Guoxia Tech banks on AI for energy storage boost

The supplier of energy management systems, trapped in a cycle of high revenues but low profits, has applied for an IPO to help fund its business development

Key Takeaways:

- The company’s turnover has surged in recent years on growing demand for intelligent systems to manage and store power

- But Guoxia’s profit margins have shrunk, and trade receivables have also ballooned, putting pressure on cash flow

Li Shih Ta

An intelligent battery system that can detect power or price fluctuations and decide when to charge or discharge. This proposition underpins an IPO pitch by China’s Guoxia Technology Co. Ltd.

The provider of AI-driven energy storage solutions has applied to list on the Hong Kong Stock Exchange, aiming to capitalize on booming demand for power management options in the commercial and industrial sectors.

Over the past five years, China’s new energy business has shifted its focus from generating photovoltaic (PV) power toward storing energy. As solar and wind have become an integral part of the power equation, balancing supply and demand while maintaining grid stability has become increasingly challenging.

Systems combining PV power and storage offer an answer. China’s new energy storage installations reached 31 gigawatt hours (GWh) in 2024 and are projected to soar to 424 GWh by 2030, a compound annual growth rate of 54.6%, according to data from China Insights Consultancy cited in the prospectus.

Responding to the trend, companies that once focused on PV or power inverters have pivoted to the storage market. Sungrow Power Supply (300274.SZ) and GoodWe Technologies (688390.SH) launched their own energy storage systems, while Pylon Technologies (688063.SH) has targeted battery cells and modules.

Meanwhile, Guoxia is aiming to carve out a niche with the help of artificial intelligence. In the IPO filing, AI was credited as giving Guoxia a differentiated edge. Proceeds from the IPO would be spent on strengthening the company’s AI capability and developing next-generation storage solutions, Guoxia said.

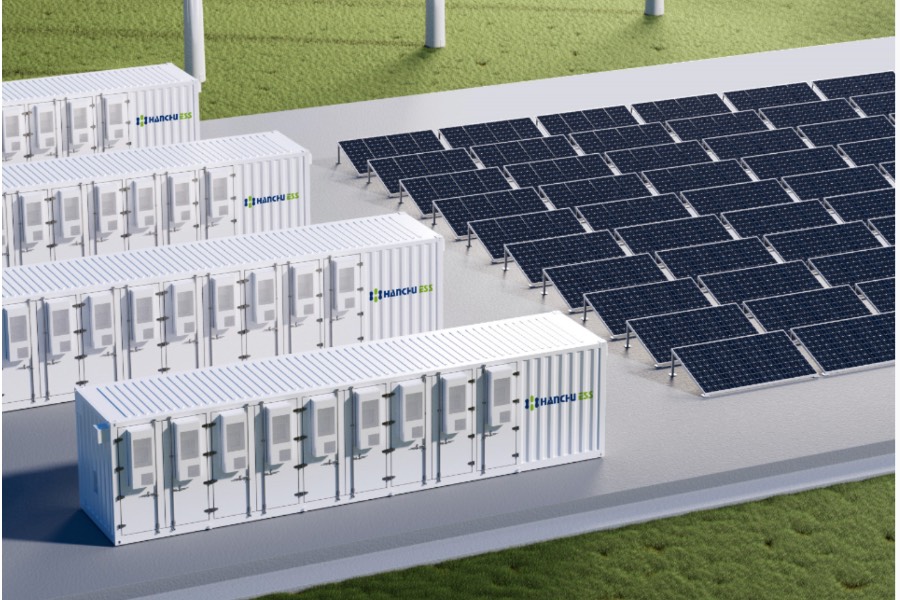

Founded in 2019, Guoxia positions itself between equipment manufacturers and energy service providers. It supplies battery modules for large-scale energy storage in commercial, industrial and residential settings using two proprietary platforms: the Safe Energy Storage System and the Hanchu Intelligent Energy Storage System.

These act as the battery’s “brain”, with cloud computing handling analysis and decisions while other devices execute real-time responses. When the grid load shifts or electricity prices fluctuate, the system can automatically adjust charging and discharging strategies, serving as a smart energy manager for large power stations, businesses or households.

Margins under pressure

The strategy has raked in revenue. Figures in the IPO documents show that turnover has skyrocketed over the last three years, climbing to 1.03 billion yuan ($144 million) in 2024 from 142 million yuan in 2022. In the first half of 2025 revenue reached 691 million yuan.

Annual net profits for the three years were 24.28 million yuan, 28.13 million yuan and 49.12 million yuan. Guoxia eked out a net profit of 5.58 million yuan in the first half of 2025, reversing a loss of 25.59 million yuan a year earlier, but its net profit margin stood at a mere 0.8%. Gross margins have deteriorated steadily, halving from 25.1% in 2022 to 12.5% in the first half of 2025.

A mix of factors including industry cycles, shifting product offerings and raw materials prices have compressed the margins.

At the same time, operating cash flow has been volatile. Net outflows of 30.32 million yuan in 2022 and 72.91 million yuan in 2023 were followed by an inflow of 3.73 million yuan in 2024, but the first half of this year saw a net outflow of 205 million yuan. At the mid-year point cash on hand stood at just 46.69 million yuan against short-term borrowings of 331 million yuan, indicating significant refinancing pressure.

Receivables risk

More troubling is the mountain of money that the business is owed by its customers. Trade receivables exploded from 41.59 million yuan in 2022 to 952 million yuan in the first half of 2025, ballooning from 29.32% of revenue to 137.8%, indicating that a substantial chunk of turnover exists only on paper. The average time taken to collect payments stretched from 56.7 days in 2022 to 198 days in the first half, pointing to intense operational strain.

This filing marks Guoxia’s second attempt at an IPO after an initial application in April lapsed. However, the company has already gained the necessary clearance from the China Securities Regulatory Commission to apply for a Hong Kong listing.

Guoxia has completed several financing rounds, getting cash this year from two investment funds. Kaibo Hongcheng put in 70 million yuan in March and Shenzhen Ningqian invested 30 million yuan in April, taking the firm’s valuation from 1.6 billion yuan to 6 billion yuan. Kaibo Hongcheng is controlled by CALB Group(3931.HK), a major supplier of power batteries and energy storage systems that has close ties to Guoxia.

CALB serves as both a battery cell supplier to Guoxia and a customer for its large-scale energy storage systems. Revenue from the CALB relationship accounted for approximately 22% of Guoxia’s total revenue in 2023. In March the following year the firms agreed to tighten their partnership through a strategic cooperation deal, according to the IPO application.

China’s energy storage sector has rebounded sharply this year. CALB’s stock has soared 168%, trading at more than 90 times earnings. Shares in battery giant Contemporary Amperex Technology (CATL)(3750.HK) have also surged since the stock’s Hong Kong debut earlier this year, while Sungrow and GoodWe shares listed in mainland China have risen roughly 50% and 30%, reflecting renewed market optimism about the energy storage business.

Despite this, Guoxia remains constrained by tight cash flow, shrinking margins and soaring receivables. While its AI platform is being integrated into various storage solutions, it has not generated standalone software revenue or emerged as a distinct growth driver. The company still relies heavily on sales of large-scale energy storage systems and battery modules, with profitability capped by volatile cell prices. Guoxia’s business breakthrough may have to wait until AI demonstrably starts to deliver benefits.

To subscribe to Bamboo Works weekly free newsletter, click here