Intsig scans global financial markets for cash with Hong Kong IPO

The operator of an app allowing users to directly convert images to PDF files from their smartphones hopes to sell investors on its growing profits and strong margins

Key Takeaways:

- Intsig has filed to list in Hong Kong, boasting nearly 30% annual profit growth over the last three years and gross profit margins of around 80%

- CamScanner, an app allowing users to create PDF files directly from images on their phones, contributes about three-quarters of the company’s revenue

By Cheng Shui Tong

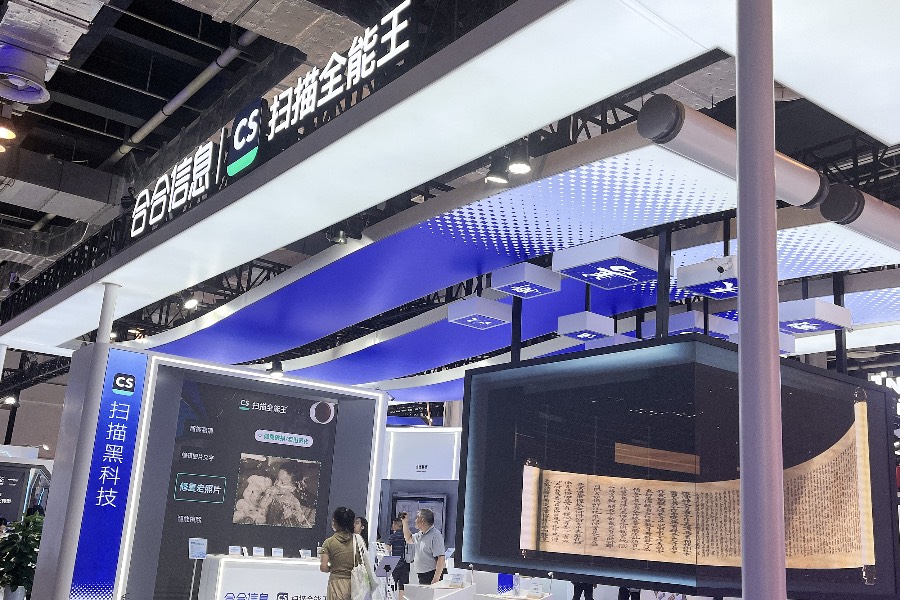

Many people around the world may have used CamScanner, an application that converts documents into PDF files using photos on a smartphone. But far fewer may know the app is operated by China’s Intsig Information Co. Ltd. (688615.SH), whose founder and Chairman Zhen Lixin has worked in some top firms, including oil major Sinopec, where he was an electrical engineer, and Motorola, which he joined in 2000 before setting up Intsig in 2006.

Zhen’s company went through various products before hitting its stride in 2010 with CamScanner, which has grown since then to contribute over 70% of its revenue. Intsig listed on Shanghai’s Nasdaq-style STAR Market last year, where it’s currently valued at a hefty figure of more than 20 billion yuan ($2.8 billion). Now, the company is trying to cash in on the recent frenzy by firms listed on China’s domestic-focused markets in Shanghai and Shenzhen to make a second listing in Hong Kong targeting global investors.

CamScanner bills itself as the world’s largest image-to-text processing product maker by user base, according to its listing documentfiled late last month. The app has ranked at the top of the free efficiency apps list in the Apple app store “at various times” since 2013, it said, citing third-party research. With over 1 billion users across 200 countries and support in 52 languages, it says it is one of the few global apps to consistently grow at an annual rate of more than 20% for more than 15 years.

AI enhancements

The company has taken advantage of the recent AI boom to integrate a wide range of new features into its flagship product, with names like AI Magic Pro, AI Smart Erasure, and AI Sign. CamScanner accounted for 77% of Intsig’s revenue last year, with the figure rising to 81% in the first quarter of 2025. The company’s portfolio also includes other consumer-focused (2C) products like business card reader CamCard and corporate credit data app Qixinbao.

For business customers (2B), Intsig offers products like TextIn and Qixin Insight, though those account for only about 16% of its revenue. Gross profit margins for 2B products come in around 60%, notably lower than more than 80% from 2C products.

While STAR Market-listed companies are often money-losing startups, Intsig hardly fits that mold. To the contrary, the company boasts strong revenue and profits, which are both growing steadily. Its revenue grew at an average annual rate of more than 20% between 2022 and 2024, reaching 1.44 billion yuan ($201 billion) last year. Its net profit grew about 28% annually over that period to reach 400 million yuan last year. That growth continued in this year’s first quarter, with its profit rising 29.4% year-on-year to 116 million yuan during the three-month period. Its gross profit margins also consistently exceeded 80% during that time.

Fierce competition

While things look good for the company right now, Intsig’s listing document also outlines a number of risks it faces. It points out the rapid evolution of AI technology could erode its competitiveness if it fails to keep pace. Despite its strong position in its niche, the company holds just 2.2% of the global 2C efficiency AI product segment, showing it faces stiff competition from both domestic and international rivals. The company’s possession of extensive user data also raises the risks of data breaches and privacy compliance – issues that are often more difficult for smaller, less experienced companies to handle.

To maintain its edge, Intsig spends heavily on R&D, whose costs have risen from 279 million yuan in 2022 to 390 million yuan in 2024, equal to 27% of its revenue last year. Moreover, with about one-third of revenue coming from overseas, Intsig faces the task of managing foreign exchange risk.

Shanghai- and Shenzhen-listed companies making second IPOs in Hong Kong has become a major recent trend, but the latter are often valued lower than the former. That means that while Intsig is valued relatively high by Shanghai investors, with a current market value of about 22 billion yuan, or roughly $3 billion, it may not get such a strong valuation from global investors who are a major force in Hong Kong.

Among such dual listings, four out of five to debut from May onward were up from their Hong Kong IPO prices as of June 27, including electric vehicle battery giant CATL, which sold its Hong Kong shares at a 7% discount to their Shenzhen price. CATL’s strong business prospects and a relatively small float for its Hong Kong listing have led the Hong Kong stock to trade at a premium to the company’s Shenzhen shares. By June 27, its Hong Kong stock price had surged 24% from the IPO price to trade at a substantial 20% premium to its Shenzhen share price. But such a premium is extremely rare.

Mixed performance for new dual listings

Instead, the opposite is more commonly the case, with the Hong Kong shares of most dual listed companies trading at discounts of around 20% to their Shanghai- and Shenzhen-listed prices. Hengrui Pharmaceuticals and Sanhua Intelligent Controls are more typical of the group. The former is up 26% from its Hong Kong IPO price and the latter is up 8%, but both still trade at discounts to their prices on Mainland Chinese markets. Hong Kong-listed shares of leading condiment maker Haitian Flavouring have fallen 3.4% since their listing, and also trade at a 20% discount to their Shanghai-listed shares.

Intsig listed on the Shanghai STAR Market in September 2024 by selling shares for 55.18 yuan apiece. The price soared past 100 yuan on its debut and later climbed to more than 500 yuan on a wave of speculative buying. It has come down since then to currently trade at around 150 yuan, giving it a price-to-earnings (P/E) ratio that still looks relatively high at about 51 times. The company’s appeal to Hong Kong investors is likely to hinge on the size of the discount it offers relative to its Shanghai share price.

To subscribe to Bamboo Works weekly free newsletter, click here