Everdisplay’s cash hunger in focus with new Hong Kong IPO application

The maker of AMOLED displays has renewed its filing to list in Hong Kong, following its application’s approval earlier this month by China’s securities regulator

Key Takeaways:

- Everdisplay is seeking funds from a Hong Kong IPO as it prepares to make the transition to flexible AMOLED displays

- The company has posted steady revenue growth in the last three years, but is also losing big money as its production costs exceed revenue

By Hugh Chen

China’s strategy for dominating different manufacturing sectors — from solar panels to electric vehicles — follows a familiar playbook. The government leads massive investment that sustains ventures through extended periods of losses, as capacity buildups outpace demand on the expectation that profits will follow one day after the market catches up.

The model applies not only to emerging sectors, but also older ones like display panels, which are constantly cycling through new technologies since the industry’s earliest days of LEDs and LCDs. China has used its strategy to catch up with South Korea’s market leadership, and is now home to some of the sector’s biggest players like BOE (000725.SZ), a government-backed project that sustained losses for nearly two decades before finally achieving profitability.

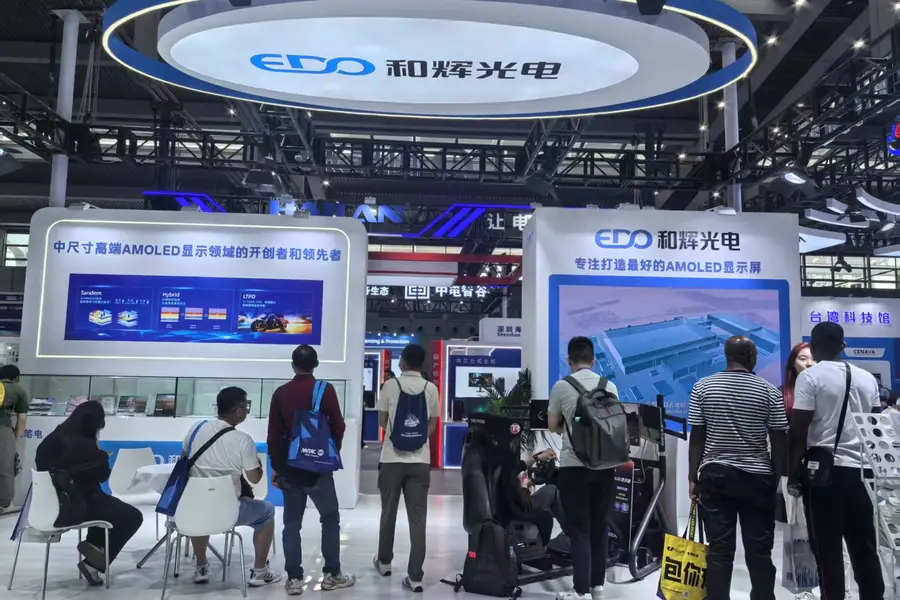

Another company still in an earlier phase of that development cycle is the money-losing Everdisplay Optronics (Shanghai) Co. Ltd. (688538.SH), which is already listed in Shanghai and is now turning to the more globally focused Hong Kong in search of fresh funds with its IPO application last week. The filing represents the company’s renewal of an earlier application in April, which lapsed after Everdisplay failed to complete the deal before a six-month deadline.

The company was established in 2012 as a state-controlled enterprise under the Shanghai goverment’s State-owned Assets Supervision and Administration Commission, tasked with breaking into the foreign-dominated space for AMOLED technology, an emerging display technology at the time. More than a decade later, many might consider Everdisplay a partial success, having achieved its original goal of establishing a footprint in the AMOLED display market. However, unlike BOE, the company remains profit-challenged and is displaying no signals to investors for when it might make money.

Everdisplay’s pursuit of a second listing follows a wave of other Chinese firms listed in the domestically focused Shanghai and Shenzhen markets seeking exposure to more global investors. Everdisplay has selected leading Chinese investment bank CICC as its underwriter, indicating the offering should be substantial – if it can complete the listing this time.

