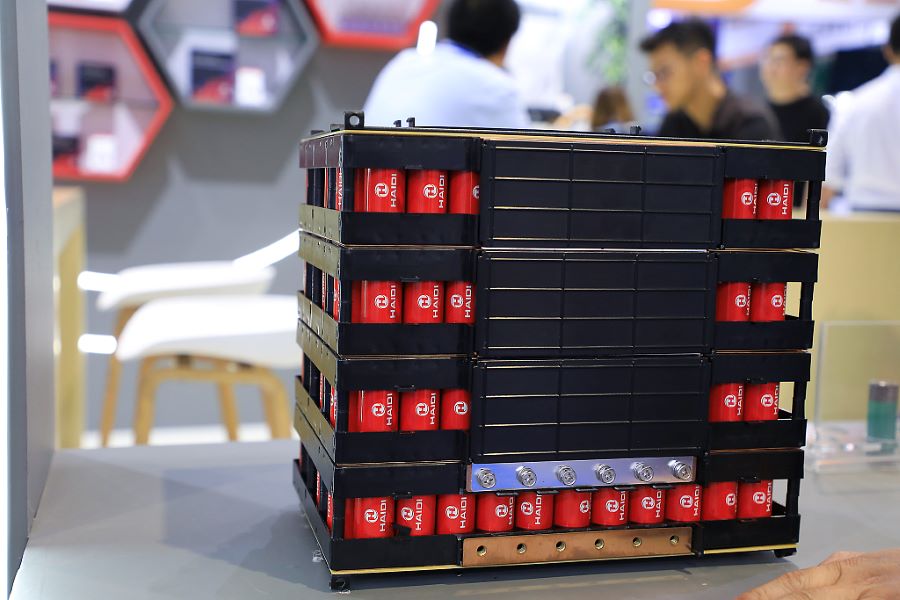

eLong certainly looks attractive on the surface due to its niche as a maker of batteries for commercial-use EVs, amid a broader boom for clean energy vehicles in China these days. But public information on the company remains scarce, at least for now, which may keep investors from getting too excited about this new EV play.

In keeping with its somewhat secretive nature, eLong’s name was on a sort of low-key public display last week when the China Securities Regulatory Commission (CSRC) cleared it for a Nasdaq listing. The CSRC said eLong, whose batteries power both commercial and specialty vehicles, as well as energy storage systems, completed its registration to list through a merger with TMT Acquisition Corp. (TMTC.US), a special purpose acquisition company (SPAC).

In practical terms, that means the regulator gave eLong the green light to list. Under new rules that took effect in March last year, Chinese companies looking to go public overseas must get such regulatory clearance for their plans.

eLong and TMT Acquisition signed their merger deal last December, saying at the time they expected to complete it in the first half of this year. There isn’t much time before that deadline, meaning it’s quite possible the timeframe will need to be extended. But with the CSRC registration out of the way, eLong can at least proceed with its plan knowing it has fulfilled its regulatory duties in China.

After the merger’s completion, eLong’s shareholders will receive 45 million shares in the listed company at a valuation of $10 apiece, giving the company an initial market capitalization of $450 million. The company’s majority shareholders will get another 9 million shares if it meets revenue targets this year and next.

For new outside investors, however, it’s quite difficult to find information about eLong’s financial health, which makes it difficult to assess the company’s prospects and risks. Last December’s merger announcement didn’t include any financials for eLong, and only alluded to the company’s potential by providing growth projections for the global markets for commercial EVs and energy storage equipment.

TMT Acquisition’s subsequent filings with the U.S. securities regulator also lacked much company-specific data about eLong. The company’s operating entity, Huizhou Yipeng, has a Chinese website, though there’s no information there on its financials.

Based on eLong’s initial market capitalization of $450 million, the company probably generates much smaller revenue than some currently listed EV battery makers. Among those, Gotion (002074.SZ) generated 31.6 billion yuan ($4.4 billion) in revenue last year, giving it a price-to-sales (P/S) ratio just above 1, based on its market capitalization of about 35 billion yuan. Another peer, EVE Energy (300014.SZ), trades at a ratio of about 1.84 times its revenue last year, based on its market cap of 86 billion yuan.

And EV battery heavyweight CATL (300750.SZ) boasts the biggest market cap of all, more than 800 billion yuan, giving it a P/S ratio of about 1.8, based on its annual revenue last year.

Young company

If eLong’s SPAC deal values it similarly to the other battery makers, with a P/S ratio of between 1 and 2, its annual revenue should be a few hundred million dollars – not a small amount, but also not huge for a maker of products that carry relatively high price tags. A higher multiple would mean its revenue was even smaller.

That said, eLong is relatively young, founded just a decade ago in 2014. And if past transactions involving the company are any guide, its valuation has increased very quickly, which probably reflects its growth, although it’s hard to know how profitable it actually is – if at all.

In the latter part of 2016, a company called Highpower International, also a battery company that was listed in the U.S. but went private in 2019, bought about 35% of the then 2-year-old Huizhou Yipeng Energy for 65 million yuan. That price valued the company that is now eLong’s main operating entity at a very modest sum of about $28 million in dollar terms.

In May the next year, Highpower sold most its Huizhou Yipeng stake in a transaction that valued the company at $46 million. As of the end of 2017, Highpower’s stake in Huizhou Yipeng was less than 5%. It’s unclear if Highpower still holds that stake, though presumably eLong currently owns a majority of Huizhou Yipeng’s shares.

It’s difficult to know what was happening among these parties in the rapid succession of deals so soon after eLong was just getting started. But from a purely valuation perspective, eLong went from a $28 million company to a $450 million in just eight years.

Such a leap isn’t so inconceivable since EVs are all the rage in China these days, and are catching on globally as well, meaning demand for their component parts like lithium batteries is high. Clean energy producers and consumers are also increasingly equipping their facilities with technologies to store electricity from the sun and wind, which allows them to provide power around the clock. Batteries lie at the heart of such storage systems, providing another major market for eLong’s products.

China’s lithium battery market is big but also quite competitive, though eLong’s niche of making batteries for commercial EVs may shield it from the worst competition. But that focus could also leave it vulnerable if demand for such specialty vehicles fails to take off as quickly as that for passenger cars due to, for example, lack of robust charging infrastructure.

eLong could be a convincing growth story, like any company in China’s clean energy business these days, once investors get more information. In announcing its plan to merge with eLong last December, TMT touted vertical integration as one of eLong’s strengths, suggesting that the company may have a relatively light cost structure and hence may already be profitable.

But at least for now, the company will remain a bit of a question mark until we get more information. Investors with a big risk appetite might take a chance that the financials will look good when they’re finally made public. At the very least, the company could offer international investors a chance to buy into the Chinese lithium battery story, since shares of most companies in the sector are currently only available to domestic investors.

To subscribe to Bamboo Works free weekly newsletter, click here