Hong Kong’s IPO rally under scrutiny, as ZTE hits new U.S. headwinds

Hong Kong's stock regulator has warned IPO underwriters over the declining qualiy of new listing applications. Is this a red flag for the city's booming IPO market, or just the usual regulatory caution? And the U.S. could fine telecoms equipment maker ZTE $1 billion for bribery in Brazil. Why does Washington think it can force ZTE to pay such a large amount?

Foreign firms face China’s cutthroat competition, while AI threatens knowledge platform Zhihu

A new survey is showing foreign investors in China are most concerned about cutthroat competition from Chinese rivals rather than the traditional concerns over market access. What's behind this changing mindset? And Q&A knowledge-sharing site Zhihu is facing an existential challenge from AI. How can the company compete in the face of such a big threat?

A Chinese EV giant’s financing reckoning, and a stockbroker’s commodities pivot

China's central bank is shutting down an IOU system used by BYD to pay its suppliers. Why is it taking this step? And revenue for a stock broker called GoFintech has soared more than 40-fold after it entered the commodities trading business. How should investors look at such a move?

Harrods retreats from Shanghai as private colleges face degree of reckoning

British retailer Harrods is pulling out of China, just five years after launching its luxury lifestyle brand in the market. Why is it leaving, and are other luxury brands going to follow? And university campus operator XJ International has been selling assets as college education loses its luster. Why are less Chinese interested in such secondary education these days?

Yum China turns to new concepts, diversified markets in accelerated growth roadmap

The operator of KFC and Pizza Hut restaurants in China aims to operate 30,000 stores by 2030, up more than 70% from current levels, it said at its recent investor…

Luckin Coffee eyes global leap as China’s Double 11 loses its luster

Luckin could be preparing a bid for Costa Coffee. What's driving this potential deal, and what are its chances for success? And this year's Double 11 festival looks like a dud, with most big e-commerce companies failing to publish any big numbers. What does the future hold for this fast-fading shopping fest?

China’s corporate pivots: Alibaba’s food delivery gambit and WuXi AppTec’s geopolitical hedge

Alibaba will retire the Ele.me takeout dining brand and merge it with its newer Taobao Instant Commerce. What's driving the move? And WuXi AppTec is the latest Chinese major to jump on the Middle Eastern bandwagon, with plans to potentially open a new center in Saudi Arabia. Why are a growing number of Chinese companies taking the Middle Eastern plunge?

From classroom crackdowns to shifting cabin crews, China adapts to new realities

Vocational educator Hiducation has become one of the few education companies to test the waters in Hong Kong's booming IPO market. Are investors ready to welcome this group again after a bloody crackdown three years ago? And budget carrier Spring Air is rolling out the welcome mat for more senior flight attendants as old as 40. Are other Asian airlines like to follow this "air auntie" trend, and what's behind it?

From green energy to property woes, China turns to financial engineering

Solar and wind farm builder Xinte announces plans to start collateralizing its assets using asset backed securities. And China International Travel is spinning off its real estate business.

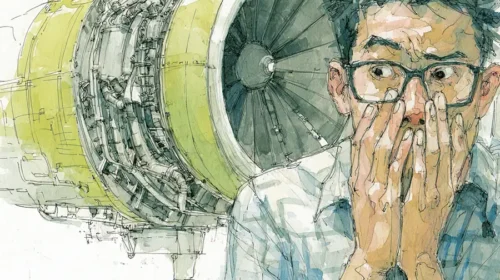

From software to the skies, China’s self-sufficiency drive meets economic reality

A key government document on rare earths was created using homegrown Chinese word processing software. And China's homegrown C919 regional jet has suffered a setback.

China bets big on stocks as consumers fret over pre-made food

Team China has pumped $550 billion into the country's two main stock markets, buying up nearly 5% of the market value of all listed companies. What's the thinking behind this strategy? And pre-made foods are in the spotlight after a popular blogger criticized a major restaurant chain for using such products. Why is this such a sensitive subject in China?

Nasdaq gets tough on small Chinese IPOs, as an AI-fueled energy storage boom takes off

For a market that basically prides itself on protecting investors… I have to say I'm amazed that it has taken so long.