Dancing robot sensation Unitree boogeys towards IPO

The company behind the dancing humanoids that wowed viewers on China’s Lunar New Year’s Eve Gala plans to take its act to the capital markets by year end

Key Takeaways:

- Unitree plans to file to list on an unspecified stock exchange by the end of this year, saying its annual revenue exceeded 1 billion yuan

- Despite buzz around its humanoid robots, the widespread deployment of such products could still be several years away due to inconsistent performance

By Hugh Chen

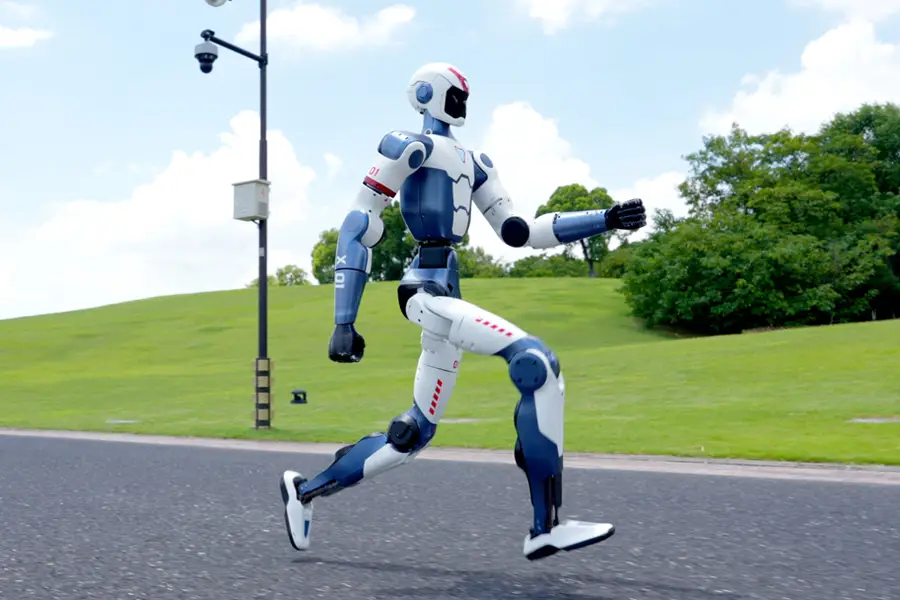

Chinese startup Unitree Robotics has become a star on the emerging humanoid robot stage over the past two years, after a dancing performance by its products on China’s widely watched Lunar New Year’s Eve Gala went viral in January. The company vaulted to additional fame at the inaugural World Humanoid Robot Games in Beijing last month, where it dominated nearly every racing event, including the 100-meter obstacle race, the 4×100 meter relay, and the 1,500 meter race. Unitree was also the star of boxing, providing all the models for those competitions as its rivals could only watch.

Seizing on the heightened attention, the company now plans to take its rising star to the capital markets, announcing last week that it intends to file for an IPO on an unspecified stock exchange by the end of this year. The pronouncement officially confirms months of media speculation about such a listing, with Reuters reporting Unitree is aiming for an IPO valuation of $7 billion.

Such a listing would mark a major milestone for Unitree, which undoubtedly needs additional capital as it ramps up its product development and commercialization efforts. It will also serve as a test case about investor appetite for China’s vibrant humanoid robot industry — a sector that has received heavy government support as Beijing seeks to lead this emerging field amid its intensifying rivalry with the U.S.

Hangzhou-based Unitree was founded by Wang Xingxing, a tech enthusiast known for his longtime passion for mechanics and inventing things. Wang famously built a bipedal robot by hand for just 200 yuan, or about $30. He earned a reputation as a tech fanatic during his university years, known for his dorm room filled with tools and countless scars on his hands testifying to the inevitable accidents that occurred as he crafted precision parts from scraps. Representing a younger generation of startup founders after earlier pioneers like Alibaba’s Jack Ma, Wang briefly worked at drone maker DJI for two months after graduating in 2016 before founding Unitree the same year.

