WUS Printed Circuit charges up Hong Kong’s growing tech pool

The leading PCB maker has filed for a second listing in Hong Kong, reporting strong revenue growth as it focuses on the markets for AI servers and smart cars

Key Takeaways:

- WUS Printed Circuit has filed for a Hong Kong IPO to complement its existing Shenzhen listing, just a week after rival Dongshan Precision made a similar filing

- WUS’ revenue grew 57% in the first half of 2025, while its profit rose 49%, as it boasts enviable gross margins due to its focus on the higher end of the PCB market

By Doug Young

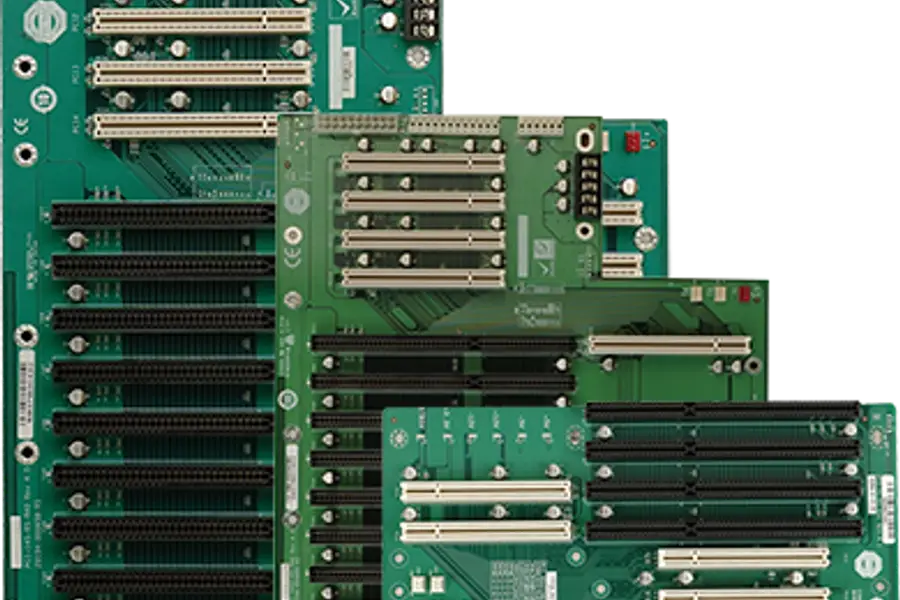

The race is on to see who can become Hong Kong’s first major listed maker of the printed circuit boards (PCBs) at the core of everything from consumer electronics to smart cars and cutting-edge servers used for AI computing.

Just a week after one of its top rivals filed for a Hong Kong IPO, WUS Printed Circuit (Kunshan) Co. Ltd. (002463.SZ) submitted its own application for a similar listing. Both WUS and that rival, Suzhou Dongshan Precision Manufacturing (002384.SZ),come from the same industry, and are already listed in Shenzhen. Both are also following a recent trend by companies already listed on China’s domestically focused A-share markets to raise new funds by tapping more globally focused investors in Hong Kong.

But the similarities end there, as this pair of companies offer two very different stories. WUS is squarely focused on the road ahead, seeing a future in PCBs used in smart vehicles and AI-based applications. By comparison, Dongshan Precision focuses on the far more mature consumer electronics space, making PCBs for smartphones and PCs. And while WUS has grown organically since its founding in 1992, Dongshan Precision started out as a sheet metal producer and has grown mostly through acquisitions since then.

As a result of those differences, WUS’ core PCB business is growing far faster than Dongshan’s. We wrote about Dongshan in more detail last week after its filing, so this week we’ll spend some time on the newer filing from WUS.

The company began from its base in the city of Kunshan, about an hour from Shanghai and known for its high concentration of Taiwan-owned manufacturers focused on electronics and electronic components. From its original two facilities in Kunshan, it added a third in the city of Huangshi in 2014.

But the two most interesting of its five facilities are its latest additions, one in the city of Jintan, also in Jiangsu province where WUS is based, and its most recent in Thailand. The Jintan production base was set up in 2017 as a joint venture with Germany’s Schweizer Electronic (SCE.DE) to make PCBs for smart vehicles, and was gradually bought out by WUS after that, though Schweizer may retain a small stake.

The Thai facility is WUS’ latest production base, set up in 2022 and starting production in 2024, with a current registered capital of 6.49 billion baht ($203 million). That facility focuses on WUS’ most advanced products, namely PCBs for use in high-speed network switches and routers and AI servers, as well as PCBs used in smart vehicles. The facility is part of a broader global diversification drive by many Chinese manufacturers seeking hedges against growing protective measures by the U.S. and other countries targeting products made in China.

WUS says it began exiting the market for consumer electronics-use PCBs back in 2007, and around the same time began to focus on less competitive areas with higher growth potential, including smart cars and data communications. It says it’s now the world’s largest maker of PCBs for use in data centers, with 10.3% of the market for the 18 months through June this year, citing third-party market data in the listing document. It’s also the leader for high-end HDI PCBs used in driving domain controllers for level 2 (L2) and above autonomous driving, with 15.2% of the market.

Rapid growth

Its focus on such high-growth areas has rewarded WUS with impressive growth, unlike the much slower growth for Dongshan Precision and other rivals in more mature areas. WUS’ revenue rose 57% year-on-year in the first half of 2025 to 8.49 billion yuan ($1.2 billion) from 5.42 billion yuan in the year-ago period, extending similarly strong 49% growth for all of 2024.

Within its revenue pie, PCBs for data communications are the clear superstar, growing 71% year-on-year to 6.53 billion yuan in the first half of 2025 to make up more than three-quarters of the total. Smart vehicle PCB revenue grew at a slower but still healthy 23% year-on-year in the first half of the year to 1.42 billion yuan, accounting for 16.7% of the total.

The company points out that sales of the most advanced PCBs with 22 or more layers now account for more than half of its total revenue, making up 54% of the total in the first half of this year.

Its focus on the higher end of the market has given WUS enviable margins among its peers. The company’s gross margin has risen steadily over the last three years, climbing from 27.9% in 2022 to 32.3% in the first half of this year. To put that in perspective, U.S. manufacturer Flex Ltd. (FLEX.US) had a gross margin of just 8.9% for the last 12 months, while Dongshan Precision’s stood at just 14.3%. Chinese rival Shennan Circuits (002916.SZ) was a bit better at 25%, while only Victory Giant (300476.SZ), at 31.6%, bested WUS.

In terms of valuation, most of these companies are surprisingly close in terms of forward price-to-earnings (P/E) ratios. WUS’ Shenzhen-listed shares currently trade at a forward P/E multiple of 18, following an 80% jump for the stock this year. That’s slightly ahead of the 17 for Dongshan Precision and Victory Giant, and 16 for Flex, though Shennan is sharply higher at 28.

WUS’ bottom line also looks quite attractive, with the company’s profit up 49% year-on-year in the first half of 2025 to 1.68 billion from 1.14 billion yuan a year earlier. It’s also quite the cash-generating machine, with its cash rising to 2.74 billion yuan from 1.54 billion yuan. So, the company clearly has no immediate need for the cash it would raise from the Hong Kong IPO, though it could use the funds to increase capacity at the Thai facility and also scout for other locations outside China.

Given a choice, it’s hard to see why investors would prefer Dongshan Precision over the more focused and cutting edge and faster-growing WUS. But either way, the latest IPOs will offer two important new choices among a growing number of China tech plays available to global investors through the Hong Kong Stock Exchange.

To subscribe to Bamboo Works weekly free newsletter, click here