Creality builds up three-dimensional IPO with low-cost 3D printer story

The company has filed to list in Hong Kong, helping to build a mass market for 3D printers costing as little as $199 each

Key Takeaways:

- Hong Kong IPO candidate Creality has democratized 3D printing by reducing consumer printer prices from $4,000 and higher to as low as $199 over a decade

- The 3D printer maker generated an 89 million yuan profit last year despite operating with significantly lower margins than its Western peers

By Hugh Chen

The founding story of 3D printer maker Creality 3D Technology Co. is grounded in China’s love affair with cutting costs to the bone. The company’s four co-founders first met at a 3D trade show where they shared a common observation: the industry was dominated by expensive industrial-grade machines. Only one or two brands were making consumer-level products, most of those imported and relatively pricey at 30,000 ($4,178) to 40,000 yuan each.

Co-founder Liu Huilin later said in media interviews that such prohibitive prices motivated the four to establish their company in 2014 with a mission of making 3D printing technology truly accessible and affordable for consumers. Now, the company is trying to sell its printed-from-the-ground-up story to investors, applying last week for a Hong Kong IPO with its filing of a preliminary prospectus.

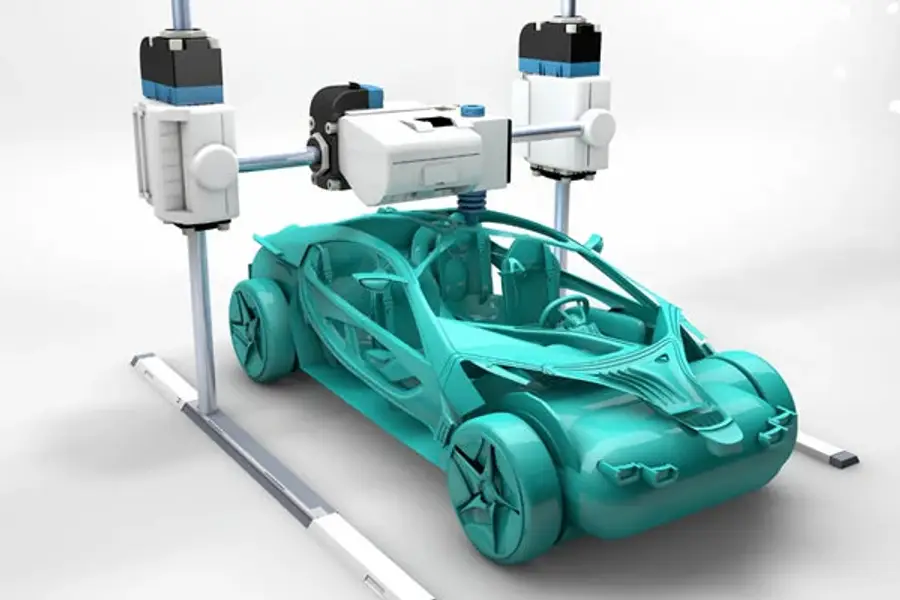

A decade after its founding, the company has largely brought its vision of “3D printers for the masses” to reality. Shenzhen-based Creality sells its printers for as little as $199 and has become one of the largest players in the global market for consumer-use 3D printers. Its ability to dramatically lower prices has helped democratize access to 3D printing technology, bringing it within reach of individual consumers, educators, and small businesses worldwide.

Creality’s preliminary prospectus shows it plans to raise fresh funds to advance its R&D capabilities while expanding further into overseas markets, which are already a major revenue source. While the company hasn’t disclosed a specific fundraising target, its selection of leading domestic investment bank CICC as the listing’s sole underwriter suggests the offering will be relatively large, perhaps raising up to $100 million or more.

Creality’s financial performance mirrors broader growth in the consumer 3D printing market. Its revenue nearly doubled from 1.3 billion yuan in 2022 to 2.3 billion yuan last year. The strong upward trajectory continued into 2025, with first-quarter revenue up 29% year-on-year to 708 million yuan, according to the listing document.