Wang’s passion has also made him popular among local financiers. Since its establishment, Unitree has completed 10 funding rounds, attracting an impressive roster of domestic backers including Shunwei Capital, Chuxin Capital, Citic Securities, Shenzhen Capital Group and HongShan, formerly known as Sequoia China. Local media reports say the company’s latest valuation ranges between 10 billion ($1.4 billion) and 15 billion yuan – just a third or less of the $6 billion valuation the company is reportedly seeking.

Falling prices

While Unitree is famous for its humanoid robots, it currently generates the majority of its revenue from robot dogs — its initial focus before expanding into humanoids. The company has released only limited data about its finances, though it has said it will provide more later this year. In one of its few publicly disclosed data points, the company said at the time of its IPO announcement last week that 65% of its 2024 revenue came from robot dogs, while 30% came from humanoid robots, and the remaining 5% was for accessories.

At an event in June, Wang told local media that the company’s annual revenue had exceeded 1 billion yuan, though he did not specify a year.

Unitree released its first humanoid robot, the H1, in 2023, which became China’s first full-sized general-purpose humanoid robot capable of the complex action of running. The company dramatically reduced its costs in its next generation, with the H1 line released in 2024 carrying a price tag starting at 99,000 yuan. Its R1 model, released in July, is even more affordable with a starting price of 39,000 yuan.

This pricing stands in stark contrast to much higher prices among Western peers. Morgan Stanley Research estimates that the cost of the most sophisticated humanoid robots in 2024 was around $200,000.

Unitree’s ability to offer products at such low prices owes largely to leveraging China’s strong manufacturing ecosystem. China already has established firms producing many of the components that go into humanoid robots, from batteries to sensors and reducers, allowing companies like Unitree to rapidly scale production while controlling costs.

Massive government support has also provided a big boost, as part of a concerted top-down effort to advance the industry’s development. Such support comes in various forms, including subsidies, tax breaks and cheap financing.

Partly as a result of such government support, the number of Chinese players focused on humanoid robots now runs into the thousands, with a long list of names including Agibot, Noetix Robotics, and Lingyi Lingyue, just to name a few. Additionally, almost every major tech and manufacturing firm is in the business or has invested in the technology — from internet giant Alibaba (BABA.US; 9988.HK) to automaker BYD (1211.HK; 002594.SZ).

While Unitree has been among the most successful at reducing costs and producing at scale, its competitors are pursuing equally aggressive pricing strategies. Many of those are selling equivalent products at similar prices to the H1, including Booster Robotics, which sells its K1 robot for 88,000 yuan. And prices are likely to keep falling, in a typical pattern of “involution” or a “race to the bottom” for many of China’s overcrowded emerging high-tech industries.

Analysts have published reports predicting huge potential for companies in the humanoid robotics space. Equity research firm Macquarie said in a February report that the global market for such robots will explode from $3.6 billion in 2026 to $51.6 billion in 2031.

But such bold predictions could lack foundation in the short-term, based on underwhelming media reports saying models at the Humanoid Robot Games varied widely in performance, with tumbles and crashes occurring frequently. While robots may excel at running and boxing in controlled and highly staged environments like the Lunar New Year’s Eve Gala, they may still struggle to perform such basic tasks as picking up objects in more realistic everyday settings.

Robotic stocks have been hot in Hong Kong lately, meaning Unitree’s listing is almost certain to attract strong attention, especially at the right valuation. Shares of Ubtech Robotics (9880.HK) currently trade at an inflated price-to-sales (P/S) ratio of 30, while Dobot (2432.HK) trades even higher at 47, showing investors believe these companies have a strong future.

That’s good for Unitree and its peers, which probably still have a long way to go to create humanoid robots that can perform more useful tasks in settings like households and factories. Some products have shown positive signs — 20% of Unitree’s robot dogs are now being used in industrial applications such as inspections and firefighting. Now, the company needs to show its humanoid robots can do more than just dance and run, moving them beyond the laboratory into more practical mass-use settings.

To subscribe to Bamboo Works weekly free newsletter, click here