Aux Electric blows into Hong Kong with IPO application

The air conditioner maker’s low-price strategy has helped it win customers in China, while its OEM model has won over customers abroad

Key Takeaways:

- Aux Electric achieved 20% revenue growth in 2024, outpacing rivals using a low-price strategy at home and OEM model overseas

- The air conditioner maker’s low-price strategy has won it market share, but has also resulted in quality concerns and significantly lower profit margins than its peers

By Hugh Chen

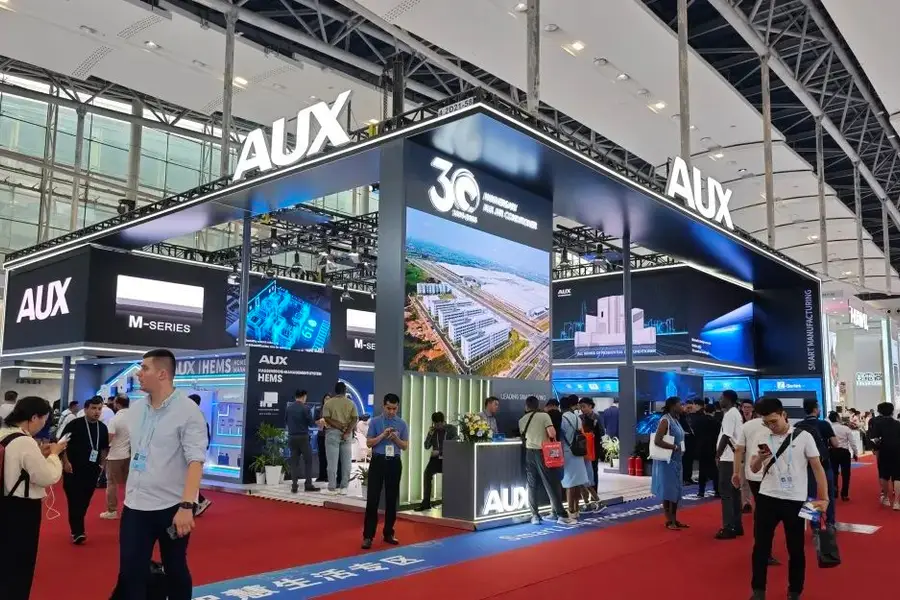

The founder of air conditioner maker Aux Electric Co. is an Ox on the Chinese zodiac. That explains why Zheng Jianjiang chose to name his company Aux when he founded it more than three decades ago, choosing a rough homophone for Ox. The name signaled Zheng’s ambition to imbue his company with traits of the Ox, including perseverance, audacity, and patience, according to Chinese tradition.

Such efforts may finally be bearing fruit as Zheng attempts to take his company public, offering investors a different type of air conditioner maker from several better-known larger rivals that are already listed. Last week, the company filed an updated IPO listing document with the Hong Kong Stock Exchange, as its plan was also approved by China’s securities regulator, marking two major milestones for the listing.

The Hong Kong IPO plan is the latest twist in the company’s tortuous journey to the capital markets. Aux first listed on China’s thinly traded “New Third Board” in Beijing nearly a decade ago in 2016. But it delisted just a year later, partly due to thin liquidity and limited financing potential for companies listed in that market.

It then shifted its focus to China’s more mainstream A-share market, planning to list on the Shanghai Stock Exchange. It kicked off that process in 2018, and in June 2023 finally completed an IPO counseling stage necessary for all listing candidates. But after completing that process, Aux shifted gears and set its sights on Hong Kong, filing its first application with the Hong Kong Stock Exchange in January this year. That application expired after six months, prompting the company to make its latest updated resubmission.

Aux has hired leading domestic investment bank CICC as its exclusive sponsor, indicating the listing should be relatively large, likely to raise up to $100 million or more.

Price advantage strategy

Aux is known for its aggressive low-pricing, credited as the force behind China’s widely publicized air conditioner price wars in the early 2000s, as machine-cooled homes began to gain traction. In 2001, the company launched the provocative slogan “Dependable quality is the father, affordable pricing is the mother,” as documented by local media.

