InnoScience makes gains in patent dispute, as growing competition remains bigger threat

The U.S. International Trade Commission ruled largely in the GaN semiconductor maker’s favor last week in a patent dispute with Infineon, though a final decision is still pending

Key Takeaways:

- InnoScience made an important advance with a ruling largely in its favor in a patent dispute last week, but faces intensifying competition and margin pressures

- The GaN semiconductor maker’s revenue surged 43% in the first half of this year as it logged its first ever positive gross margin, but it remains unprofitable

By Hugh Chen

Nearly two years after being sued by an industry titan for patent infringement, a major cloud hanging over power semiconductor maker InnoScience (Suzhou) Technology Holding Co. Ltd. (2577.HK) appears to be lifting, easing a major distraction for the company and investors.

The legal dispute with Infineon Technologies (IFX.DE), which dates back to March 2024, posed a significant risk to InnoScience, even as it listed its shares in Hong Kong about a year ago. The company currently mostly does business in China, but an unfavorable ruling could have barred it from selling some of its products in the U.S. in the future.

That potential roadblock appeared to dissipate somewhat last week when the company announced that the U.S. International Trade Commission (ITC) ruled partly in its favor regarding one of the two patents in the case. InnoScience said its products related to the other patent also did not infringe on that patent. It stated the ruling “further clarifies the status of InnoScience’s relevant intellectual property and will clear the way for its future global development.”

Infineon saw things a bit differently, pointing out that the ITC found in its favor regarding one of the patents in the lawsuit, according to its own statement. It added a final decision is expected on April 2 next year, and confirmation of the initial decision could lead to a ban of related InnoScience products to the U.S.

Investors appeared to side with InnoScience in determining the ITC’s decision was largely positive for the Chinese company. InnoScience’s stock initially fell 1.5% the day of the announcement last Wednesday, but have come roaring back since then and now trade nearly 10% above pre-announcement levels.

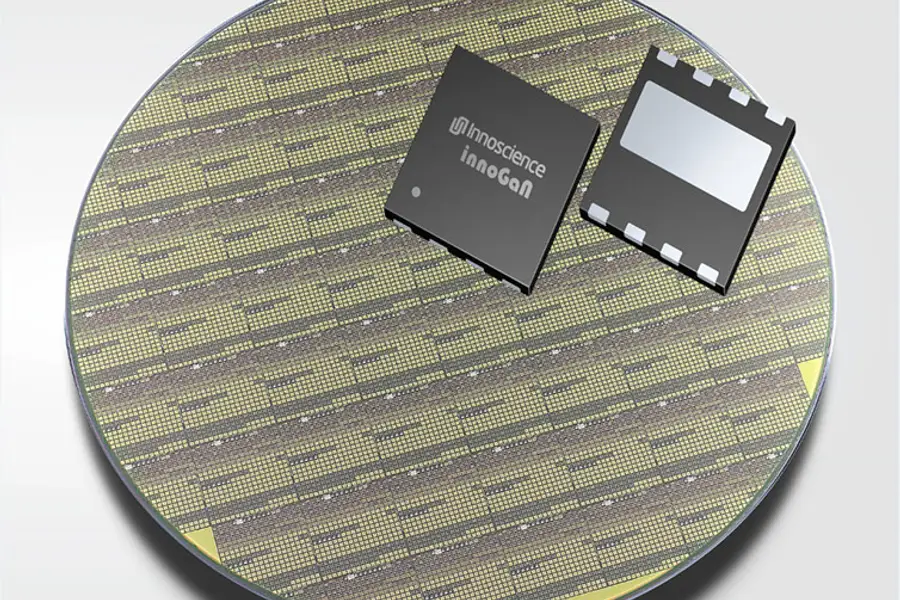

Since its founding in 2017, InnoScience has been a key driver of a niche but promising technology in the power semiconductor industry called gallium nitride (GaN). The technology offers advantages over traditional silicon-based semiconductors, including higher efficiency and faster switching speeds, and InnoScience has been a stronger promoter of the material.

