AI powers Agora back to revenue growth

The maker of real-time engagement technology is benefitting from new demand for products like real-time online virtual tutors and talking toys

Key Takeaways:

- Agora reported a slight revenue increase in the first quarter, as it returned to growth after three years of declines

- The maker of real-time engagement technology said it is actively investing in “promising areas” such as conversational AI that can power virtual tutors and call centers

By Doug Young

Could the AI era finally return long-neglected real-time engagement technology company Agora Inc. (API.US) to some of its former glory? The jury is still out on that question, but the company’s latest financial results and executive comments on its earnings call certainly contain some encouraging signs.

The actual results are noteworthy for including a net profit – only the second quarter in the black for the company since 2021. The report also shows the company’s revenue grew year-on-year during the quarter, albeit by a very modest 0.8%. Still, that’s a big accomplishment for a company whose revenue has been steadily contracting over the last four years, after one of its major customer groups in China was hit by a major industry crackdown.

Agora also recorded one of its strongest gross margins in recent years, following the retirement last year of one of its lower-margin businesses connected to the education sector.

Somewhat ironically, the same education sector that brought Agora so much suffering over the last three years now appears to be one of the engines driving its recovery. The company briefly became an investor darling in early 2021 when its stock shot above the $100 level, five times its $20 IPO price, due to its relationship as a key technology supplier to voice chatroom operator Clubhouse. But the stock has tanked since then, and mostly trades in the $3 to $6 range.

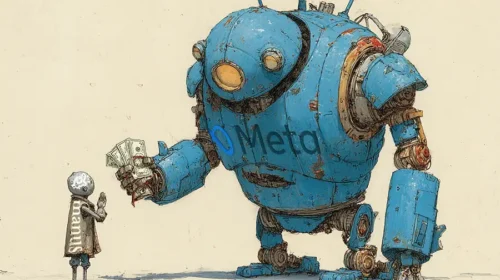

After the Clubhouse effect faded, Agora suffered a more serious setback when China banned private companies from providing after-school tutoring services to K-12 students in 2021. Such tutoring service providers were one of Agora’s largest customer groups, and its China-based service, called Shengwang, has been shrinking ever since.

But now education is making a comeback on the back of a new generation of voice-based virtual tutors who can provide advice and coaching in real time using AI-powered tools that Agora is developing. Education is just one of several applications where Agora is developing such voice-based tools, with others including shopping and toys that can engage with children in real time, as well as call centers.

“Our continued profitability and solid cash position enable us to proactively invest in promising areas, particularly conversational AI,” Agora founder and Chairman Tony Zhao said on the company’s earnings call. “Since launching our conversational AI engine in March, we’ve seen significant interest from developers and customers building voice agents for use cases from companion toys to language tutoring.”

Zhao added that as Agora’s momentum continues, he was confident it would be able to maintain its profitability for the rest of the year.

While that all sounds good, investors weren’t particularly impressed by the latest report and the potential of AI to return Agora to its headier revenue growth of earlier years. The stock barely budged in the two trading days after the earnings announcement, and is down about 10% so far this year. That said, it has also nearly doubled since last September, joining a rally for U.S.- and Hong Kong-listed Chinese stocks. Agora is actually based in the U.S., but has strong ties to China, which supplies about half of its revenue.

Return to revenue growth

Next, we’ll take a deeper dive into some of the financials that show how the company is finally turning around after three difficult years. Agora’s revenue rose slightly to $33.3 million in the latest quarter from $33 million a year earlier. That marked only the second quarter of revenue growth since 2021, when the company was posting strong double-digit gains during an earlier period of strong interest in its technology. Excluding revenue from some discontinued low-margin products last year, the first-quarter revenue growth would have been higher at 12%.

The company forecast second-quarter revenue of $33 million to $35 million, which could extend its recent growth streak at the top of that range, from $34.2 million in the year-ago period.

Agora divides its revenue into two major sources, its Shengwang service for China, and its service for the rest of the world, which it calls Agora. The latter service has been growing consistently over the last three years, though at less-than-spectacular rates, mostly in the single-digit and low double-digit range. Shengwang has been contracting for the last three years as a result of the education crackdown.

Those trends continued in the first quarter, though revenue for the Agora service picked up a bit and rose 18% year-on-year to $18.6 million. Shengwang continued to contract, down 14% year-on-year to 105.5 million yuan ($14.7 million). But excluding the contribution of discontinued low-margin products in the year-ago period, Shengwang’s revenue rose 6.7% in the latest quarter.

Shengwang also reported a 5.2% rise in active customers in the latest quarter, reversing mostly declines for that metric over the last few years. Its customer retention rate also ticked up to 85%, for the trailing 12 months, improving from rates mostly in the 70% to 80% range in recent reports. The Agora service has always had much better customers loyalty, with retention rates above 90%.

As it discarded its lower-margin business and began to generate business from its new generation of AI-based products, the company’s gross margin rose to 68.0%, up from 61.2% a year earlier and better than its gross margins that have generally stayed in the 60% to 65% range in recent years.

All those improvements, combined with a 20% drop in operating costs, helped the company to log a modest net profit of $400,000 for the quarter, reversing a $9.5 million loss a year ago and also improving from its $200,000 profit in last year’s fourth quarter.

Following the rally since last September, Agora’s stock now trades at a price-to-sales (P/S) ratio of 2.66. That’s about half the 4.14 for U.S. rival Twilio (TWLO.US), but well ahead of the 0.76 for Chinese rival Goertek (002241.SZ). Generally speaking, we tend to be cautious about companies that hype the big potential of AI to boost their business. But Agora really does look like a company that could benefit significantly from the trend if companies embrace its new generation of products that enable things like AI-generated virtual tutors and talking toys.

To subscribe to Bamboo Works free weekly newsletter, click here