ShanH seeks IPO recharge after years of losses

The smartphone recycler has filed a third time to list in Hong Kong, hoping to jump on a surging market for new public offerings

Key Takeaways:

- ShanH has filed to list in Hong Kong for a third time, reporting it lost nearly 25 million yuan in the first half of this year

- The smartphone recycler has net liabilities of more than 700 million yuan

By Lau Chi Hang

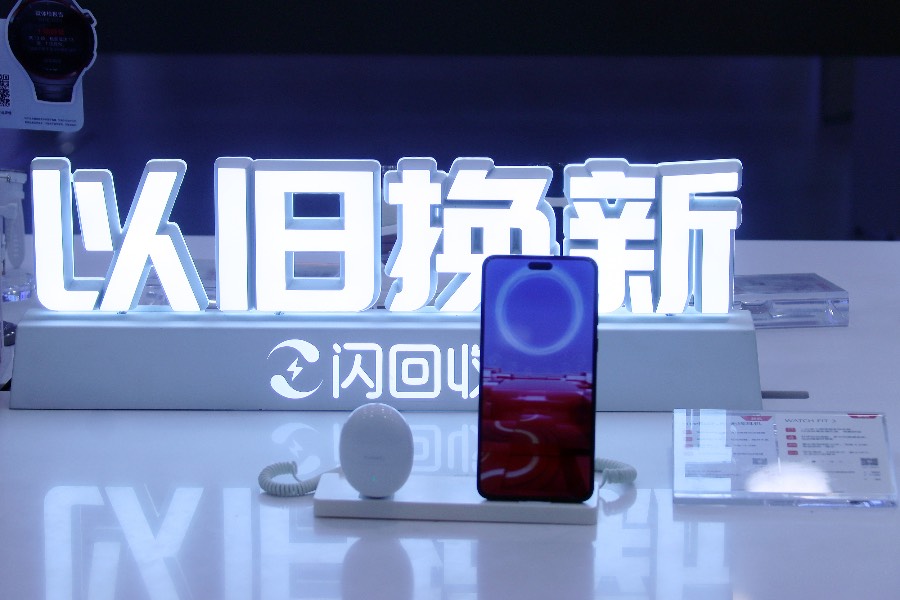

ShanH Technology Ltd. is showing that what began as a setback might turn out to be a blessing in disguise. The smartphone recycler tried twice to list in Hong Kong, but failed to complete the process in the required six-month limit. But in a stroke of good timing, the company has renewed its effort again, hoping the third time will be the charm, as Hong Kong experiences one of its strongest IPO markets in years. A successful listing could secure much-needed new funds to give the money-losing company a new lease on life, much the way ShanH does for the recycled smartphones that are its bread-and-butter.

The company specializes in recycling a range of used consumer electronics, but smartphones are the largest of those. Its Shanhuishou recycling system allows consumers to trade in their old products for new ones by visiting its partners’ brick-and-mortar retail stores, or via its online shop.

After products are inspected, graded and maintained, they are priced and sold on the company’s own Shanhui Youpin online platform, or over various third-party e-commerce platforms.

Growing revenue, continuing losses

ShanH’s biggest tailwind is policy support as Beijing promotes recycling and the “circle economy.” In 2021, the Ministry of Ecology and Environment published guidelines on the recycling of nine categories of electronic waste, with smartphones as one of those. In January, Beijing also added smartphones to another program aimed at boosting consumption, promising subsidies of up to 500 yuan for people who traded in old handsets for new ones.

Even with such policy support, however, ShanH’s actual performance has been underwhelming. We laid out many of our concerns in an article last year. Despite some improvements in its latest filing, many of the same core issues remain. That means that even if it succeeds in listing this time, ShanH’s lackluster outlook could fail to excite investors, even in the current hot IPO market.

The company’s revenue has been on a steady upward track in the past four years, rising from 750 million yuan ($104.4 million) in 2021 to 1.3 billion yuan last year. That growth continued this year, with revenue up 40% year-on-year to 809 million yuan in the first half of 2025. While its revenue growth looks solid, the same isn’t true for its bottom line. The company lost nearly 100 million yuan each year in 2022 and 2023, though the figure narrowed to about 66 million yuan last year. It further narrowed by nearly 40% in the first half of this year, though the loss was still sizable at 24.8 million yuan.

Razor-thin gross margin

A primary factor behind the losses was investor redemptions of preferred shares, which is a non-cash item that doesn’t affect the company’s actual finances. But its core smartphone recycling business isn’t without problems. Leading those is an extremely low gross profit margin for product sales, which has consistently been below 8% in the past four years. What’s more, the figure fell to 4.4% last year from a high of 7.5% in 2021, though it rebounded to 6% in the first half of this year. Still, such razor thin margins make earning profits that much harder.

To make up for that weakness, the company must ratchet up its sales volume if it hopes to someday become profitable. But doing that isn’t necessarily easy. According to third-party data in the listing document, China’s top five smartphone recyclers controlled just 18.6% of the market, showing how fragmented things are. ShanH ranked third on the list, but had just 1.3% of the market, well behind leader ATRenew’s (RERE.US) 7.9% and 7.4% for the second-largest player.

Its smaller market share means ShanH is also well behind the two leaders in terms of smartphone sales value. It had just 1.2 billion yuan for that metric in 2024, compared with 7.8 billion yuan and 7.7 billion yuan for the top and second-largest companies, respectively. That shows ShanH lags well behind its two larger rivals, making it more likely to lose market share to that pair than to gain the scale it needs to become profitable.

High debt, weak cash flow

ShanH’s heavy debt load is another vulnerability. Its net liabilities shot up from 235 million yuan in 2021 to 688 million yuan last year, and further rose to 713 million yuan in the first half of 2025, tripling in just four and a half years. The company attributed the increase to book-value changes caused by the redemption of preferred shares by investors.

Preferred share redemptions and their impact aside, ShanH was also troubled by net cash outflow to the tune of more than 100 million yuan over the last four years, though the figure turned positive in the first half of this year at 43.72 million yuan. While the move to positive cash flow looks encouraging, we don’t know if it’s the result of accounting tactics by the company designed to make it look more attractive to investors.

What’s more, the company also logged a positive 13.1 million yuan in operating cash flow in the first half of last year, only to see that wiped out in the second half, resulting in a net outflow of nearly 20 million yuan for the entire year.

Given the company’s shaky finances, it’s fair to say the stock may be greeted with investor skepticism despite the policy support ShanH enjoys. The listing, if it succeeds this time, could enjoy some short-term success on the strength of the broader IPO market. But over the longer term, ATRenew looks like a stronger bet due to its larger market share, which includes not only higher revenue but also a healthier profit profile, despite its relatively high price-to-earnings (P/E) ratio of 57 times. Accordingly, absent a quick performance gain in the next two to three years, ShanH looks like a second-fiddle choice for recycling-minded investors.

To subscribe to Bamboo Works free weekly newsletter, click here