NEWS WRAP: Seyond sued by rival ahead of Hong Kong SPAC listing

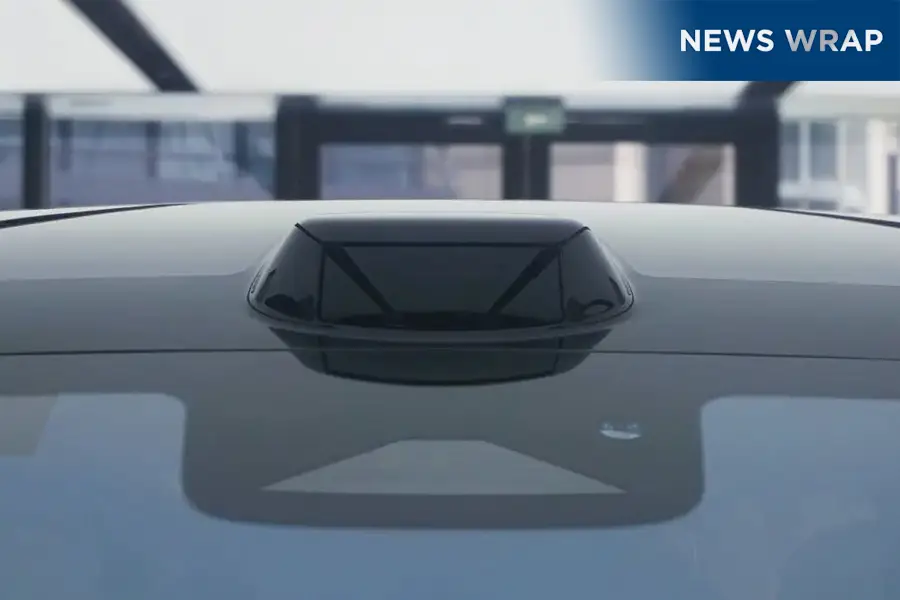

The lawsuit claims Seyond’s long-range Robin E1X closely resembles Hesai’s AT series LiDAR sensors in both product design and system architecture

By Teri Yu

Autonomous driving technology company Seyond Holdings was sued on Tuesday by rival Hesai Group (HSAI.US; 2525.HK), which alleged patent infringement involving one of its core products using light detection and ranging (LiDAR) technology. The action was filed in East China’s Zhejiang province with the Ningbo Intermediate People’s Court, which officially accepted the case, according to local Chinese media, citing unnamed sources.

According to people familiar with the case, Hesai alleges that Seyond’s Robin E1X long-range compact sensor, which the company showcased at the Consumer Electronics Show (CES) this year in Las Vegas, bears a striking resemblance to Hesai’s own AT series LiDAR. Chinese media Future Auto Review reported that Seyond historically used a 1550 nm wavelength architecture in its major products, including the Falcon series, but the company shifted to a 905 nm wavelength architecture more recently, similar what Hesai uses. Seyond had not previously produced 905 nm lidar products, the media noted.

The AT series, a mature product line launched by Hesai Technology in 2021 and mass-produced in 2022, has already shipped 1 million units. The company filed related patents as early as 2017. Hesai’s ATX is one of the best-selling LiDARs on the market, securing design wins with a large number of leading Chinese auto brands.

Seyond is also in the process of going public, announcing in December last year that it plans to list in Hong Kong through a merger with special purpose acquisition company (SPAC) TechStar Acquisition Corp. The new lawsuit casts a shadow over that listing plan, which was approved by China’s securities regulator earlier this month.

Seyond was founded in 2016 and is based in Silicon Valley with R&D centers in Shanghai and Suzhou, where it also has a manufacturing base. According to a TechStar filing detailing Seyond’s business, 85.6% of Seyond’s revenue in the first quarter of this year came from a single OEM customer.

In TechStar’s latest filing with the Hong Kong Stock Exchange in August, Seyond listed the Robin E1X as one of its latest long-range LiDAR products, with a maximum detection range of 250 meters. It describes the Robin series as its “mid-range compact LiDAR solutions targeting urban low-to-medium speed application scenarios,” with products from the latest Robin E line set for mass production this year.

Seyond reported $25.3 million in revenue in the first quarter of this year, down 3.4% year-on-year, with 92% of that coming from its Falcon series. It lost $14.8 million during the quarter, narrowing from a $40.4 million loss a year earlier, as its gross margin turned positive. According to the August filing, private investment in public equity (PIPE) investors have agreed to provide an additional HK$551 million ($71 million) in net proceeds to TechStar by purchasing its shares concurrent with the de-SPAC merger that would make Seyond a listed company.

The Bamboo Works offers a wide-ranging mix of coverage on U.S.- and Hong Kong-listed Chinese companies, including some sponsored content. For additional queries, including questions on individual articles, please contact us by clicking here.

To subscribe to Bamboo Works free weekly newsletter, click here