The company’s technological leadership in the technology – including being the first to mass-produce 8-inch GaN wafers – positions it to capture growth in the small but quickly expanding GaN market. However, investors should remain cautious, as fast-growing competition remains a major challenge to the company as others crowd into the space.

Large market, but fierce competition

The GaN power semiconductor market is undoubtedly on the rise. The market is expected to grow from 2.7 billion yuan ($382 million) in 2024 to 19.2 billion yuan in 2028, representing 63% annual growth, according to a November note from Bank of America. InnoScience is currently the leader in GaN power semiconductors, with 30% of the market last year – nearly twice second-place Navitas (NVTS.US) at 17%, according to Bank of America.

Several factors put InnoScience in strong position going forward. Central among them is its integrated device manufacturer (IDM) model, which means the company handles everything from design to manufacturing to marketing of its products.

This approach gives InnoScience greater control over its supply chain and production quality compared to the fabless model, where manufacturing is outsourced to third parties. The model’s major downside is its far higher costs, since companies must spend huge amounts to build expensive production lines. But in this case, the advantages of vertical integration are becoming increasingly apparent. Navitas uses the fabless model and is currently scrambling to find new manufacturing partners after production partner TSMC announced plans to exit the GaN manufacturing business in 2027.

InnoScience’s business model also gives it a more diversified revenue stream, since it not only makes end products like GaN chips and modules, but also wafers – the raw material out of which chips are “carved.”

Two recent supply deals underscore this advantage. The latest, announced last week with U.S.-based ON Semiconductor, and an earlier similar agreement with Europe’s STMicroelectronics, will see InnoScience supply its GaN wafers to both companies. These partnerships should help diversify InnoScience’s geographic revenue mix, which currently remains heavily concentrated in China.

Morgan Stanley, in an October note, projected that InnoScience’s revenue would outpace overall GaN market growth, expanding 66% annually through 2027. It attributed this outlook largely to the company’s technological leadership and the advantages of its IDM model.

That growth trajectory is already evident in the company’s recent results. In the first half of 2025, InnoScience’s revenue jumped 43.4% to 553.4 million yuan ($71.1 million). More significantly, the company achieved its first ever positive gross profit margin of 6.8%.

InnoScience still posted a net loss of 429 million yuan for the period, though this represented an improvement from the 488 million yuan loss in the prior-year period.

Another major positive development for InnoScience came in July, when global AI chip leader Nvidia announced it had selected InnoScience to supply it with 800V DC power solutions for its Rubin Ultra GPU, which is slated for commercialization in 2027. This represents an important breakthrough for InnoScience into the data center segment, one of the fastest-growing areas for GaN power semiconductors.

Buoyed by these positive developments, InnoScience’s stock has delivered impressive returns. Its shares climbed steadily after its Hong Kong listing last December, more than tripling from their IPO price of HK$30.86 to hit a peak of nearly HK$100 in early September, before moderating to their latest close of HK$80.85 last Friday.

However, investors should be aware of significant downside risks, led by intensifying competition. InnoScience is aggressively expanding capacity, targeting 60,000 wafers per month by 2027, up from 13,000 in the first half of this year. But the company is hardly alone in this buildout. Morgan Stanley forecasts that global GaN capacity will surge from 100,000 wafers per month in 2024 to 345,000 6-inch wafer equivalents by 2029.

Such rapid buildups are quite common in the chip sector, which is famous for its regular boom-bust cycles due to overbuilding. Overall industry utilization is expected to improve but remain below 60% over the next five years, suggesting persistent pricing and profitability pressures across the GaN market, according to Morgan Stanley. As a result, the investment bank expects InnoScience’s gross margin to improve only at a moderate pace in 2026 and 2027, with the company losing money through at least next year.

At the end of the day, InnoScience’s potential to become a dominant force in the fast-growing GaN market is promising but far from assured. While it enjoys technological leadership and a diversified business model, the path to profitability remains uncertain amid surging industry capacity and persistent pricing pressures. The ITC ruling appears to be an important step forward for the company, yet that won’t do anything to address the bigger competitive issues.

To subscribe to Bamboo Works weekly free newsletter, click here