FAST NEWS: Genscript’s controlling shareholder sells shares to Hillhouse Capital

The latest: Genscript Biotech Corp. (1548.HK) announced Wednesday its controlling shareholder Genscript Corp. will sell 85.78 million shares, or about 0.4% of its shares, to GNS II Holdings Ltd, a subsidiary of Hillhouse Capital, and promised not to reduce its stake for one year.

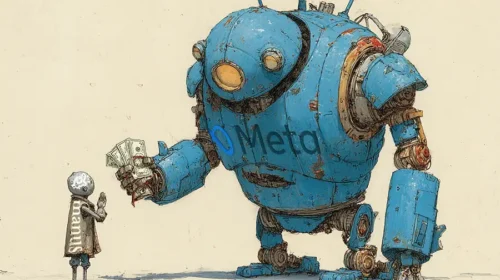

Looking up: Hillhouse Capital is one of the fund investment companies with the largest assets under management with outstanding performance in Asia. Its willingness to invest in Genscript may mean that its prospects are promising.

Take Note: The transfer of shares is priced at HK$18.2, a substantial discount of about 10.13% to yesterday’s closing price of HK$20.25, which may have a negative impact Genscript’s share price.

Digging Deeper: GenScript was established in 2002 and went public in Hong Kong in 2015. It bills itself as a platform biotech company with many sub-brands, including Legend Biotech, a cell therapy business independently listed in the U.S., which has been “burning money” for R&D projects in recent years and dragged down the financial performance of GenScript. However, with its product Carvykti approved by the U.S. Food and Drug Administration (FDA) for marketing in 2021, has brought in a significant amount of revenue for the parent company. In the first half of this year, the drug provided Genscript with approximately $110 million in revenue, accounting for nearly 28% of its total.

Market Reaction: Genscript’s shares rose in early Wednesday trading, and were up 2.5% at HK$20.75 by the midday break. The stock now trades near the lower end of its 52-week range.

Translation by A. Au

Have a great investment idea but don’t know how to spread the word? We can help! Contact us for more details.

To subscribe to Bamboo Works weekly free newsletter, click here