Top position contested

Creality’s products are competitively priced compared to similar Western offerings. Its 3D printers range from $199 to $1,499, though the company also offers a professional-grade series starting at $3,400. Such machines serve a diverse range of applications, used for everything from manufacturing lifestyle products like lamps and toys, to producing medical items such as dentures and dental molds.

The company’s ability to squeeze prices so low stems partly from China’s manufacturing prowess, giving Creality significant cost advantages over international rivals. The company has also benefited from substantial government support, with the Chinese government identifying 3D printing as a key strategic industry in its Made in China 2025 plan launched in 2015.

Government backing comes through various channels, including direct subsidies, tax exemptions and favorable policies such as subsidies for enterprises purchasing 3D printing technology. Such tactics are part of China’s broader industrial strategy to establish dominance in emerging technologies through coordinated state support. But such support has also raised objections from Western governments who complain it gives Chinese companies an unfair advantage, and often leads to the buildup of excess capacity.

The results of China’s campaign speak for themselves, with Chinese companies now dominating the entry-level segment for 3D printers. According to a Tom’s Hardware report in July citing data from research firm Mordor Intelligence, Chinese manufacturers held 95% of the market for entry-level 3D printers priced below $2,500 in 2024, giving them a lock on the market.

According to the Tom’s Hardware report, Creality is the largest vendor globally with 39% of the entry-level consumer segment. However, third-party research cited in Creality’s own prospectus is slightly different, positioning the company as the world’s second-largest player in 2024 with 16.9% of the consumer 3D printer market and 700,000 units shipped globally. The prospectus doesn’t specify the exact price range or market definition used for its “consumer 3D printer market” classification, which may explain the discrepancy.

Selling products at lower price points inevitably pressures profit margins – something Chinese companies have shown a great willingness to do over the years as they place heavier emphasis on gaining market share. Creality’s gross margin has ranged from 28.8% to 35.2% in the last three years, significantly below western counterparts such as U.S.-based Stratasys (SSYS.US), which posted a non-GAAP gross margin of 47.7% in its latest quarter.

Despite its lower margins, Creality remains profitable, generating 89 million yuan in net income last year and 82 million yuan in the first quarter of this year. Such figures demonstrate the company’s ability to stay profitable despite sacrificing its margins, reflecting strong operational efficiency and market demand.

However, Creality’s position as China’s consumer 3D printer leader faces increasing pressure from a growing roster of local competitors equally willing to sacrifice their margins, including Bambu Lab, Flashforge and Elegoo. While the company’s prospectus shows it ranked first in cumulative shipments from 2020 to 2024, single-year data reveals that Creality dropped to second place last year. That suggests the company’s growth has fallen behind some of its peers, signaling intensifying competition in a Chinese 3D printing market that could well become the next battlefield for a “race to the bottom.”

The company’s prospectus doesn’t directly name the 2024 market leader, but its description clearly points to Bambu Lab. This development is undoubtedly of concern to Creality, as Bambu Lab’s rapid ascension looks quite remarkable. Also based in Shenzhen, Bambu was founded only five years ago by former executives from DJI, the world’s largest drone maker, meaning the company is probably well connected in both the technology and investment realms.

Despite such competitive pressures, the 3D printing industry remains in its early stages with rapidly evolving technology. Creality sees significant growth potential ahead, citing third-party projections that consumer 3D printer shipments will more than triple from 4.1 million units in 2024 to 13.4 million by 2029, representing 26.6% annual growth over that time.

Stratasys currently trades at a relatively low price-to-sales (P/S) ratio of just 1.24, possibly reflecting concerns about the company after its revenue fell in the last two years and it continued to lose money. A similar multiple for Creality would give the company a relatively modest valuation of about $400 million, though investors would likely give it a higher multiple as a reward for its continuing strong revenue growth and profitability.

While Creality’s contribution to making 3D printing affordable is certainly commendable, such lower-priced models inevitably carry the lowest margins. Accordingly, potential investors will be watching closely to see whether the company can also compete more effectively in higher-priced models. Striking such a balance could help Creality to stand out in an increasingly crowded field.

To subscribe to Bamboo Works weekly free newsletter, click here