Its status as a state-backed player in a strategic sector means the company is almost guaranteed to get strong government support for the listing, and, indeed, the Chinese securities regulator gave its approval for the IPO earlier this month. Now, Everdisplay needs to convince Hong Kong investors, who may want to see a clearer road to profitability.

Before we examine the company’s operations and business, we’ll start with some quick background on the key display technology central to Everdisplay’s story. AMOLED, or active-matrix organic light emitting diodes, is a major type of OLED where each pixel generates its own light using organic compounds.

Compared to earlier generations of LCD and LED displays, AMOLED eliminates the need for energy-consuming backlighting, enabling true black colors, higher contrast, and significantly thinner screens. This technology has become the premium choice for smartphones and high-end devices, with flexible AMOLED now allowing manufacturers to create curved and foldable displays that have become popular and were impossible with previous technologies.

Mounting losses

Everdisplay’s success in AMOLED is supported by market data. The company has made particular inroads in the medium- to large-size segment for devices like tablets and laptops, where it held 14.5% of the global market by sales volume last year. That made it the third-largest player globally for that segment and the leading player in China, according to third-party research cited in its prospectus.

The company now counts leading smartphone brands such as Honor and Transsion, as well as automotive companies, as its clients. This growth is reflected in its financials, with revenue doubling to 4.96 billion yuan ($697 million) in 2024 from 2.5 billion yuan in 2020. The growth continued this year, albeit at a less dazzling pace, as the figure rose 12% year-on-year to 2.67 billion yuan in the first half of 2025, according to its prospectus.

Such expansion has naturally required massive capacity expansion and heavy investment in R&D. Everdisplay currently operates two production lines: its first 4.5-generation AMOLED line launched in 2012, and a second 6th-generation line that began construction in 2016. Such lines are quite expensive, exemplified by the estimated cost of 27.3 billion yuan for the 6th-generation AMOLED line, according to local media reports.

Everdisplay has consistently lost money, with its cost of revenue exceeding its actual revenue every year since 2022, the earliest year in its prospectus. That means it loses money before even accounting for other expenses — a reflection of the substantial depreciation costs that come with such massive capital expenditure. For the first six months of this year, it reported a gross loss of 395 million yuan and net loss of 840 million yuan.

The company has highlighted the increasing penetration of AMOLED technology in the broader display market, citing third-party research in its prospectus that projects that segment will command 35.8% of the overall market by 2030, up from 29.2% in 2024.

While Everdisplay has performed well in the medium- to large-size segment, it has lagged in the smartphone space, ranking seventh with only 3.7% of global volume. That’s an important shortfall, since smartphones arguably represent the largest segment where AMOLED penetration will grow.

Everdisplay’s failure to capture significant market share in smartphone displays owes largely to its lack of investment and capabilities in flexible AMOLEDs, which have become increasingly popular. Most major smartphone brands currently sell models with foldable screens. The notable exception is Apple, though rumors frequently pop up saying the iPhone maker is experimenting with the technology.

Everdisplay has largely focused on rigid AMOLED displays, which are primarily used for larger screens in devices like laptops. As part of its catch-up strategy, the company has been promoting a “rigid-flexible combination” approach since this year, centered on manufacturing both products according to different customer specifications. Local media reported that its 6th-generation production line is already capable of producing small volumes of flexible AMOLED displays for smartphones.

Such a move to flexible AMOLEDs looks like the right step toward growing its business and achieving eventual profitability, as this segment is currently experiencing the strongest demand. According to research firm Omdia, flexible AMOLED display models accounted for 51% of smartphone shipments in the first quarter of 2025, reaching 151 million units with 15% year-over-year growth. This growth trend has continued for three years, with annual growth rates consistently around 20%.

But such a move will require huge investment, since Everdisplay has relatively little expertise in the area. That could worsen its financial position in the near term, pushing profitability even further into the distance. The company needs to balance any such expansion with fiscal discipline to convince investors of its long-term chances for success. A successful IPO now is something it sorely needs to fund its technological transition while giving it the financial flexibility to navigate an increasingly competitive display market.

To subscribe to Bamboo Works weekly free newsletter, click here