The following year, Aux published a white paper breaking down one of its models to show its production costs. It used such analysis to accuse its competitors of overcharging, and then announced its own price cuts of 30% or more across its entire line of more than 40 products.

This strategy proved ruthless and effective. At a time when most air conditioners were priced around 3,500 yuan, or nearly $500, Aux’s were often below 3,000 yuan. The strategy caught its competitors off guard, and positive consumer response established Aux’s reputation overnight.

The company’s relentless use of low prices has helped it establish itself as an affordable option, even if it hasn’t challenged the dominance of China’s three major players — Midea (0300.HK; 000333.SZ), Gree (000651.SZ) and Haier (6690.HK). According to research firm All View Cloud, air conditioner prices in China averaged 2,775 yuan online and 4,306 yuan at brick-and-mortar stores in 2024. Aux’s online average price of just 2,207 yuan was the lowest among the top five manufacturers, while its offline average price was only 2,982 yuan.

The low-price strategy is serving the company well in China’s current economic slowdown that has made consumers more price sensitive.

Still, Aux’s revenue remains a fraction of giants like Haier and Gree, totaling 29.8 billion yuan ($4.15 billion) last year, or less than one-tenth of Haier’s 401.6 billion yuan. Aux’s revenue grew 20% year-on-year in 2024, more than double Haier’s 8% and Midea’s 9.4%, while Gree’s revenue declined 7% for the year. That growth rate accelerated slightly in the first quarter of this year, as Aux’s revenue rose 27% to 9.35 billion yuan from 7.36 billion yuan a year earlier.

The company’s profits have also grown steadily over the last three years, rising 23% to 925 million yuan in the first quarter of 2025 from 752 million yuan a year earlier.

While the low-price strategy has won Aux market share, it also comes at a cost. The relentless focus on affordability has made it challenging for the company to maintain its product quality. A high-profile dispute in 2019 revolved around such quality issues, with Gree accusing multiple Aux models of failing energy efficiency and cooling power consumption tests.

But more importantly, the lower-price strategy has come at the expense of lower profit margins. Aux’s air conditioner gross margin is significantly lower than its larger rivals, at just 19.2% last year, compared to Haier’s 23.87%. While Midea and Gree don’t break down margins by product, the former reported its smart home business, which includes air conditioners, was 29.97% last year. Meantime, Gree’s manufacturing category, consisting largely of air conditioners, reached 32.55%.

Aux has been ramping up its international business to offset a slowing market at home, helping to fuel its relatively fast growth of recent years. Its exports grew 41% last year, and overseas sales accounted for 57.1% of its revenue total. The company touts such international sales as a major future growth driver.

However, the majority of Aux’s overseas business consists of original equipment manufacturing (OEM), producing products carrying other companies’ brands. Such a business model is notorious for its low profit margins, further explaining Aux’s lower overall profitability compared to bigger rivals that have found more success by selling their own-branded models both at home and overseas.

At the end of the day, while strong sales growth is important, profitability is just as important, especially in a mature industry like air conditioners. To thrive over the longer term, Aux will need to find ways to better establish its own brand and compete on quality, not just price. Some recent moves are commendable, such as launching a high-end brand called Shin Flow in 2023, though that effort puts Aux in more direct competition with its larger rivals.

The company could also consider expanding into higher-margin central air conditioners that are widely used in commercial buildings but still relatively uncommon in homes. Aux derived over 87% of its revenue last year from household air conditioners, largely wall-mounted units. Increasing its focus on central air conditioners, which carried a profit margin of 30.4% compared to 19.25% for household units last year, would significantly improve its overall profitability.

For its international business, Aux will need to gradually transition away from simply serving as an OEM and work toward building its own brand recognition outside China. Only by balancing growth with profitability and quality can Aux Electric win over investors, showing it can produce air conditioners that are not only affordable but also dependable.

To subscribe to Bamboo Works free weekly newsletter, click here